How Investors May Respond To Evercore (EVR) Hiring Veteran Banker To Bolster Healthcare Tech Franchise

- Earlier this week, Evercore announced that Ashish Varshneya has joined as a senior managing director in its healthcare investment banking group, bringing nearly two decades of healthcare technology advisory experience from prior roles at TripleTree, Citigroup, and The TriZetto Group.

- The hire underscores Evercore’s push to deepen its healthcare technology capabilities, particularly for payer, provider, and employer-focused platforms, potentially broadening the firm’s reach in one of investment banking’s most complex and specialized sectors.

- We’ll now examine how bringing in a seasoned healthcare technology banker like Varshneya could influence Evercore’s broader investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Evercore Investment Narrative Recap

To own Evercore, you generally need to believe it can keep translating its advisory franchise and talent bench into durable fee pools, even as M&A cycles ebb and flow. The Varshneya hire strengthens its healthcare technology credentials but does not materially change the near term picture, where the key catalyst remains overall deal activity and the main risk is that elevated compensation and fixed costs could pressure margins if revenues soften.

Against that backdrop, Evercore’s continued use of its US$1.04 billion buyback program in 2025 stands out as the most relevant recent announcement, because it directly frames how shareholders participate if earnings growth and capital return remain aligned. Together with a growing dividend and new senior hires, it shows a firm that is actively investing in both its people franchise and its equity base, but investors still need to weigh those commitments against the risk of a slower M&A cycle.

Yet while Evercore is adding high profile bankers and returning capital, investors should be aware that its high compensation ratio could...

Read the full narrative on Evercore (it's free!)

Evercore's narrative projects $5.4 billion revenue and $953.1 million earnings by 2028. This requires 18.7% yearly revenue growth and an earnings increase of about $491 million from $462.2 million today.

Uncover how Evercore's forecasts yield a $347.88 fair value, a 5% upside to its current price.

Exploring Other Perspectives

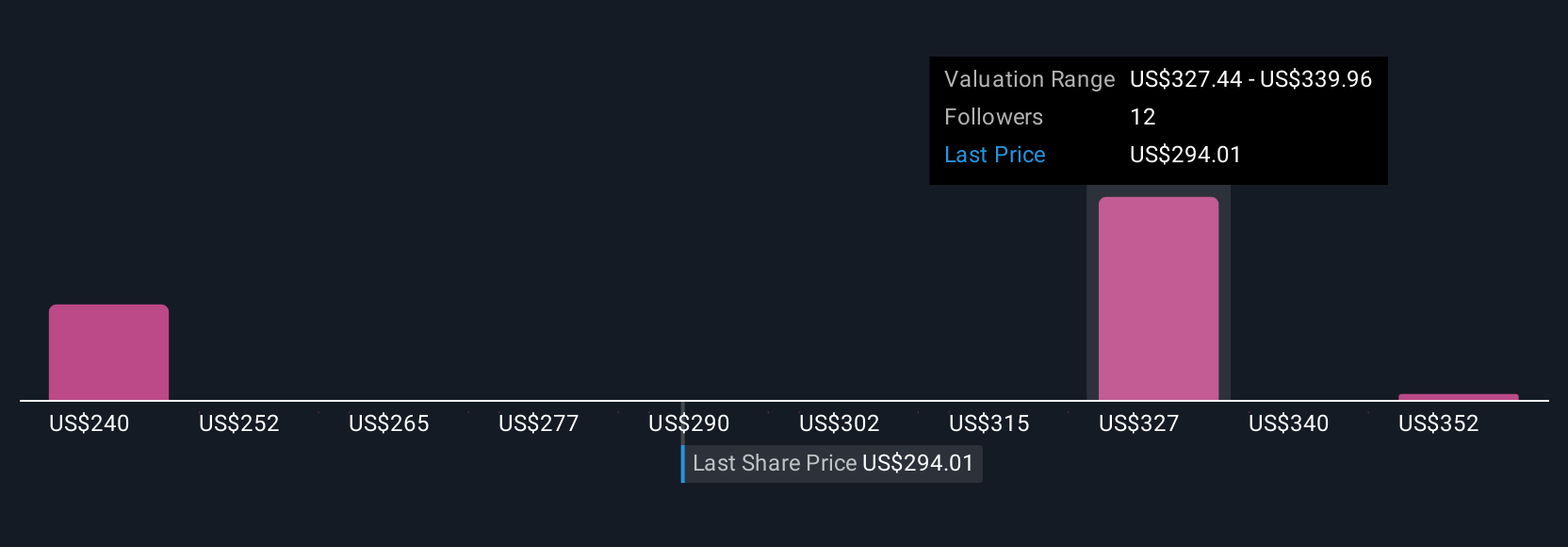

Three fair value estimates from the Simply Wall St Community span roughly US$231 to US$365 per share, showing how far apart individual views can be. When you set those side by side with Evercore’s rising fixed cost base and margin sensitivity to deal volumes, it becomes clear why checking several independent perspectives on the company’s prospects can be so important.

Explore 3 other fair value estimates on Evercore - why the stock might be worth as much as 10% more than the current price!

Build Your Own Evercore Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Evercore research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Evercore research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Evercore's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com