What CGI (TSX:GIB.A)'s AI-Driven Cloud Wins and Record Backlog Reveal About Its Evolving Moat

- CGI Inc. recently reported strong Q4 2025 results with year-over-year revenue growth, a 119% book-to-bill ratio, and a CA$31.45 billion backlog, while renewing key client relationships and achieving AWS Premier Tier Services Partner and SAP Competency Partner status.

- At the same time, Nevada’s deployment of CGI’s government-focused ERP platform and the expanded Highmark ProperPay partnership highlight how CGI’s AI-enabled IP and cloud capabilities are becoming embedded in critical public and private sector systems.

- We’ll now examine how CGI’s expanded AWS Premier partnership and growing AI-integrated services footprint may influence this existing investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

CGI Investment Narrative Recap

To own CGI, you need to believe it can keep turning its large, recurring backlog into steady earnings while deepening its role in clients’ core systems through AI and cloud services. The latest AWS Premier status and Nevada ERP go live support that thesis, but do not fundamentally change the near term catalyst, which remains sustained bookings growth in AI enabled managed services, or the key risk around macro driven delays and competitive pressure in large government and enterprise contracts.

Among the recent announcements, CGI’s elevation to AWS Premier Tier Services Partner, alongside new AWS SAP Competency status, looks most central to the current story. It reinforces the catalyst around cloud and AI driven modernization work, where CGI is aiming to convert technical accreditation and thousands of AWS trained staff into higher quality bookings and potentially more resilient, higher margin managed services revenue over time.

Yet while these wins are encouraging, investors should be aware that heavy reliance on large public sector and enterprise contracts still leaves CGI exposed to...

Read the full narrative on CGI (it's free!)

CGI's narrative projects CA$17.9 billion revenue and CA$2.3 billion earnings by 2028. This requires 4.8% yearly revenue growth and roughly a CA$0.6 billion earnings increase from about CA$1.7 billion today.

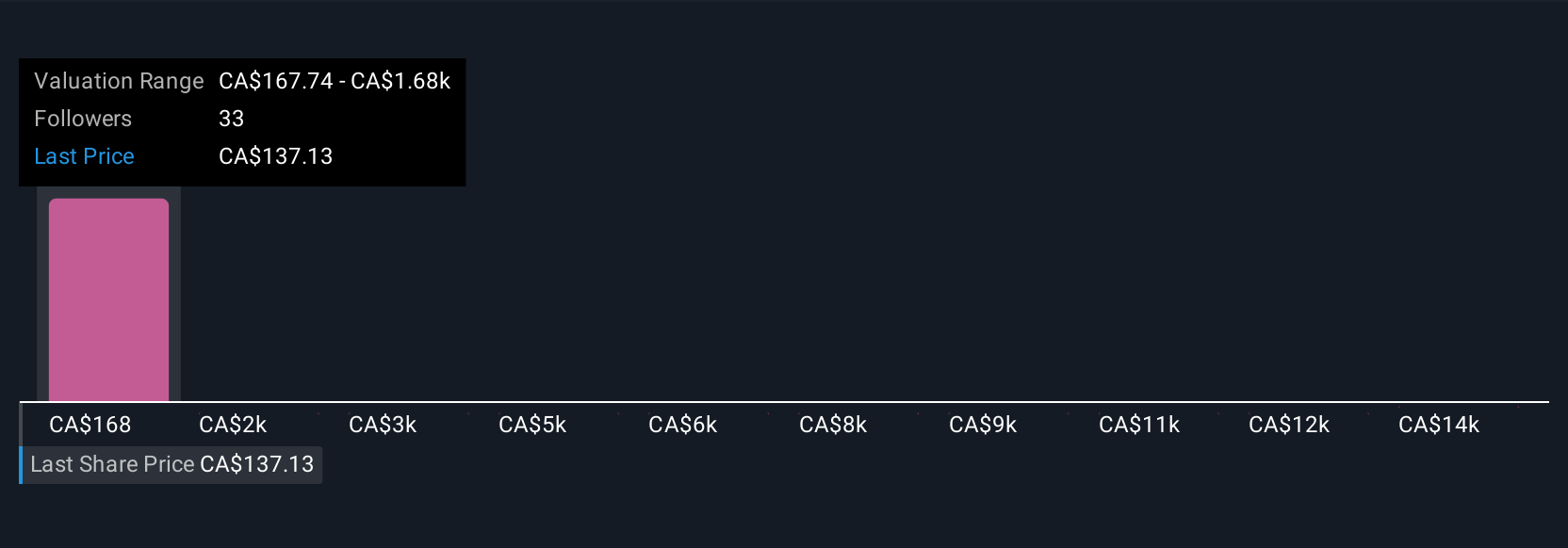

Uncover how CGI's forecasts yield a CA$155.08 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Seven fair value estimates from the Simply Wall St Community span a wide CA$136.69 to CA$1,382.16 per share, underlining how differently you and other investors might view CGI. Set against that, the recent AWS Premier recognition and growing AI enabled services highlight how execution on cloud and AI catalysts could be just as important as headline valuation when you think about the company’s future performance.

Explore 7 other fair value estimates on CGI - why the stock might be worth just CA$136.69!

Build Your Own CGI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CGI research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free CGI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CGI's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com