CCL Industries Inc.'s (TSE:CCL.B) Business Is Yet to Catch Up With Its Share Price

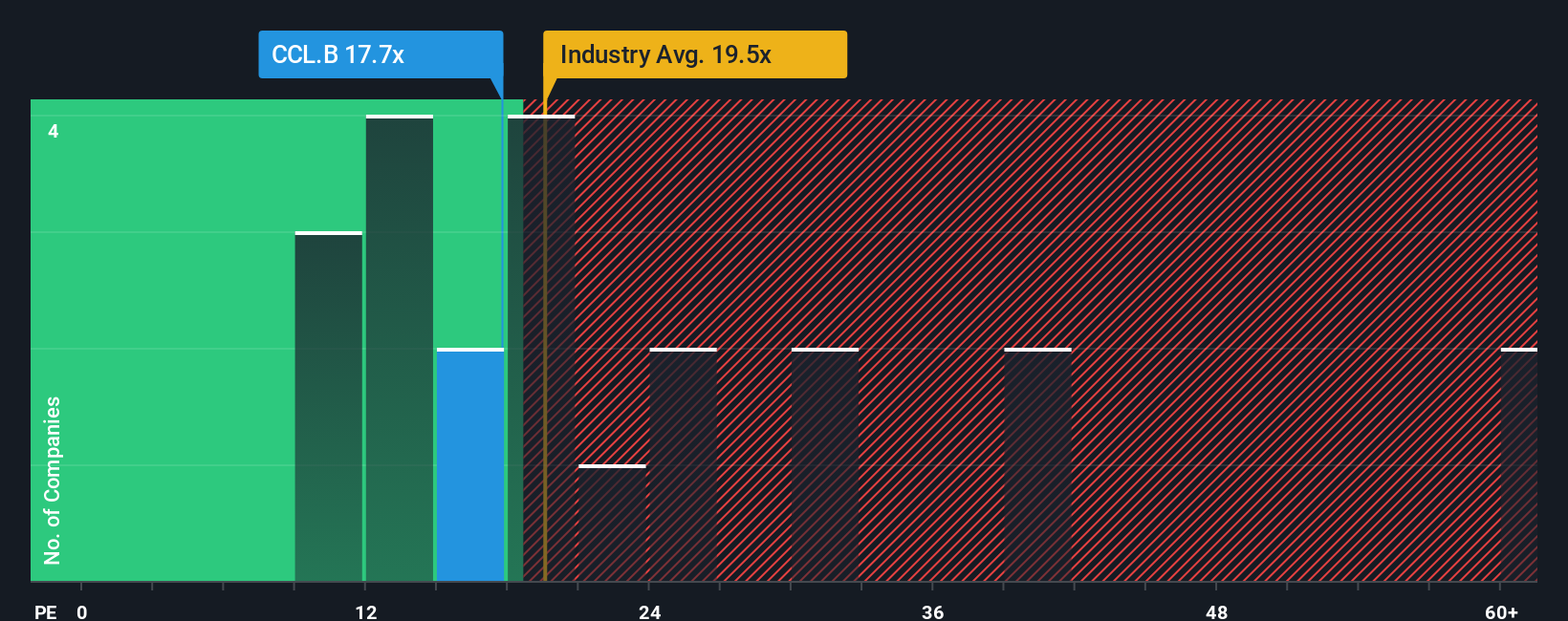

It's not a stretch to say that CCL Industries Inc.'s (TSE:CCL.B) price-to-earnings (or "P/E") ratio of 17.7x right now seems quite "middle-of-the-road" compared to the market in Canada, where the median P/E ratio is around 16x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings growth that's superior to most other companies of late, CCL Industries has been doing relatively well. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for CCL Industries

Does Growth Match The P/E?

In order to justify its P/E ratio, CCL Industries would need to produce growth that's similar to the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 17% last year. The latest three year period has also seen an excellent 34% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 2.7% during the coming year according to the ten analysts following the company. With the market predicted to deliver 23% growth , the company is positioned for a weaker earnings result.

With this information, we find it interesting that CCL Industries is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of CCL Industries' analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

We don't want to rain on the parade too much, but we did also find 1 warning sign for CCL Industries that you need to be mindful of.

If you're unsure about the strength of CCL Industries' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.