DFI Retail Group (SGX:D01) Is Up 19.2% After Boosting Dividends And Targeting Higher Returns - Has The Bull Case Changed?

- Earlier this month, DFI Retail Group Holdings outlined a new three-year plan, lifting its dividend payout ratio from 60% to 70% from the final 2025 dividend, while targeting an underlying profit compound annual growth rate of 11–15% and a return on capital employed of at least 15% by 2028.

- The group also plans to accelerate Health & Beauty and Convenience store growth via a capital-light franchise model and increase its online sales mix to 7–10%, signalling a stronger focus on asset efficiency and digital reach alongside higher cash returns to shareholders.

- We’ll now examine how the higher 70% dividend payout and profit-growth targets reshape DFI’s existing investment narrative and risk profile.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

DFI Retail Group Holdings Investment Narrative Recap

To own DFI Retail Group, you need to believe it can turn a challenged, low-growth retail base into a more profitable, cash generative network by leaning on higher margin formats and digital channels. The new dividend target and profit-growth ambitions reinforce the near term catalyst of improving profitability, but they also sharpen the key risk that higher cash returns could constrain reinvestment just as competition from offline and online rivals remains intense.

The most relevant recent announcement here is the sizeable 2025 special dividend of US$0.443 per share, on top of higher ordinary payouts. Together with the move to a 70% payout ratio, this points to a more generous capital return framework that could appeal to income focused investors in the short term, while intensifying questions about how DFI will fund continued price investments and digital initiatives in the face of…

Read the full narrative on DFI Retail Group Holdings (it's free!)

DFI Retail Group Holdings’ narrative projects $8.6 billion revenue and $509.9 million earnings by 2028.

Uncover how DFI Retail Group Holdings' forecasts yield a $3.86 fair value, a 6% downside to its current price.

Exploring Other Perspectives

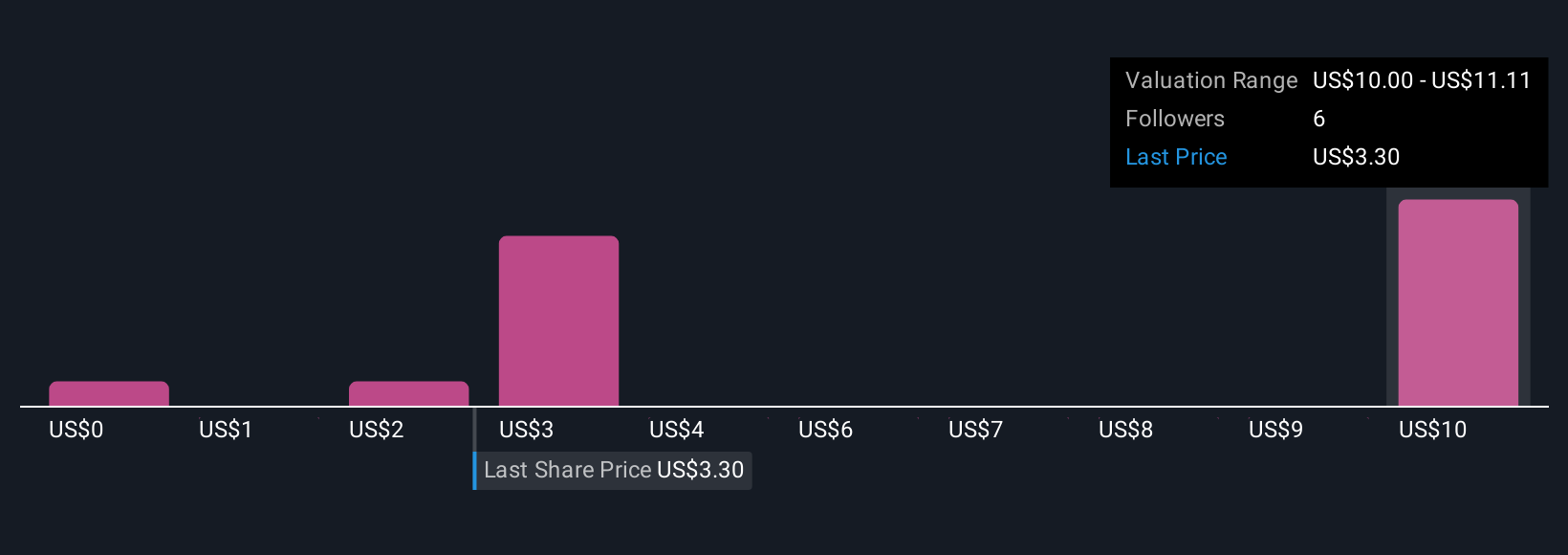

Five fair value estimates from the Simply Wall St Community span a wide range, from about US$1.43 up to roughly US$14.28 per share, showing how far opinions can diverge. Set against DFI’s push for profit growth, asset light expansion and a higher dividend payout, these varied views underline why you may want to compare different assumptions about how sustainable its margin and cash flow improvements really are.

Explore 5 other fair value estimates on DFI Retail Group Holdings - why the stock might be worth over 3x more than the current price!

Build Your Own DFI Retail Group Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DFI Retail Group Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DFI Retail Group Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DFI Retail Group Holdings' overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com