SiriusPoint (SPNT): Taking Stock of Valuation After Fresh Analyst Upgrades and a Zacks Rank #1 Rating

Several analyst upgrades have pushed SiriusPoint (SPNT) into the spotlight, as a fresh Zacks Rank #1 rating and rising earnings estimates help explain the stock's climb toward its recent 52 week highs.

See our latest analysis for SiriusPoint.

Those upgrades are landing at a time when momentum already looks constructive, with SiriusPoint’s share price delivering a 90 day share price return of about 13 percent and a year to date share price return of roughly 37 percent. The three year total shareholder return above 200 percent shows how strongly the story has evolved over a longer horizon.

If SiriusPoint’s run has you rethinking your portfolio, this could be a good moment to explore fast growing stocks with high insider ownership as potential next wave candidates.

Yet with SiriusPoint now near its 52 week highs and trading only modestly below analyst targets, investors face a key question: is this still an undervalued turnaround story, or has the market already priced in its next leg of growth?

Most Popular Narrative Narrative: 21.9% Undervalued

At a last close of $21.49 versus a narrative fair value of $27.50, SiriusPoint is framed as having meaningful upside if its roadmap plays out.

The company is strategically allocating capital toward higher margin specialty and casualty lines, alongside a disciplined approach to underwriting and risk selection, as evidenced by 11 consecutive quarters of underwriting profits and an improving combined ratio. This suggests a pathway to expanding net margins and earnings stability. SiriusPoint's investment in technology, data analytics, and automation through its MGA partnerships enables better loss ratio management and operational efficiency. Combined with the increasing use of AI, this is likely to support sustained reductions in operating cost ratios and improved net profitability.

Curious how steady premium growth, rising margins and shrinking share count combine into that upside case? The most followed narrative breaks down the math behind it.

Result: Fair Value of $27.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could crack if new MGA partnerships underdeliver, or if climate driven catastrophes erode underwriting gains and reserve assumptions.

Find out about the key risks to this SiriusPoint narrative.

Another Angle on Valuation

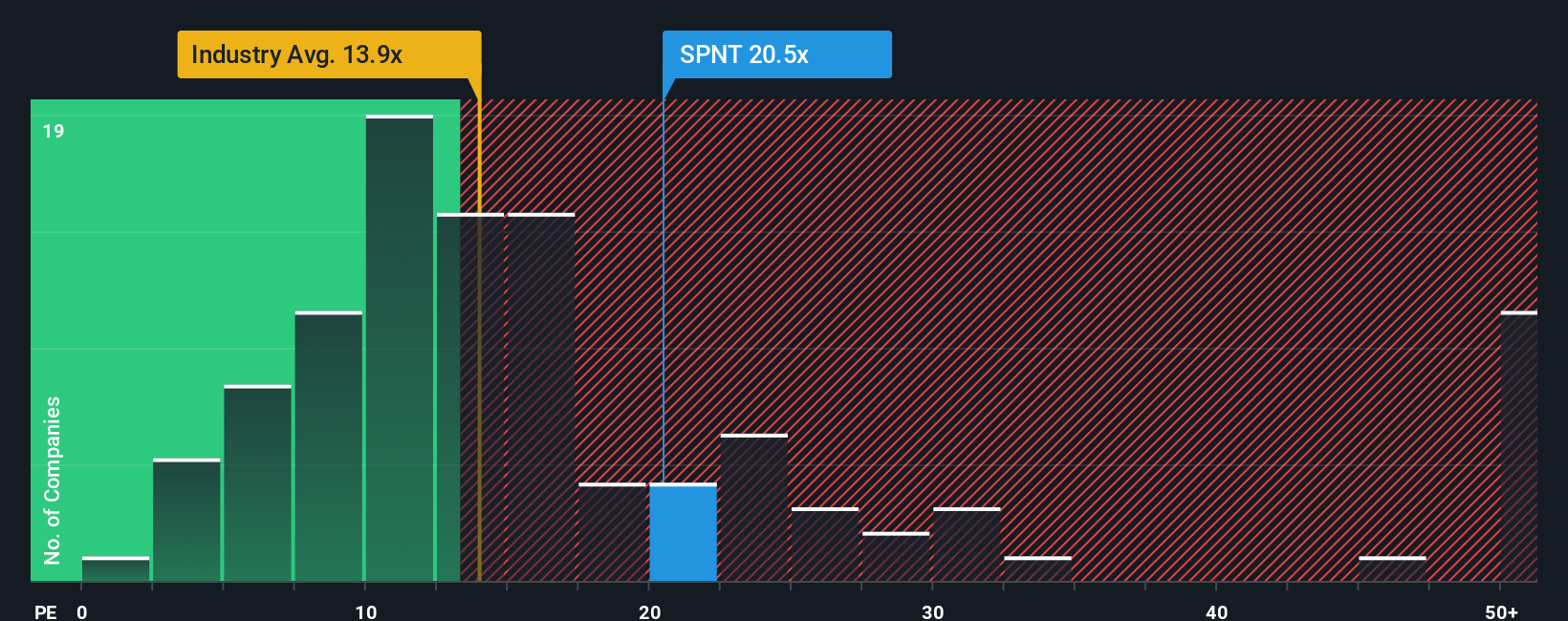

On simple earnings maths, SiriusPoint looks tighter than the upbeat narrative suggests. Its 13.5 times price to earnings sits above both US Insurance peers at 11.8 times and the broader industry at 12.8 times, which implies less margin for error if growth or margins disappoint.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SiriusPoint Narrative

If you see the numbers differently or want to dig into the data yourself, you can build a complete view in minutes with Do it your way.

A great starting point for your SiriusPoint research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop at SiriusPoint, you risk missing other powerful setups, so take a few minutes now to scan the market for your next edge.

- Capture potential mispriced winners by running through these 907 undervalued stocks based on cash flows that pair solid fundamentals with meaningful valuation upside.

- Ride structural growth tailwinds by scanning these 30 healthcare AI stocks harnessing data driven breakthroughs in diagnosis, treatment, and patient outcomes.

- Position ahead of the next digital shift by reviewing these 81 cryptocurrency and blockchain stocks shaping payments, infrastructure, and blockchain enabled services.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com