Does Ubiquiti’s Audit Committee Shortfall Reveal Deeper Governance Risks for Investors in UI?

- Ubiquiti Inc. reported that longtime director Ronald A. Sege, who joined the board in 2012 and most recently chaired its nominating and corporate governance committee while serving on the audit and compensation committees, passed away on November 30, 2025, leaving his Class II board seat temporarily vacant.

- His passing reduced the audit committee to two independent directors, putting Ubiquiti out of compliance with New York Stock Exchange rules that require three independent audit committee members.

- We will now examine how the temporary NYSE audit committee non-compliance shapes Ubiquiti’s investment narrative and governance risk profile.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Ubiquiti's Investment Narrative?

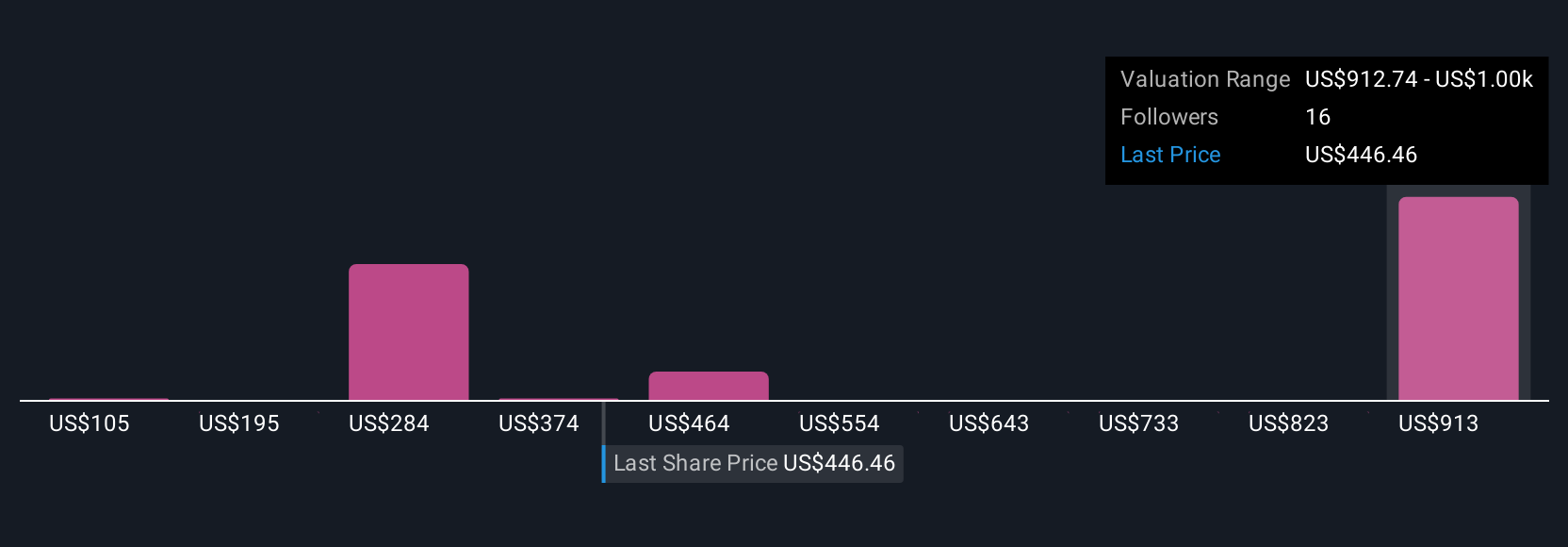

For Ubiquiti, you really have to believe in the durability of its high-margin hardware and software franchise, and in management’s ability to keep translating that into strong earnings and generous, recurring dividends. Recent results show solid revenue and profit growth, but the valuation already prices in a lot of that optimism, with the shares trading above some fair value estimates and on a richer multiple than peers. Near term, the key catalysts remain execution on product demand, maintaining margins, and the board’s stated commitment to at least US$0.80 per share in quarterly dividends for fiscal 2026. Against that backdrop, Ronald Sege’s passing and the temporary NYSE audit committee non-compliance look more like a governance watchpoint than a direct earnings threat, unless it signals deeper board refreshment challenges.

However, the board’s slow refresh and NYSE non-compliance raise governance questions investors should not overlook. Ubiquiti's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 14 other fair value estimates on Ubiquiti - why the stock might be worth less than half the current price!

Build Your Own Ubiquiti Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ubiquiti research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ubiquiti research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ubiquiti's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com