New World Development (SEHK:17): Reassessing Valuation After Major Debt Exchange and Sharp Balance Sheet Deleveraging

New World Development (SEHK:17) has just wrapped up a major debt exchange, issuing about USD 1.36 billion in new bonds and cutting its debt load by nearly 50%, a meaningful shift for equity holders.

See our latest analysis for New World Development.

The sizeable debt cut seems to have given sentiment a lift, with a 1 day share price return of 4.87% helping extend its year to date share price return of 41.07%. However, the 3 year total shareholder return is still deeply negative at 62.10%.

If this kind of balance sheet reset has you rethinking your portfolio, it could be a good moment to explore fast growing stocks with high insider ownership for other potential turnaround or momentum stories.

Yet with losses still heavy, revenue only modestly growing, and the share price trading above the average analyst target, investors now face a key question: is this a fresh buying opportunity, or is future growth already priced in?

Most Popular Narrative: 32.6% Overvalued

With New World Development last closing at HK$7.11 against a narrative fair value of HK$5.36, the story leans toward optimism that markets may be overreaching.

The analysts have a consensus price target of HK$4.57 for New World Development based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$11.0, and the most bearish reporting a price target of just HK$2.0.

Why does a company with heavy recent losses still attract a valuation that leans higher than its implied fair value, even after conservative growth and margin assumptions? The narrative quietly bakes in a turnaround in profitability, a steady climb in revenues, and a future earnings multiple that has to work hard to justify today’s price. Curious which specific profit and revenue paths underpin this gap between fair value and current trading levels? The full narrative breaks down the exact levers that must fall into place.

Result: Fair Value of $5.36 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a faster recovery in Chinese property demand, along with stronger rental performance from K11 assets, could accelerate earnings and challenge the overvaluation narrative.

Find out about the key risks to this New World Development narrative.

Another Angle on Valuation

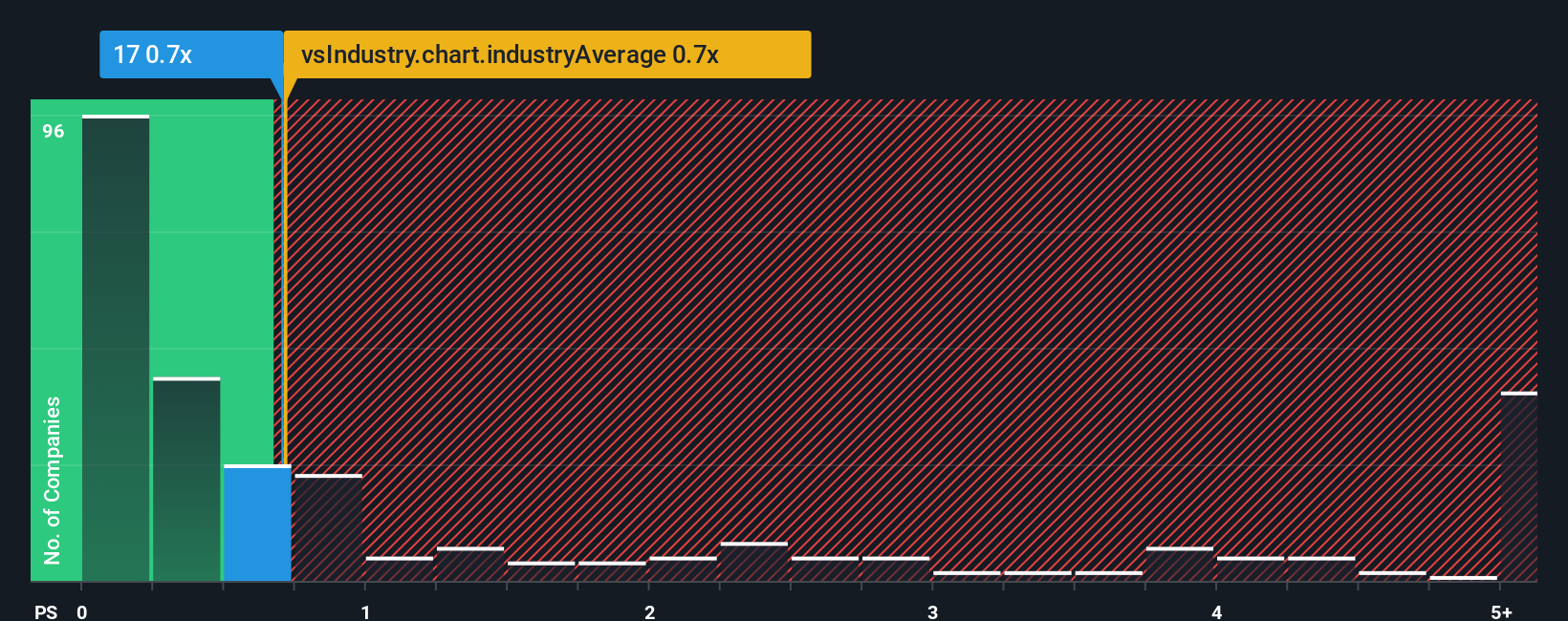

While the narrative fair value suggests New World Development is overvalued, its 0.6x price to sales looks cheap versus the Hong Kong real estate industry at 0.7x and peers at 3.8x. A fair ratio of 0.9x hints at potential upside if sentiment normalizes. Which signal should investors trust?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own New World Development Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom narrative in just minutes, Do it your way.

A great starting point for your New World Development research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors rarely stop at a single story, so take the next step and unlock fresh opportunities across sectors before the market moves without you.

- Secure more reliable income streams by targeting companies in these 15 dividend stocks with yields > 3% that offer yields supported by solid fundamentals.

- Tap into structural growth trends by focusing on innovators in these 26 AI penny stocks positioned to benefit from wider adoption of artificial intelligence.

- Strengthen your return potential by focusing on these 907 undervalued stocks based on cash flows where market prices differ from long term cash flow prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com