Pentagon Access Lawsuit Over Press Freedom Might Change The Case For Investing In New York Times (NYT)

- The New York Times recently filed a lawsuit against the US Department of Defense and Defense Secretary Pete Hegseth, arguing that new Pentagon rules restricting press access and source-based reporting violate journalists’ constitutional rights and chill independent coverage.

- This legal clash highlights how government-imposed limits on newsgathering could influence not only press freedom, but also the long-term operating environment for subscription-based news businesses like the Times.

- We’ll now examine how the Pentagon access lawsuit, and its implications for press freedom, may influence the New York Times’ investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

New York Times Investment Narrative Recap

To own New York Times stock, you need to believe that trusted, differentiated journalism and a growing digital subscription base can support durable earnings, even as platforms and AI reshape how audiences find news. The Pentagon access lawsuit does not appear to change the near term business catalyst, which still centers on subscription growth and bundled engagement, but it does highlight a structural risk around the legal and political climate for independent reporting.

Against this backdrop, the latest Q3 2025 results, with revenue of US$700.82 million and net income of US$81.65 million, matter more to the near term investment story than the lawsuit itself. They show how the Times is currently converting its audience and product investments into higher earnings, which may help offset pressures from platforms, AI aggregation and potential constraints on newsgathering access that emerge over time.

Yet even if the lawsuit fades from headlines, investors should be aware of how growing dependence on large tech platforms could...

Read the full narrative on New York Times (it's free!)

New York Times' narrative projects $3.2 billion revenue and $487.8 million earnings by 2028. This requires 6.7% yearly revenue growth and about a $167 million earnings increase from $320.4 million today.

Uncover how New York Times' forecasts yield a $65.00 fair value, in line with its current price.

Exploring Other Perspectives

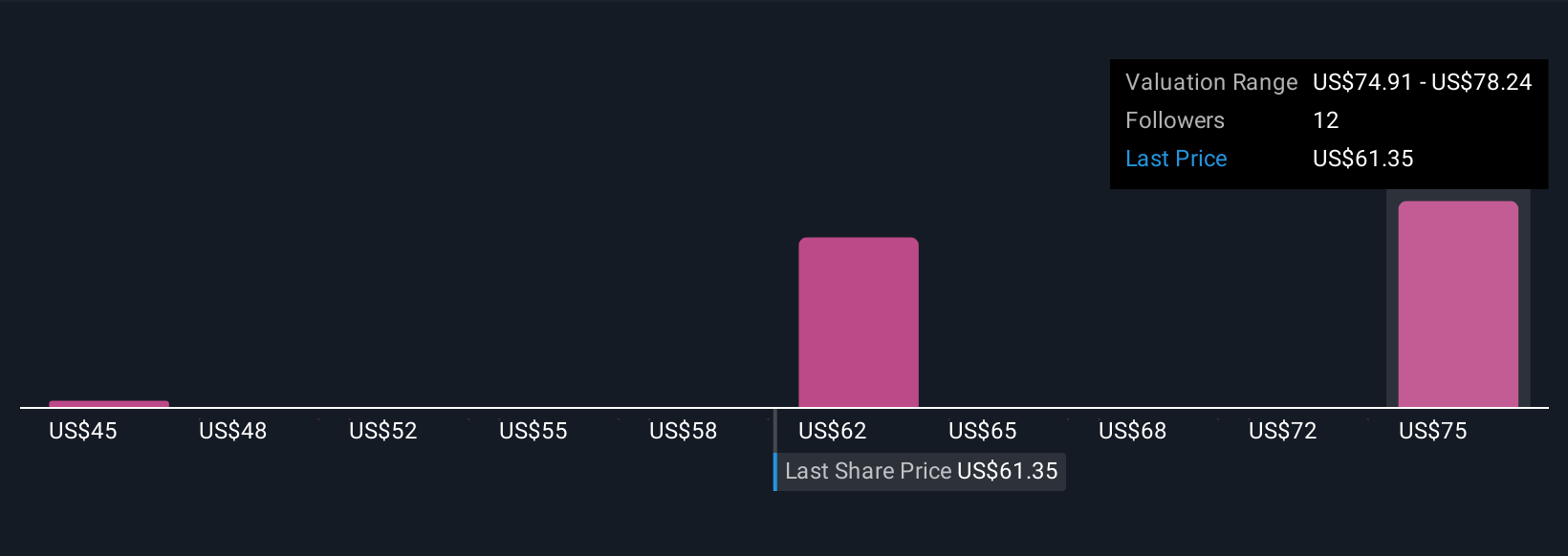

Three members of the Simply Wall St Community currently value New York Times between US$44.95 and US$83.83 per share, illustrating wide disagreement. When you set those views against the central catalyst of digital subscription growth and bundling, it underlines how differently the long term earnings power of the business can be interpreted and why it is worth weighing several independent perspectives before deciding how this stock fits into your portfolio.

Explore 3 other fair value estimates on New York Times - why the stock might be worth 31% less than the current price!

Build Your Own New York Times Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your New York Times research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free New York Times research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate New York Times' overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com