Should Brookfield Infrastructure Partners’ Expanded Buybacks and Preferred Redemption Strategy Require Action From BIP Investors?

- Brookfield Infrastructure Partners L.P. recently renewed its normal course issuer bids, gaining TSX approval to repurchase up to 23,062,017 LP Units, significant portions of several preferred unit series, and up to 10,594,212 Brookfield Infrastructure Corporation exchangeable shares through December 1, 2026, while also moving to redeem all outstanding Series 3 preferred units at C$25.00 each.

- This combination of renewed buyback capacity and the planned cash redemption of an entire preferred series tightens the equity base and can modestly enhance per‑unit economics for remaining common and preferred holders.

- We’ll now examine how this renewed capacity to retire up to 5% of LP Units over the next year influences Brookfield Infrastructure Partners’ investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Brookfield Infrastructure Partners Investment Narrative Recap

To own Brookfield Infrastructure Partners today, you need to be comfortable with a capital intensive, acquisition driven model that leans on stable cash flows and regular distributions. The renewed buyback program and Series 3 preferred redemption are helpful for per unit economics, but they do not materially change the near term focus on capital allocation discipline as the key catalyst, or the risk that heavier deal activity and leverage could strain balance sheet flexibility.

The most relevant recent development alongside the new buyback authorization is the 6% year over year increase in the quarterly distribution to US$0.43 per unit in early November. Together with the normal course issuer bid, this points investors back to the same central question around Brookfield Infrastructure Partners today: how comfortably its cash generation can fund both an elevated payout and an active pipeline of new projects without pushing leverage to levels that compound refinancing and rate risk.

Yet even with these shareholder friendly moves, investors still need to be aware of how higher-for-longer interest costs could interact with...

Read the full narrative on Brookfield Infrastructure Partners (it's free!)

Brookfield Infrastructure Partners’ narrative projects $14.5 billion revenue and $1.1 billion earnings by 2028. This implies revenues will decrease by 12.3% per year and earnings will increase by about $1.1 billion from $38.0 million today.

Uncover how Brookfield Infrastructure Partners' forecasts yield a $41.64 fair value, a 17% upside to its current price.

Exploring Other Perspectives

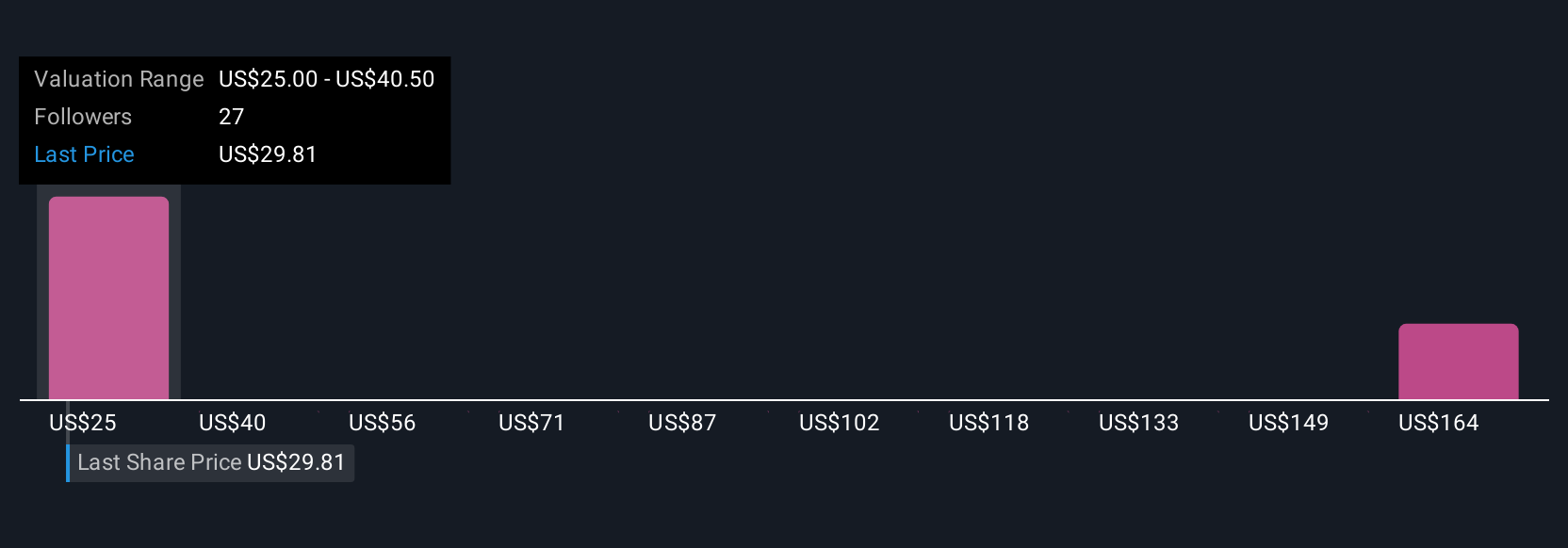

Seven members of the Simply Wall St Community currently see fair value anywhere between about US$25 and US$162 per unit, with views spread across that range. As you weigh those opinions, remember that Brookfield Infrastructure Partners’ renewed capacity to retire units only matters if its acquisition pace and leverage do not amplify the refinancing and regulatory risks already hanging over its long term performance, so it is worth exploring several contrasting takes before deciding where you stand.

Explore 7 other fair value estimates on Brookfield Infrastructure Partners - why the stock might be worth over 4x more than the current price!

Build Your Own Brookfield Infrastructure Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brookfield Infrastructure Partners research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Brookfield Infrastructure Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brookfield Infrastructure Partners' overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com