Core Scientific (CORZ): Valuation Check After VR Advisory’s Big Buy and Ongoing AI Data Center Pivot

Core Scientific (CORZ) just caught fresh attention after VR Advisory Services scooped up more than 1.2 million shares, underscoring growing institutional interest in its pivot toward higher margin, AI focused data center services.

See our latest analysis for Core Scientific.

The stock has been choppy, with a recent 1 month share price return of minus 15.3 percent after a strong 3 month share price return of 22.8 percent. Today’s 17.11 dollar share price still reflects building momentum as investors reassess its AI focused pivot and risk profile.

If Core Scientific’s AI infrastructure story has your attention, it could be worth exploring other high growth tech and AI names using our high growth tech and AI stocks to see what else stands out.

With analysts projecting upside to around 26 to 28 dollars and Core Scientific still unprofitable but rapidly growing AI infrastructure revenue, is this a mispriced turnaround or is the market already discounting that future growth?

Most Popular Narrative: 38.1% Undervalued

With Core Scientific last closing at 17.11 dollars and the most followed narrative pointing to fair value near 27.65 dollars, the gap hinges on how convincingly its AI centric power and data center strategy translates into future earnings.

The analysts have a consensus price target of $19.045 for Core Scientific based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $23.0, and the most bearish reporting a price target of just $15.0.

Want to see what justifies a higher fair value than even the consensus target? The story leans heavily on assumptions of aggressive revenue expansion and a sharp swing into strong profitability. Curious how fast earnings would have to scale and what profit multiple investors might be willing to pay for that future? Explore the full narrative to unpack the assumptions used in this upside case.

Result: Fair Value of $27.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained losses and heavy reliance on CoreWeave as a key customer could still derail the high-growth AI infrastructure upside that investors are banking on.

Find out about the key risks to this Core Scientific narrative.

Another View: Valuation Looks Stretched on Sales

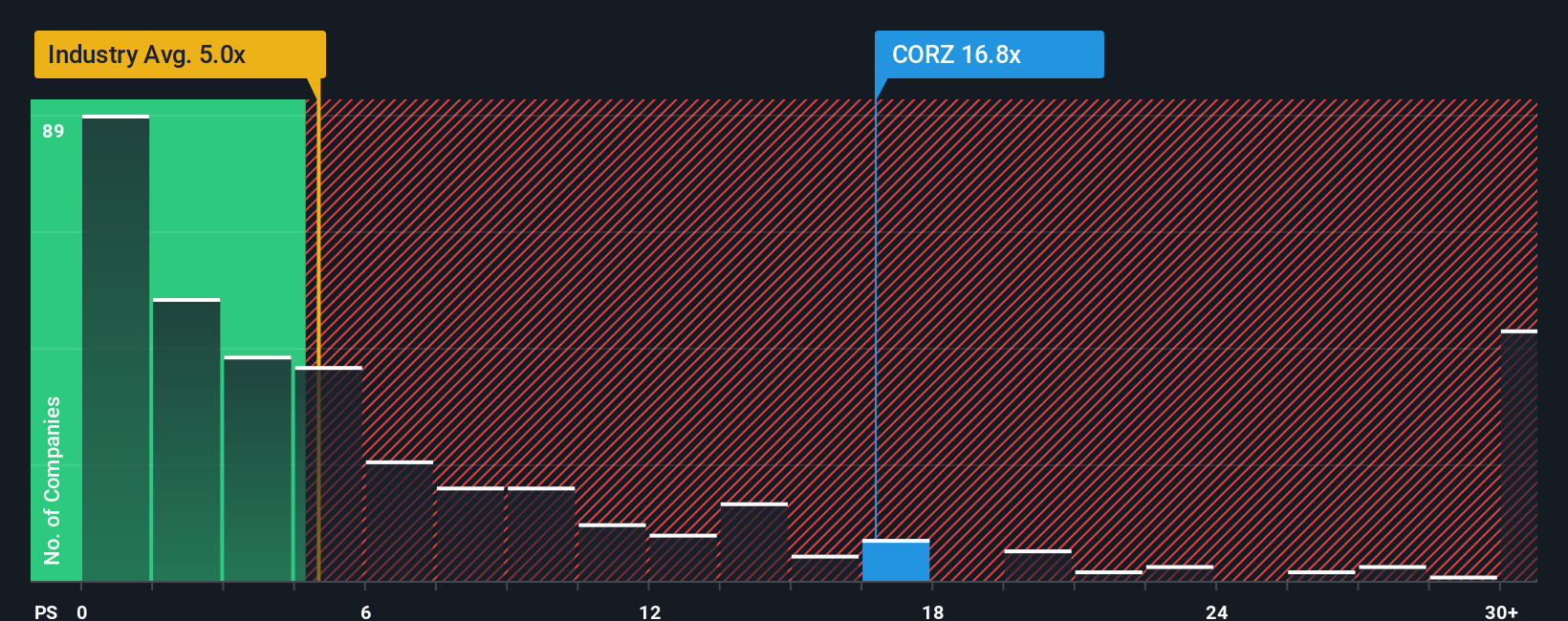

While the narrative based fair value suggests upside, a simple price to sales lens tells a sharper story. Core Scientific trades around 15.9 times sales, far above the US software industry at 4.9 times and its own fair ratio of 4.2 times. This implies meaningful downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Core Scientific Narrative

If you see things differently or want to dig into the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your Core Scientific research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in fresh opportunities by scanning focused stock ideas from the Simply Wall Street Screener, tailored to different strategies and themes.

- Capitalize on potential market mispricing by targeting quality companies trading below their estimated worth through these 907 undervalued stocks based on cash flows that spotlight compelling cash flow stories.

- Supercharge your growth watchlist by zeroing in on next generation innovators using these 26 AI penny stocks that are riding powerful, long term artificial intelligence trends.

- Strengthen your income strategy by reviewing dependable payers via these 15 dividend stocks with yields > 3% and focus on businesses offering yields above 3 percent with room for sustainable distributions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com