How New CGM Lawsuits And Dexcom Academy At DexCom (DXCM) Have Changed Its Investment Story

- In late November and early December 2025, DexCom faced new securities class action lawsuits over alleged unauthorized design changes to its G6 and G7 CGM systems, while also launching Dexcom Academy, a personalized education platform for healthcare professionals across several EMEA markets.

- This combination of legal scrutiny around product safety claims and investment in clinician training tools highlights the tension between regulatory risk and efforts to strengthen long-term adoption of DexCom’s technology.

- We’ll now explore how the securities lawsuits over alleged unauthorized G6 and G7 design changes may alter DexCom’s existing investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

DexCom Investment Narrative Recap

To own DexCom, you generally need to believe continuous glucose monitoring will remain central to diabetes care and that DexCom can keep a leading role with reliable, regulator-approved products. The new securities class actions around alleged unauthorized G6 and G7 design changes increase near term regulatory and reputational risk, which could become as important as pricing pressure from potential CMS competitive bidding as a key risk to watch.

Against that backdrop, the launch of Dexcom Academy looks most relevant, because it focuses on training healthcare professionals to use DexCom’s G7 and broader software portfolio confidently and consistently. While it does not directly address the securities lawsuits, it speaks to efforts to support adoption and correct use of the technology, which ties into the core catalyst of broader CGM penetration across both type 1 and type 2 diabetes populations.

Yet despite these growth efforts, the allegations around G6 and G7 design changes raise questions investors should be aware of about...

Read the full narrative on DexCom (it's free!)

DexCom's narrative projects $6.5 billion revenue and $1.4 billion earnings by 2028. This requires 14.8% yearly revenue growth and an earnings increase of about $0.8 billion from $571.5 million today.

Uncover how DexCom's forecasts yield a $84.31 fair value, a 29% upside to its current price.

Exploring Other Perspectives

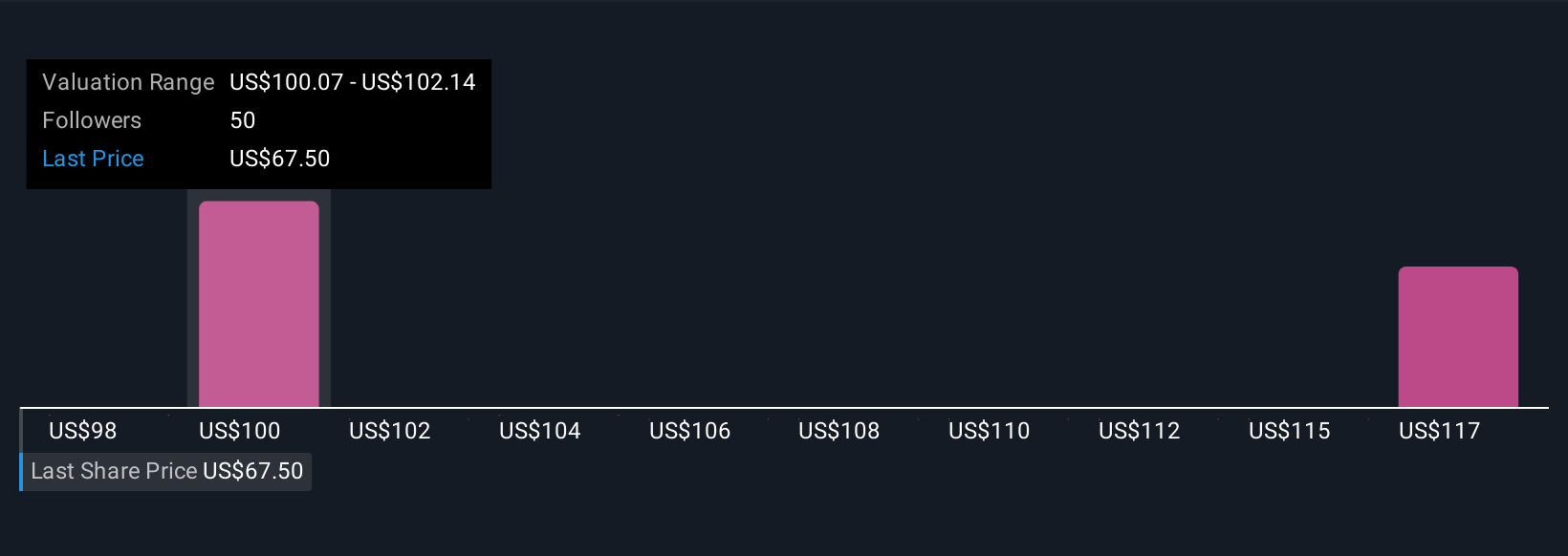

Seven members of the Simply Wall St Community see DexCom’s fair value between US$84 and US$127, reflecting a wide spread of expectations. You can set those views against the heightened legal and regulatory scrutiny tied to the recent securities lawsuits, which could influence how you think about DexCom’s future performance and risk profile.

Explore 7 other fair value estimates on DexCom - why the stock might be worth as much as 94% more than the current price!

Build Your Own DexCom Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DexCom research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free DexCom research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DexCom's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com