What Monolithic Power Systems (MPWR)'s AI Data-Center Surge and 15-Year Compounding Feat Means For Shareholders

- In recent months, Monolithic Power Systems reported strong Q3 results and rapid expansion in its enterprise data, storage, and computing segment, with AI and data center demand driving a greater share of revenue.

- An eye-catching data point is how very large compounded returns over 15 years turned a US$1,000 investment in MPWR into more than US$50,000, underscoring the impact of long-term compounding in high-growth businesses.

- We’ll now examine how this AI-fueled shift toward higher-value power-management solutions may reshape Monolithic Power Systems’ existing investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Monolithic Power Systems Investment Narrative Recap

To own Monolithic Power Systems, you need to believe that demand for AI data centers and high value power solutions will keep expanding and that MPS can keep winning content in those systems. The latest Q3 beat and rapid mix shift toward enterprise data, storage, and computing reinforce that near term AI data center momentum is the key catalyst, while the biggest current risk is that expectations embedded in the share price leave little room for earnings disappointment.

Among recent announcements, the sharp rise of the enterprise data, storage, and computing segment to 52% of revenue by Q2 2025 stands out, because it directly ties MPS to AI servers and high performance computing trends that many investors see as its main growth driver. This shift supports the view that MPS is evolving from a broad power IC vendor into a higher value solutions provider anchored in AI centric infrastructure, which may magnify both the upside from design wins and the downside if AI related demand or spending patterns change.

Yet investors should also be aware that, while AI demand is a clear tailwind, high expectations and short ordering cycles could quickly expose...

Read the full narrative on Monolithic Power Systems (it's free!)

Monolithic Power Systems' narrative projects $3.9 billion revenue and $1.0 billion earnings by 2028.

Uncover how Monolithic Power Systems' forecasts yield a $1181 fair value, a 23% upside to its current price.

Exploring Other Perspectives

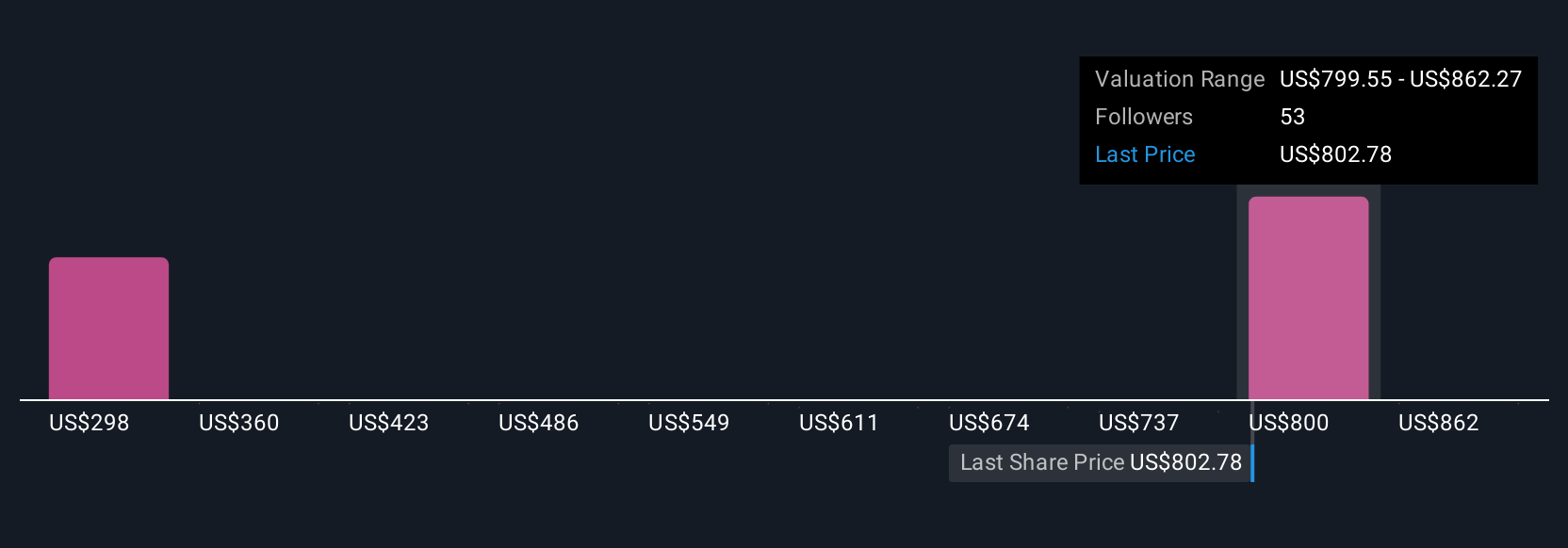

Twelve members of the Simply Wall St Community currently see fair value for MPS spread widely, from about US$340.84 up to roughly US$1,180.93 per share. Against that backdrop, the reliance on AI driven data center growth as a primary catalyst underlines why these investors can disagree so sharply and why it helps to compare several different views before forming your own.

Explore 12 other fair value estimates on Monolithic Power Systems - why the stock might be worth less than half the current price!

Build Your Own Monolithic Power Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Monolithic Power Systems research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Monolithic Power Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Monolithic Power Systems' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com