Is Build-A-Bear’s (BBW) Hello Kitty Expansion Sharpening Its Experiential Retail Edge Or Stretching It?

- In early December 2025, Build-A-Bear Workshop and Sanrio announced plans to expand their Build-A-Bear x Hello Kitty and Friends Workshop concept nationwide, adding new locations at American Dream in New Jersey and Mall of America in Minnesota in early 2026, while also updating investors on completed share repurchases and reaffirming 2025 earnings guidance.

- The decision to roll out this experience to two of the highest-traffic retail destinations in the United States highlights how Build-A-Bear is leaning into branded, experiential concepts to deepen engagement with both families and adult collectors.

- Next, we’ll examine how expanding the Hello Kitty and Friends experiential locations could influence Build-A-Bear’s long-term experiential retail-driven investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Build-A-Bear Workshop Investment Narrative Recap

To own Build-A-Bear, you need to believe that experiential, character-driven retail can keep pulling people into physical locations, even as digital entertainment and mall traffic pressures persist. The Hello Kitty and Friends expansion into American Dream and Mall of America fits this thesis but does not materially change the near term risk that rising tariffs and labor costs could squeeze margins more than expected.

Among the recent updates, the reaffirmed 2025 guidance for mid to high single digit revenue growth is most relevant here, because it frames these new experiential builds within an outlook that already assumes steady, but not rapid, top line progress. For investors focused on catalysts, this combination of guidance and high profile destination openings may help assess how much experiential concepts can offset structural cost headwinds over time.

Yet even with these appealing destinations, investors still need to weigh the risk that rising import tariffs could...

Read the full narrative on Build-A-Bear Workshop (it's free!)

Build-A-Bear Workshop's narrative projects $588.9 million revenue and $62.6 million earnings by 2028.

Uncover how Build-A-Bear Workshop's forecasts yield a $71.67 fair value, a 44% upside to its current price.

Exploring Other Perspectives

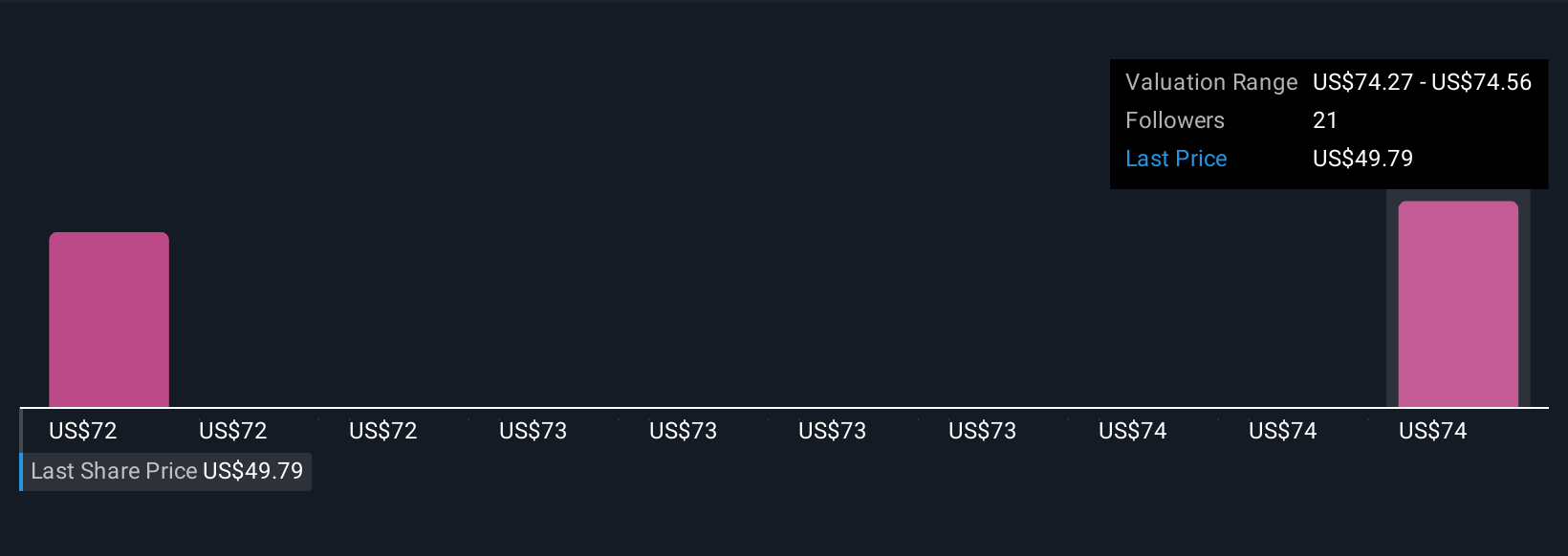

Two fair value estimates from the Simply Wall St Community cluster tightly between US$71.67 and US$74.56, showing how closely some private investors view Build-A-Bear’s potential. You can compare these views with the tariff and labor cost risks that could pressure margins and decide which assumptions about the company’s future performance you find more convincing.

Explore 2 other fair value estimates on Build-A-Bear Workshop - why the stock might be worth just $71.67!

Build Your Own Build-A-Bear Workshop Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Build-A-Bear Workshop research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Build-A-Bear Workshop research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Build-A-Bear Workshop's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com