Evaluating Confluent’s (CFLT) Valuation After Strong Q3 Results and Raised AI‑Driven Growth Guidance

Confluent (CFLT) just delivered an upbeat third quarter, with revenue climbing around 19% and subscriptions accelerating across Confluent Cloud and Platform. This prompted management to lift full year guidance and lean harder into AI driven data streaming.

See our latest analysis for Confluent.

Despite the upbeat quarter, Confluent’s share price return over the past year is still negative. The 90 day share price return of 14.33% suggests momentum is tentatively rebuilding as investors reassess its AI driven growth story against prior drawdowns and a weak year to date share price return.

If this AI themed strength has you rethinking your tech exposure, it could be worth exploring other high growth tech and AI stocks that are starting to show similar momentum.

With shares still trading at a notable discount to analyst targets despite accelerating AI demand and raised guidance, is Confluent quietly undervalued, or is the market already baking in the next wave of growth?

Most Popular Narrative: 17% Undervalued

With Confluent closing at $23.14 against a narrative fair value of $27.87, followers see a sizeable upside emerging from compounding growth and margin expansion.

The proliferation of data volumes and the fundamental shift toward real-time, event-driven architectures are expanding Confluent's addressable market, positioning its platform as mission-critical for data-centric digital transformation across industries. This underpins sustained topline revenue growth and strong customer retention.

Curious how this mission critical status could translate into a higher share price? The narrative focuses on accelerating revenue, rising margins, and an ambitious future earnings multiple. Want to see how those assumptions stack up?

Result: Fair Value of $27.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cloud optimization and competitive pressure from self managed or open source alternatives could slow growth and challenge assumptions underpinning that upside.

Find out about the key risks to this Confluent narrative.

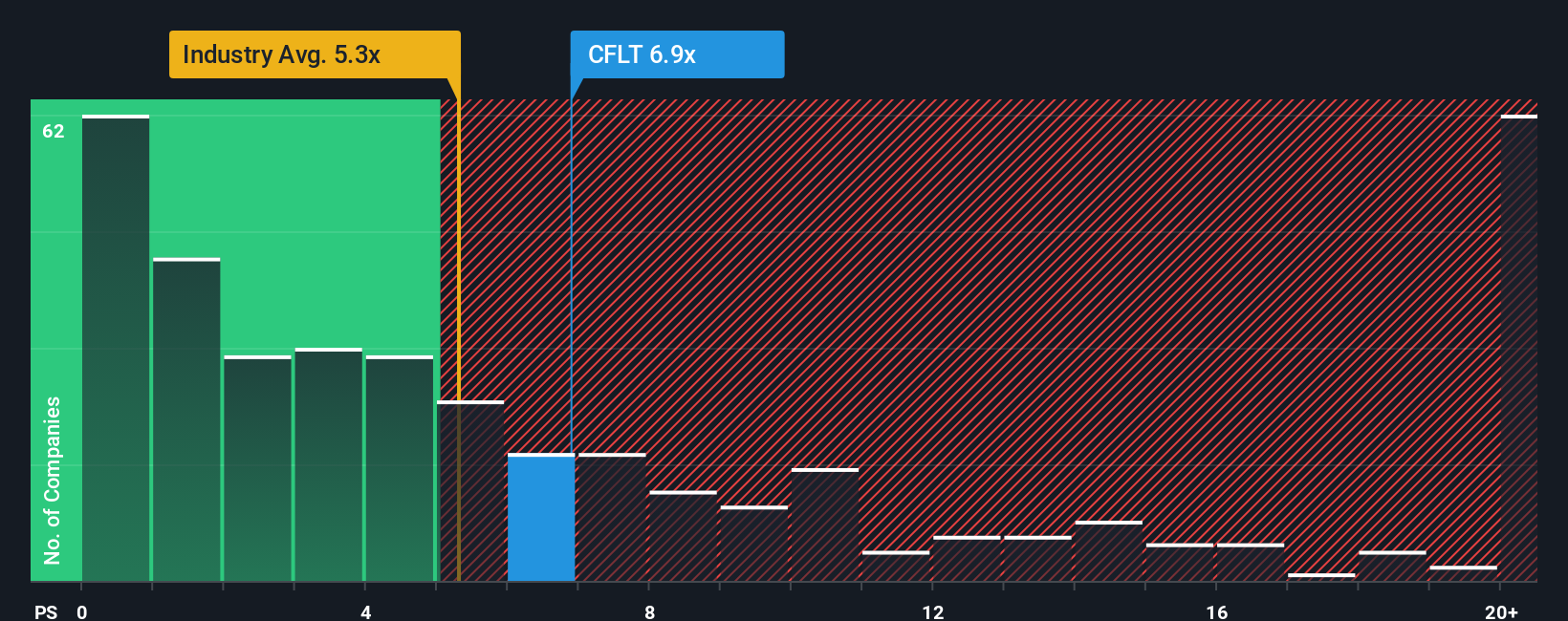

Another View: Price to Sales Sends a Different Signal

While the narrative fair value suggests upside, a simple price to sales lens looks tougher. Confluent trades on 7.3x sales, richer than the US Software average of 4.9x and above its 6.9x fair ratio, even if still below peers at 8.7x. Could sentiment already be running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Confluent Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom take in just a few minutes: Do it your way.

A great starting point for your Confluent research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Do not stop your research with Confluent. Use the Simply Wall St screener to uncover fresh, data backed opportunities that other investors may be overlooking.

- Capture potential early stage upside by reviewing these 3573 penny stocks with strong financials that already show financial strength, not just hype.

- Position your portfolio for tomorrow’s breakthroughs by assessing these 26 AI penny stocks shaping the next wave of intelligent software and automation.

- Lock in value focused opportunities by scanning these 908 undervalued stocks based on cash flows, where market pessimism may have pushed prices below long term cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com