The Bull Case For Grocery Outlet (GO) Could Change Following Shutdown-Hit EBT Sales And Lowered 2025 Outlook

- In recent weeks, Grocery Outlet Holding Corp. reported softer November sales, citing an 8.2% decline in Electronic Benefits Transfer purchases and a 0.5% drop in non-EBT transactions during the U.S. government shutdown, and lowered its 2025 outlook to flat comparable store sales with earnings per share at the low end of prior guidance.

- The company is responding by accelerating store refresh efforts and emphasizing its value-focused, independently operated model, aiming to stabilize demand and rebuild momentum after these shutdown-related headwinds.

- We’ll now examine how the reduced 2025 guidance, tied to shutdown-driven EBT weakness, may reshape Grocery Outlet’s longer-term investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Grocery Outlet Holding Investment Narrative Recap

To own Grocery Outlet today, you need to believe its value-focused, independently operated model can keep attracting cost-conscious shoppers even as near-term results soften. The shutdown-driven hit to EBT spending and flat 2025 comp guidance weigh on the key near-term catalyst of a sales recovery, and also highlight the biggest current risk: sensitivity to lower income consumer spending and government benefit disruptions.

Against this backdrop, the company’s plan to accelerate store refreshes and lean into its value proposition is the most relevant recent announcement, as it directly targets stabilizing traffic after weaker November trends and revised guidance. How effectively these refreshes support comps, margins and the pace of new store expansion will be central to whether the longer term growth and profitability story stays intact.

Yet investors should also be aware that Grocery Outlet’s reliance on value-oriented, lower income shoppers could become a bigger issue if...

Read the full narrative on Grocery Outlet Holding (it's free!)

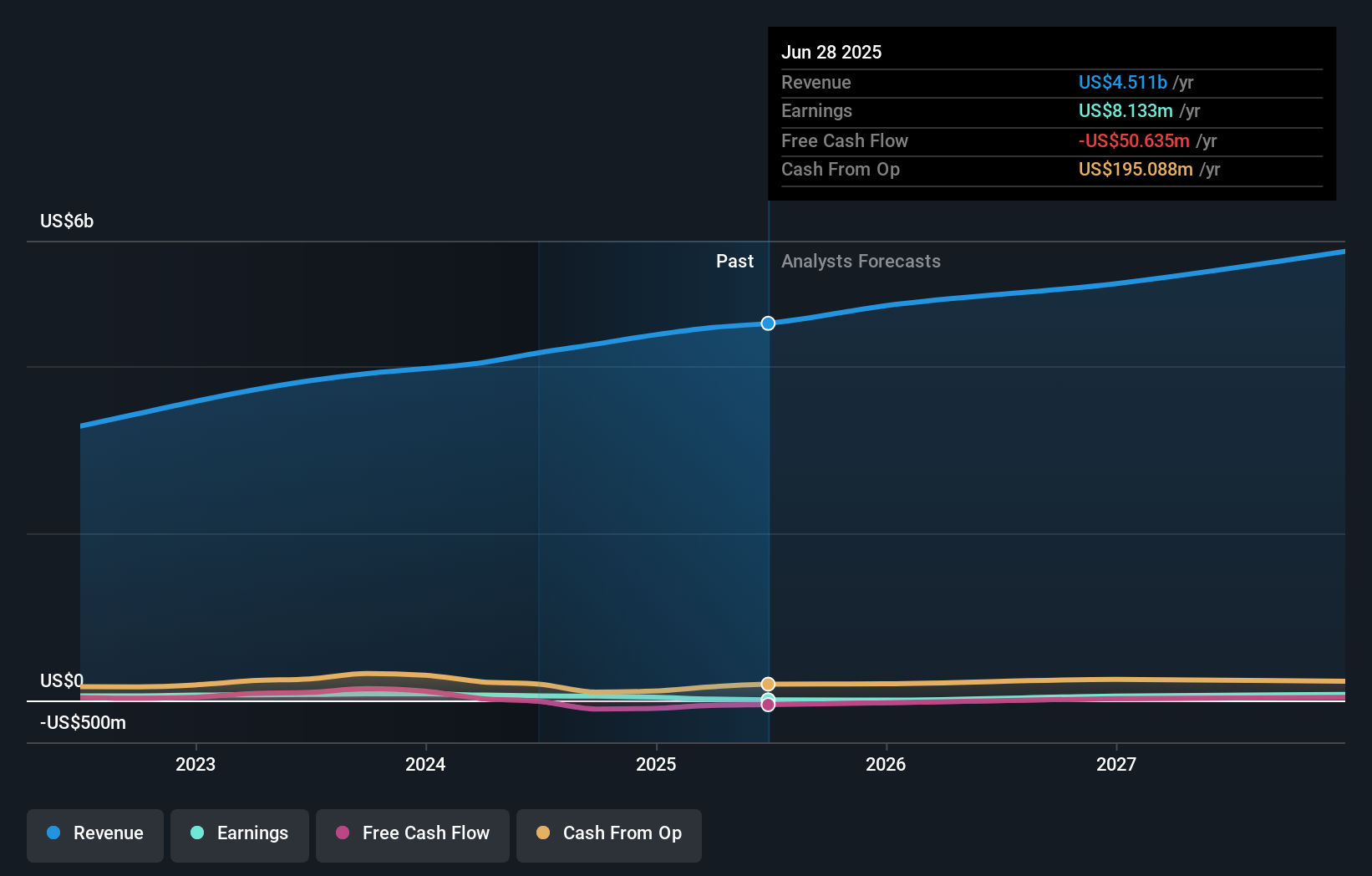

Grocery Outlet Holding’s narrative projects $5.7 billion revenue and $88.0 million earnings by 2028.

Uncover how Grocery Outlet Holding's forecasts yield a $17.15 fair value, a 51% upside to its current price.

Exploring Other Perspectives

One member of the Simply Wall St Community currently pegs Grocery Outlet’s fair value at US$17.15, reflecting a single but detailed viewpoint. You may want to weigh that against how shutdown related EBT volatility affects expectations for value driven traffic and longer term earnings power.

Explore another fair value estimate on Grocery Outlet Holding - why the stock might be worth just $17.15!

Build Your Own Grocery Outlet Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Grocery Outlet Holding research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Grocery Outlet Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Grocery Outlet Holding's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com