How Strong Q3 Results, Buybacks and Higher Guidance At Autodesk (ADSK) Has Changed Its Investment Story

- Autodesk reported past third-quarter fiscal 2026 results with revenue of US$1,853 million and net income of US$343 million, alongside higher GAAP EPS, and also completed a multi-year buyback totaling about 8.02 million shares for US$2.19 billion under its 2022 authorization.

- The company raised its full-year fiscal 2026 guidance, now expecting revenue of US$7,150 million to US$7,165 million and GAAP EPS of US$5.16 to US$5.33, underscoring management’s confidence in ongoing business momentum.

- Next, we’ll examine how Autodesk’s upgraded full-year guidance reshapes its existing investment narrative and the assumptions underpinning future margin expansion.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Autodesk Investment Narrative Recap

To own Autodesk, you need to believe its design and construction software will remain central as customers move deeper into cloud, subscription and AI-enabled workflows. The latest quarter’s revenue and EPS strength, plus higher full-year guidance, reinforce that story, while the key near term catalyst remains execution in AEC and cloud platforms. The main near term risk is that cheaper or open-source alternatives start to undercut Autodesk’s pricing power, and this news does not materially change that.

The most relevant update is Autodesk’s raised fiscal 2026 outlook, with revenue now guided to US$7,150 million to US$7,165 million and GAAP EPS to US$5.16 to US$5.33. That upgraded guidance leans on continued AEC and cloud adoption as drivers of margin expansion, but it also raises the bar for how effectively Autodesk must defend its premium pricing against emerging low cost and open-source competitors.

Yet even with higher guidance, investors should be aware that increased adoption of lower cost and open-source tools could...

Read the full narrative on Autodesk (it's free!)

Autodesk's narrative projects $9.3 billion revenue and $2.0 billion earnings by 2028. This requires 12.0% yearly revenue growth and a $1.0 billion earnings increase from $1.0 billion today.

Uncover how Autodesk's forecasts yield a $364.52 fair value, a 19% upside to its current price.

Exploring Other Perspectives

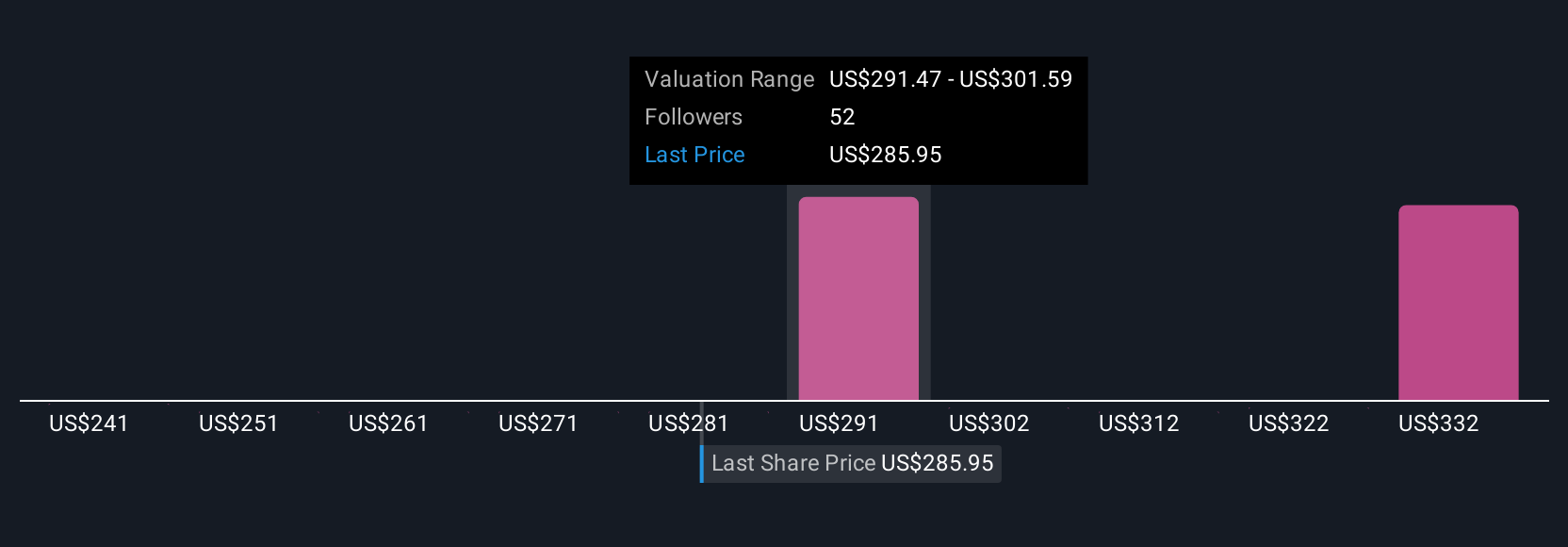

Four fair value estimates from the Simply Wall St Community span roughly US$280 to US$365 per share, underscoring how far opinions can diverge. Against that backdrop, Autodesk’s higher full year guidance built on cloud and AEC momentum invites you to weigh how enduring those growth drivers really are for future performance.

Explore 4 other fair value estimates on Autodesk - why the stock might be worth as much as 19% more than the current price!

Build Your Own Autodesk Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Autodesk research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Autodesk research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Autodesk's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com