Kasumigaseki Capital (TSE:3498): Assessing Valuation After Comprehensive Leadership and Governance Refresh

Kasumigaseki CapitalLtd (TSE:3498) just pushed through a sweeping leadership refresh at its November 27 AGM and board meetings, adding new executives and independent directors that could subtly reshape how the market views its governance.

See our latest analysis for Kasumigaseki CapitalLtd.

The shake up comes after a solid run, with the share price up strongly on a year to date basis and a three year total shareholder return above 200 percent. This suggests longer term momentum remains intact even as near term moves stay choppy.

If this governance reset has you thinking about where else growth and aligned management might show up, it could be worth exploring fast growing stocks with high insider ownership.

With earnings still growing briskly and the shares trading well below analyst targets, has Kasumigaseki CapitalLtd quietly become a mispriced governance turnaround story, or is the market already factoring in years of future expansion?

Price-to-Earnings of 15.3x: Is it justified?

On a last close of ¥7,940, Kasumigaseki CapitalLtd trades on a 15.3x price to earnings multiple, screening slightly rich versus its industry but roughly in line with similar peers.

The price to earnings ratio compares what investors pay today with the company’s current earnings. It is a key lens for profitable real estate operators where cash flows and profitability drive value more than asset speculation alone.

Here, the 15.3x multiple sits above the broader JP real estate sector average of 11.5x, hinting that the market is willing to pay a premium for Kasumigaseki CapitalLtd’s growth and earnings profile. It still edges below the peer group average of 15.7x and remains under the estimated fair price to earnings level of 21x that our fair ratio work suggests the shares could gravitate toward if current conditions endure.

Explore the SWS fair ratio for Kasumigaseki CapitalLtd

Result: Price-to-Earnings of 15.3x (ABOUT RIGHT)

However, that story could unravel if Japan’s property cycle turns abruptly or execution stumbles across its logistics, hotel, and overseas expansion projects.

Find out about the key risks to this Kasumigaseki CapitalLtd narrative.

Another View, What Does Our DCF Say?

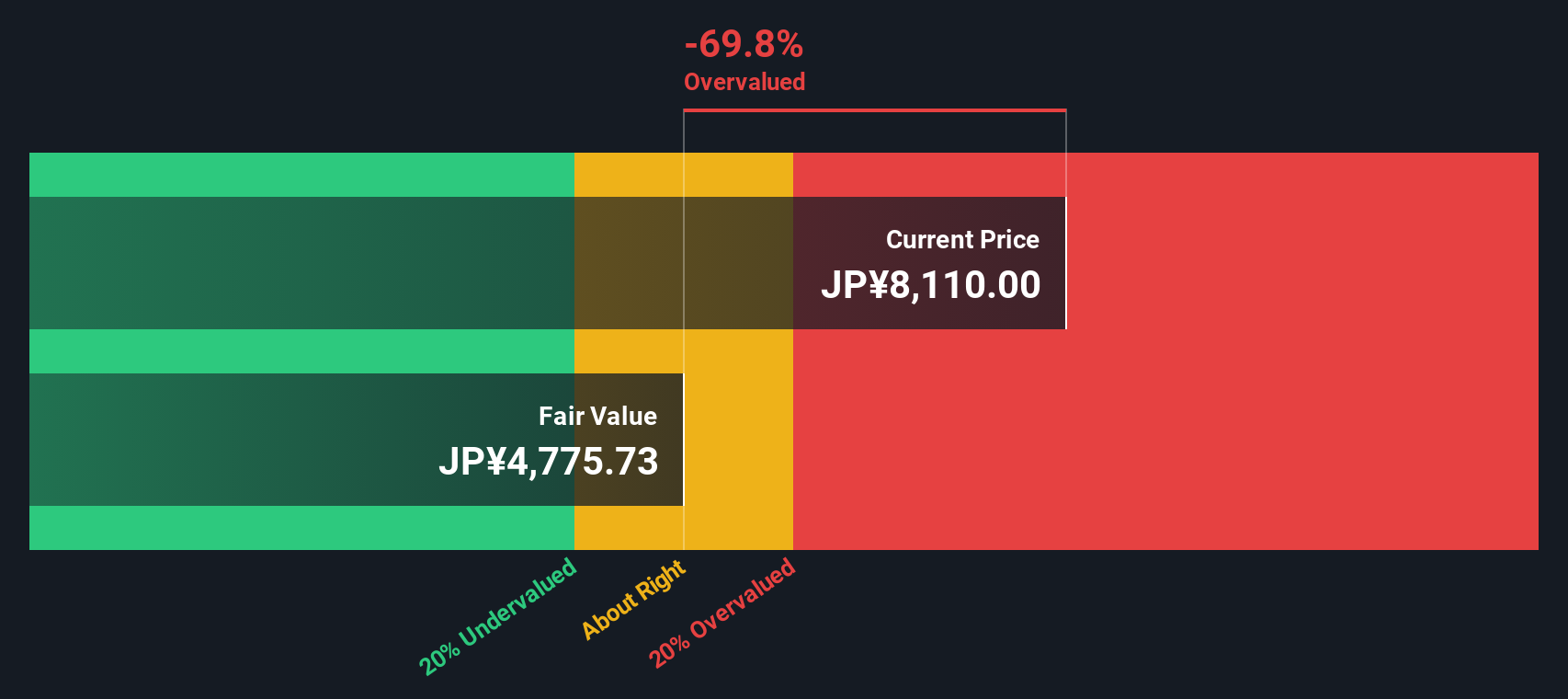

Our DCF model paints a cooler picture, putting fair value around ¥4,401, well below the current ¥7,940 share price. On this view, the stock screens as overvalued, raising the question of whether recent momentum has already pulled forward too much of that growth story.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kasumigaseki CapitalLtd for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kasumigaseki CapitalLtd Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a fresh narrative in just minutes, Do it your way.

A great starting point for your Kasumigaseki CapitalLtd research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more smart investment ideas?

Before you move on, consider finding your next edge by scouting targeted stock ideas on Simply Wall St’s powerful screener to stay ahead of slower investors.

- Seek under the radar value by scanning these 908 undervalued stocks based on cash flows that may be pricing in far less than their long term cash flow potential.

- Refine your growth search by zeroing in on these 26 AI penny stocks that are exposed to demand for real world AI adoption.

- Strengthen your income stream by pinpointing these 15 dividend stocks with yields > 3% that can help anchor your portfolio through changing market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com