Somnigroup International (SGI): Assessing Valuation After a Strong Multi‑Year Share Price Run

Market context and recent performance

Somnigroup International (SGI) has quietly rewarded patient investors, with the stock up about 68% over the past year and roughly 192% in the past 3 years, far outpacing broader consumer durables peers.

See our latest analysis for Somnigroup International.

With the share price now at $91.87 and a strong year to date share price return alongside a powerful multi year total shareholder return, momentum still looks firmly on Somnigroup International’s side as investors price in steadier growth and lower perceived risk.

If Somnigroup’s run has you thinking about what else could surprise to the upside, this is a good moment to explore fast growing stocks with high insider ownership.

After such a strong run, the key question is whether Somnigroup is still trading below its true value or if the market has already priced in years of future growth and left little upside for new buyers.

Most Popular Narrative: 9% Undervalued

With Somnigroup International last closing at $91.87 versus a narrative fair value of $101, the story hinges on aggressive earnings expansion and richer margins ahead.

Analysts expect earnings to reach $931.4 million (and earnings per share of $4.41) by about September 2028, up from $267.8 million today.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.0x on those 2028 earnings, down from 66.4x today.

Want to see the playbook behind that step change in profits and valuation multiples, including revenue growth, margin expansion, and a re rated earnings profile, unpacked side by side?

Result: Fair Value of $101 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this narrative could unravel if discretionary spending weakens or if digital native competitors capture share faster than Somnigroup’s omnichannel strategy matures.

Find out about the key risks to this Somnigroup International narrative.

Another View on Valuation

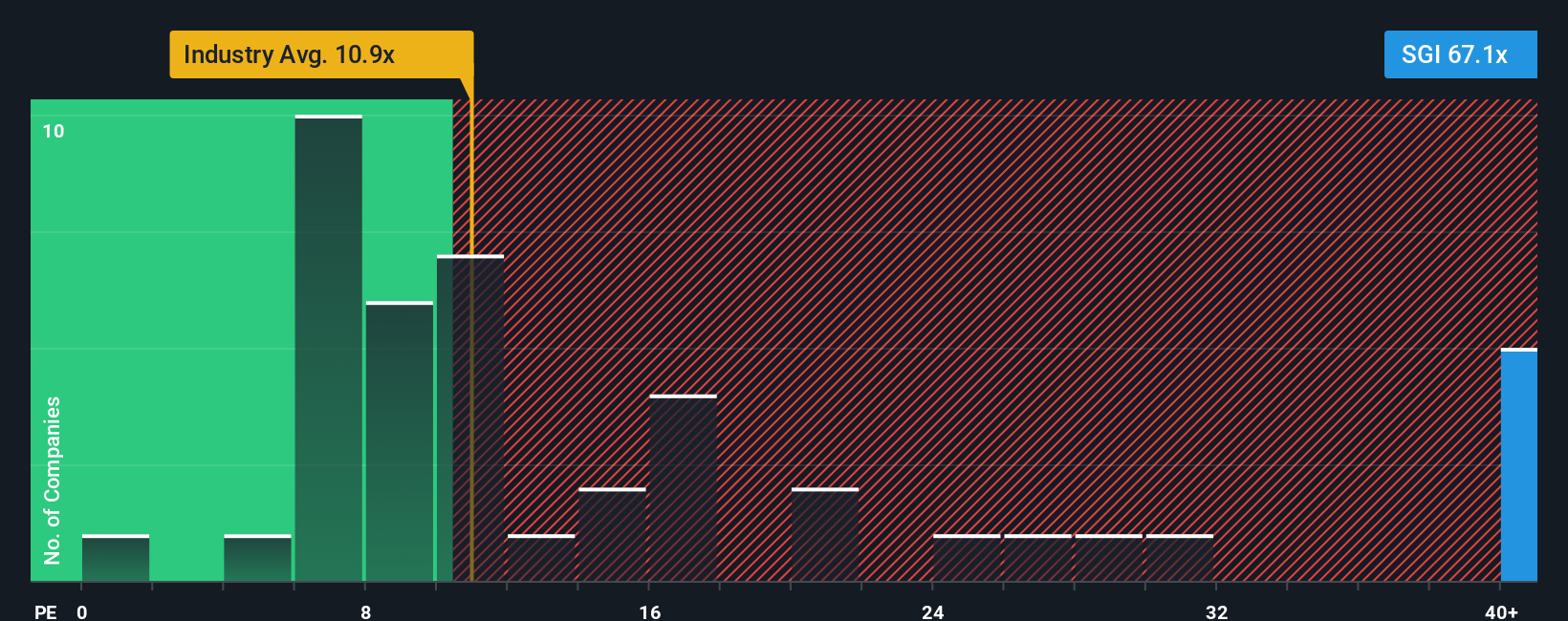

While the fair value narrative paints Somnigroup as roughly 9% undervalued, our price to earnings lens sends a colder signal. At 61.2x earnings versus a fair ratio of 28.1x and an industry average near 11.5x, the stock screens as richly priced and valuation risk feels front loaded. Which story do you trust more when momentum cools?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Somnigroup International Narrative

If this perspective does not quite match your own view, or you simply prefer hands on research, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your Somnigroup International research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before momentum shifts again, use the Simply Wall St Screener to target sharper opportunities, sharpen your watchlist, and position yourself ahead of the next big move.

- Capture potential mispricing early by targeting companies flagged as undervalued through these 907 undervalued stocks based on cash flows before the broader market catches on.

- Ride powerful secular trends by focusing on innovators shaping artificial intelligence and automation via these 26 AI penny stocks.

- Lock in reliable cash flows by zeroing in on companies offering robust income streams using these 15 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com