Will Elevance Health’s Expanded AI Virtual Assistant Rollout Reshape Elevance Health's (ELV) Narrative

- Earlier this week, Elevance Health expanded access to its AI-powered Virtual Assistant across the Sydney Health app and affiliated plan websites, extending the tool to roughly 22 million commercial members to help them understand benefits, estimate costs, and find in-network care in English and Spanish.

- The rollout, supported by early data showing high member success in getting answers, aligns with investors’ focus on Elevance’s technology-driven efficiency push and recent double-digit operating revenue growth highlighted in fund commentary.

- We’ll now examine how this expanded Virtual Assistant, aimed at simplifying benefit use and care decisions, could influence Elevance Health’s investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Elevance Health Investment Narrative Recap

To own Elevance Health, you need to believe that a heavily regulated insurer can still grow earnings by tightening medical cost control while expanding higher-margin services. The Virtual Assistant rollout looks directionally supportive of Elevance’s technology and efficiency catalyst, but it does not materially change near term around the key risk of elevated medical cost trends and lagging Medicaid and ACA rate adjustments.

The most relevant recent announcement here is Elevance’s Q3 2025 update, where management reported a 12% year over year increase in operating revenue alongside continued investment in digital tools. Against that backdrop, the broader deployment of an AI-powered Virtual Assistant fits into the push to use analytics and automation to improve cost management and member engagement, both of which sit at the center of the current investment thesis.

Yet despite the promise of better digital tools, investors still need to watch the risk that persistent medical cost inflation and slow state rate updates could...

Read the full narrative on Elevance Health (it's free!)

Elevance Health's narrative projects $230.4 billion revenue and $7.4 billion earnings by 2028. This requires 6.8% yearly revenue growth and about a $2.0 billion earnings increase from $5.4 billion today.

Uncover how Elevance Health's forecasts yield a $387.16 fair value, a 17% upside to its current price.

Exploring Other Perspectives

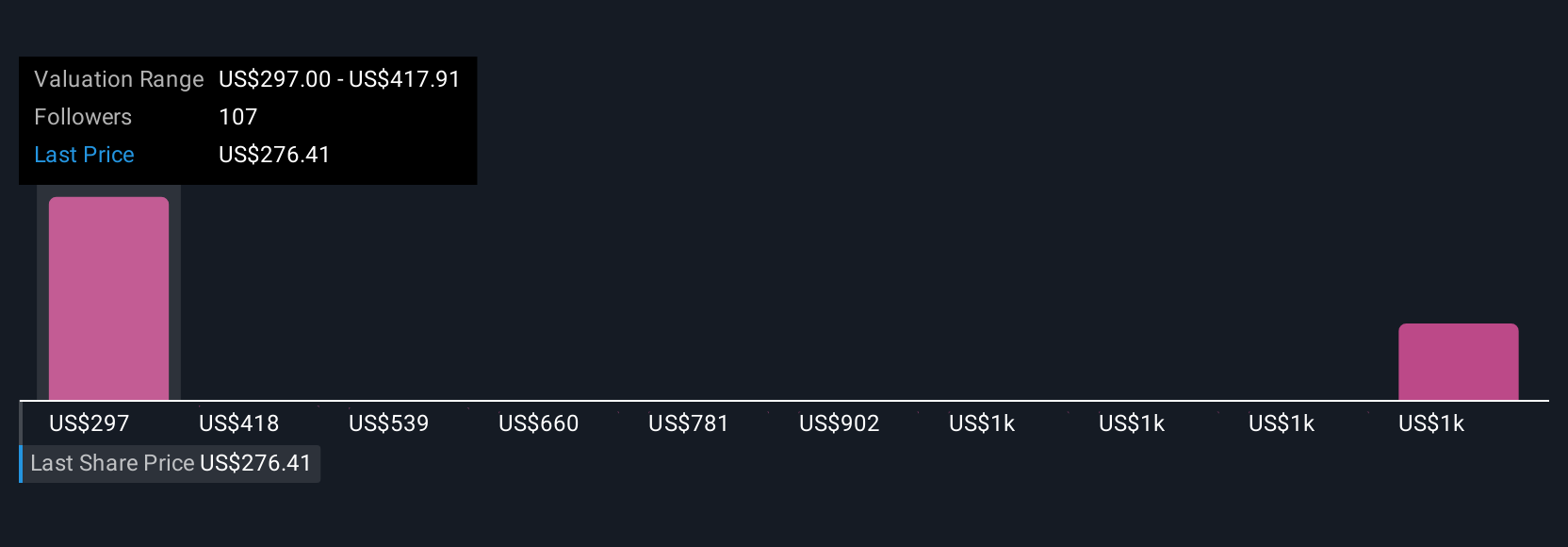

Fifteen members of the Simply Wall St Community currently estimate Elevance Health’s fair value anywhere between about US$297 and US$1,082, underscoring how far apart individual views can be. As you weigh those opinions, remember that the bullish focus on AI enabled efficiency sits alongside real concerns about stubborn medical cost trends and reimbursement lags that could influence the company’s future performance.

Explore 15 other fair value estimates on Elevance Health - why the stock might be worth 10% less than the current price!

Build Your Own Elevance Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Elevance Health research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Elevance Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Elevance Health's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com