OMRON (TSE:6645): Reassessing Valuation After Recent Share Price Rebound

OMRON (TSE:6645) has had a mixed run lately, with shares slipping over the past month but still edging higher in the past 3 months. This raises a fresh valuation question.

See our latest analysis for OMRON.

At around ¥4,111, the recent one-week share price rebound contrasts with a weak year-to-date share price return and a significant multi-year total shareholder return decline. This suggests that momentum remains tentative, despite some pockets of optimism.

If OMRON has you rethinking your tech exposure, it could be a good moment to explore other high growth tech and AI stocks that might better match your return and risk preferences.

With earnings still growing but multi year shareholder returns deeply negative, investors face a key valuation puzzle: is the recent rebound signalling a mispriced turnaround, or is the market already baking in the next leg of growth?

Price to Earnings of 28.2x: Is it justified?

OMRON trades on a price to earnings ratio of 28.2 times at a last close of ¥4,111, pointing to a premium valuation rather than a bargain tag.

The price to earnings multiple compares the current share price with the company’s earnings per share, making it a direct snapshot of how much investors are willing to pay for each unit of profit today.

For OMRON, that premium suggests the market is paying up for expected earnings growth, despite a difficult multiyear shareholder return profile and only recently restored profitability. Yet relative models flag a stretched setup, with the current 28.2 times earnings sitting well above an estimated fair price to earnings level of 22.8 times. That band could act as a gravity point if optimism fades.

Against the wider JP Electronic industry, where the average price to earnings multiple sits at 14.6 times, OMRON’s valuation looks markedly richer, and still elevated even versus its closer peer set at 26.6 times. This underscores how much future earnings strength is already priced into the shares.

Explore the SWS fair ratio for OMRON

Result: Price-to-Earnings of 28.2x (OVERVALUED)

However, lingering weak multi year shareholder returns and a still rich premium to sector peers could quickly unwind if earnings growth stalls or margins compress.

Find out about the key risks to this OMRON narrative.

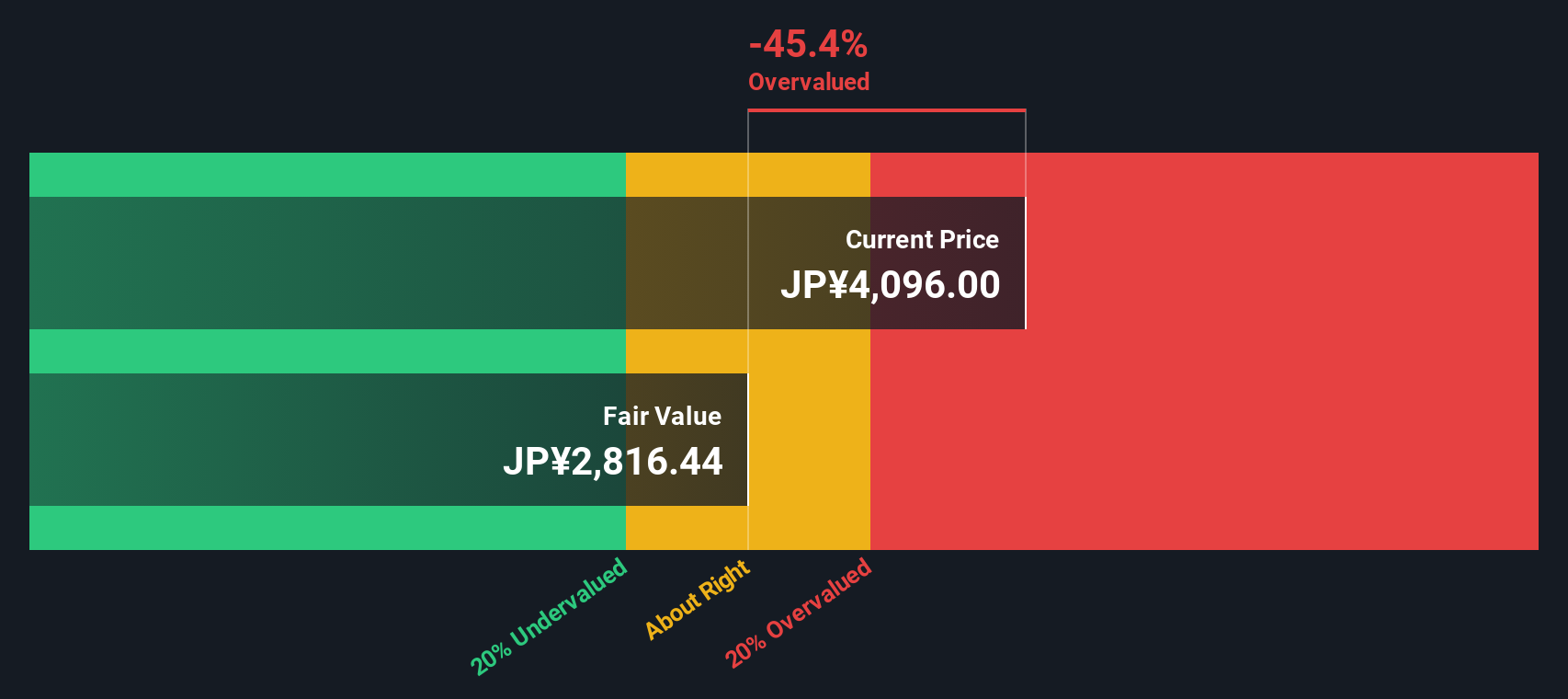

Another View: DCF Points to Steeper Downside

While the earnings multiple paints OMRON as expensive, our DCF model goes further and suggests the shares are trading well above an estimated fair value of ¥2,591.61. If cash flows are closer to the truth than sentiment, is today’s rebound just a value trap in disguise?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out OMRON for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own OMRON Narrative

If you see the story differently or would rather rely on your own analysis, you can build a full narrative in just minutes: Do it your way.

A great starting point for your OMRON research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before OMRON makes your final cut, put a few more high potential opportunities on your radar with targeted screens that could sharpen your next move.

- Capture potential mispricings early by scanning these 908 undervalued stocks based on cash flows where strong cash flows might not yet be fully recognised in the share price.

- Lock in income opportunities by reviewing these 15 dividend stocks with yields > 3% that aim to combine reliable payouts with sustainable balance sheets.

- Get ahead of emerging digital finance trends by tracking these 81 cryptocurrency and blockchain stocks positioned to benefit as blockchain adoption accelerates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com