Solaris Energy Infrastructure (SEI): Reassessing Valuation After Bullish Analyst Coverage on Distributed Power Pivot

Morgan Stanley and Piper Sandler have both leaned in on Solaris Energy Infrastructure (SEI) after its pivot into distributed power, spotlighting the Mobile Energy Rentals acquisition as a key driver of its fast growing turbine business.

See our latest analysis for Solaris Energy Infrastructure.

The bullish commentary has landed on a stock that already has serious momentum, with a roughly 88 percent year to date share price return and a three year total shareholder return above 560 percent. This suggests investors are rapidly repricing Solaris as a high growth power platform rather than a niche oilfield services name.

If this kind of re rating story interests you, it could be worth exploring fast growing stocks with high insider ownership for other fast moving names where insiders are strongly aligned with shareholders.

Yet with Solaris trading near all time highs but still at a double digit discount to analyst targets, the key question now is whether this is still a mispriced growth story or if markets already reflect its future expansion.

Most Popular Narrative Narrative: 13.8% Undervalued

With Solaris Energy Infrastructure last closing at $55.36 against a narrative fair value of about $64.22, the story frames the stock as mispriced upside.

The accelerating demand for grid resiliency, electrification of industries, and AI-driven data center power needs is creating strong, ongoing demand for Solaris's modular, scalable power generation solutions, positioning the company for significant revenue growth as delivery of new capacity ramps through 2026 and beyond.

Curious how much growth, margin expansion, and future earnings power this narrative is baking in to reach that higher value. Want to see the full playbook behind those assumptions.

Result: Fair Value of $64.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this narrative could still be challenged if recent one off Power Solutions strength fades or supply chain delays push back turbine deployments and contracts.

Find out about the key risks to this Solaris Energy Infrastructure narrative.

Another Angle on Valuation

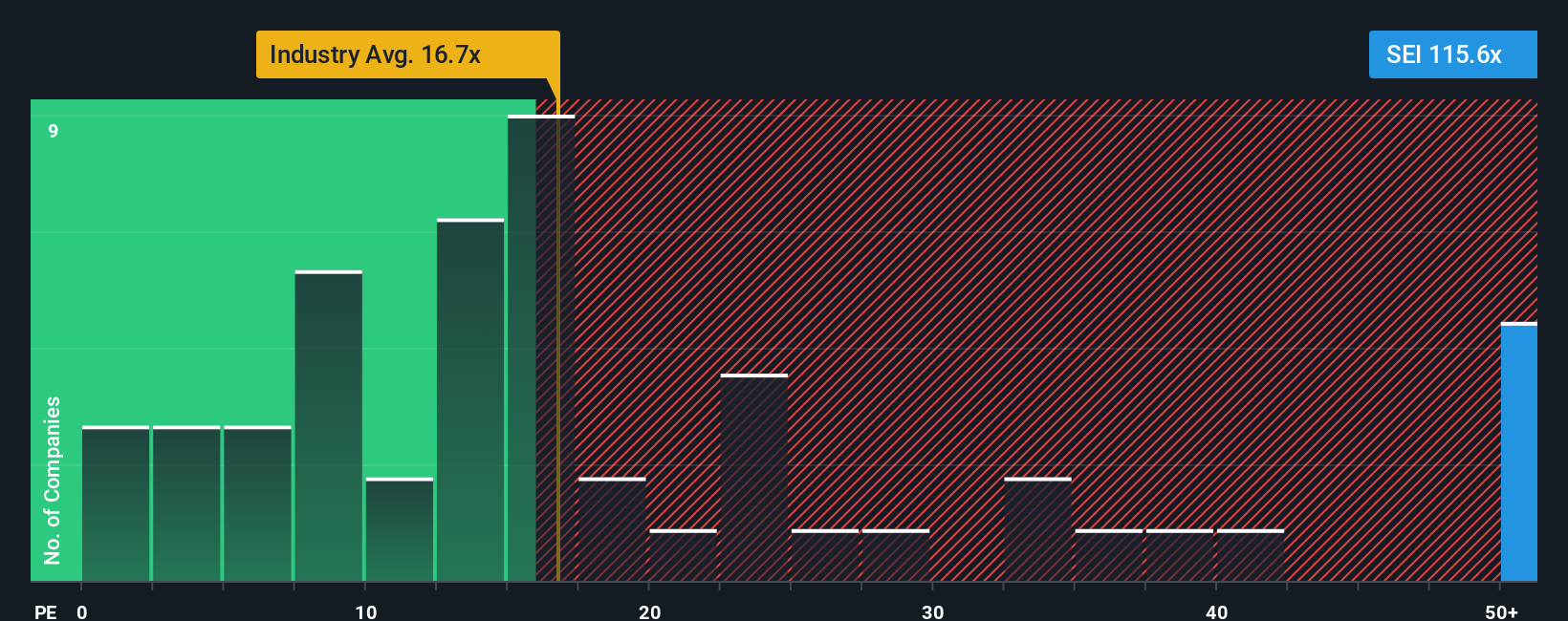

On simple earnings maths, Solaris looks far from cheap, with a price to earnings ratio of 74.4 times compared with about 18.3 times for the wider US Energy Services industry and 19.4 times for peers, and a fair ratio closer to 25.7 times.

That gap signals investors are already paying a rich premium for future growth, raising the risk that any wobble in execution or sentiment could hit the share price much harder than for more reasonably priced rivals.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Solaris Energy Infrastructure Narrative

If you see Solaris differently or want to dig into the numbers yourself, you can easily build a fresh narrative in just a few minutes: Do it your way.

A great starting point for your Solaris Energy Infrastructure research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with Solaris, you could miss other powerful setups, so put Simply Wall Street's screener to work and actively hunt your next edge.

- Capture potential multi-baggers early by scanning these 3573 penny stocks with strong financials where small, resilient businesses already show financial strength behind their tiny share prices.

- Ride the next wave of innovation by targeting companies powering AI disruption through these 26 AI penny stocks, before their growth stories hit the mainstream.

- Identify potential value ahead of the crowd by focusing on cash flow mispricings with these 907 undervalued stocks based on cash flows, where fundamentals may not be fully reflected in the current price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com