Is Becton Dickinson (BDX) Quietly Reframing Its Moat Around Everyday Hospital Safety Workflows?

- Earlier this month, BD (Becton, Dickinson and Company) and ChemoGLO announced a collaboration that links BD’s 10‑minute HD Check point‑of‑care hazardous drug tests with ChemoGLO’s LC‑MS/MS lab analysis, giving healthcare facilities an integrated way to detect and quantify surface contamination and better protect staff.

- This pairing of rapid screening with detailed follow‑up results aligns with expert recommendations for both qualitative and quantitative monitoring, underscoring BD’s push to embed its safety technologies deeper into everyday hospital workflows.

- Next, we’ll look at how this expanded hazardous‑drug safety offering fits into BD’s reset‑and‑separation investment narrative and long‑term growth drivers.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Becton Dickinson Investment Narrative Recap

To own BD, you need to believe it can compound value by pairing a large installed base of medical consumables with a steady stream of clinically useful innovation, while executing a complex Biosciences and Diagnostics separation. The ChemoGLO collaboration strengthens BD’s worker safety offering, but it does not materially change the short term focus on managing tariff and trade headwinds or delivering a clean separation with controlled stranded costs.

Among recent updates, the expanded BD FACSDiscover A8 cell analyzer portfolio is most relevant, because it highlights how BD is still investing in higher value Biosciences tools even as that segment heads toward separation. For investors, successful adoption of these advanced instruments could support the reset and separation narrative by reinforcing the quality of the assets BD plans to spin, while the core remains anchored in consumables backed by programs like BD Excellence.

Yet, while product news is encouraging, investors should be aware that the planned Biosciences and Diagnostics separation still carries meaningful execution risk, including...

Read the full narrative on Becton Dickinson (it's free!)

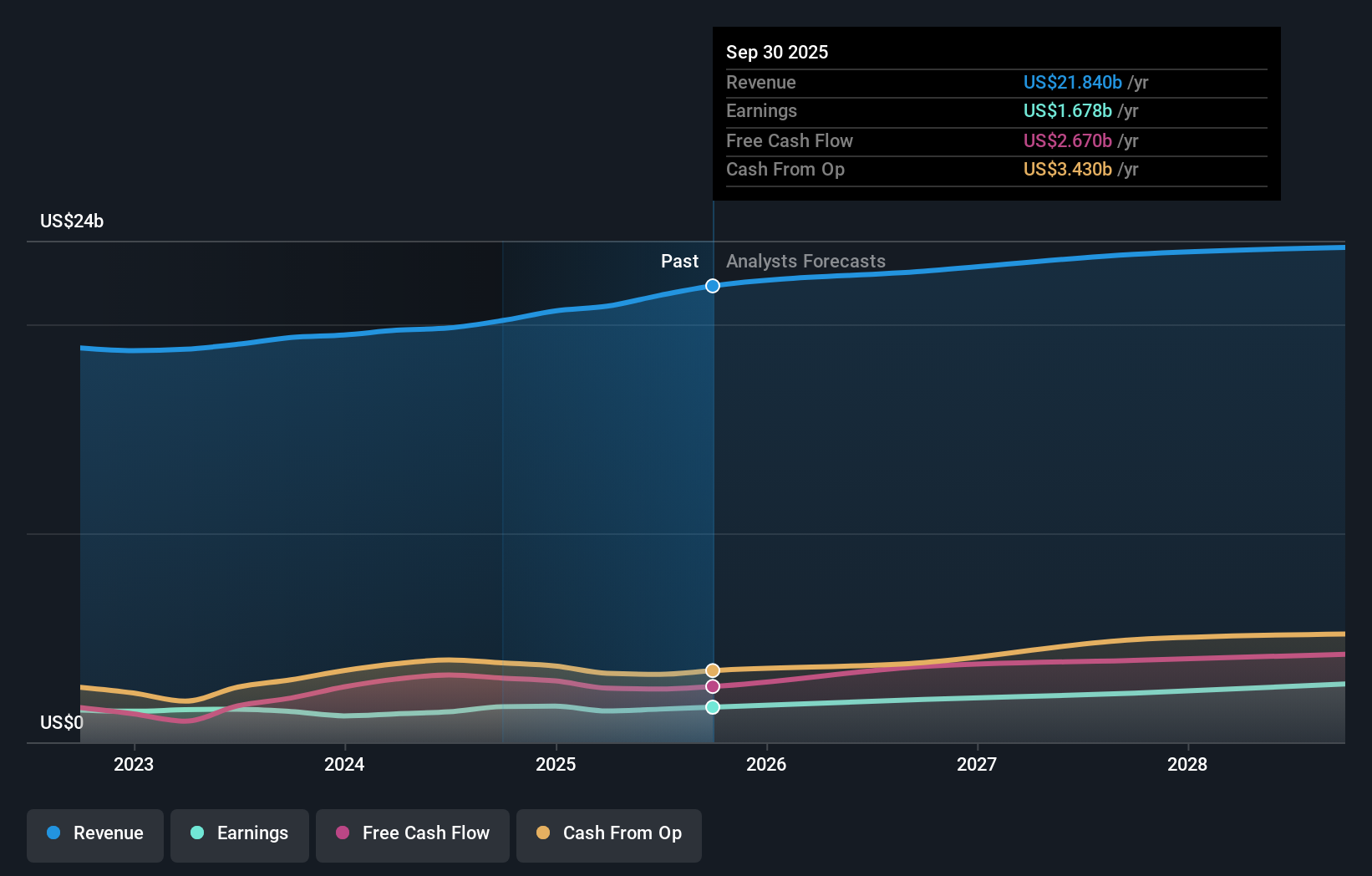

Becton Dickinson's narrative projects $24.7 billion revenue and $2.8 billion earnings by 2028.

Uncover how Becton Dickinson's forecasts yield a $202.58 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Five Simply Wall St Community fair value estimates for BD span roughly US$203 to US$324 per share, reflecting very different outlooks on upside. Against that backdrop, ongoing tariff and trade headwinds that could pressure BD’s margins give you a concrete issue to test your own expectations about the company’s future performance.

Explore 5 other fair value estimates on Becton Dickinson - why the stock might be worth just $202.58!

Build Your Own Becton Dickinson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Becton Dickinson research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Becton Dickinson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Becton Dickinson's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com