EnerSys (ENS) valuation after multiple earnings beats and stronger AI data center growth outlook

EnerSys (ENS) is back on investors radar after another earnings beat and a higher full year outlook, with the market starting to tie its industrial batteries more directly to the AI data center buildout.

See our latest analysis for EnerSys.

The latest beat and guidance hike have capped a powerful run, with EnerSys sitting around $147.65 after a roughly 60 percent year to date share price return and a triple digit three year total shareholder return that signal momentum is still building.

If EnerSys strong run has you thinking more broadly about the AI hardware theme, now could be a smart time to explore high growth tech and AI stocks as potential next candidates.

With the stock near record highs, trading slightly above analyst targets but still at modest earnings multiples, the key question now is whether EnerSys remains mispriced upside or if the market is already discounting years of AI driven growth.

Most Popular Narrative Narrative: 2.5% Overvalued

With EnerSys closing at $147.65 against a narrative fair value of $144, the story hinges on steady growth, fatter margins, and disciplined capital returns.

The analysts have a consensus price target of $120.0 for EnerSys based on their expectations of its future earnings growth, profit margins and other risk factors.

In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.9 billion, earnings will come to $394.7 million, and it would be trading on a PE ratio of 12.4x, assuming you use a discount rate of 9.7%.

Curious how modest top line growth, expanding profitability, shrinking share count, and a restrained earnings multiple still add up to this valuation playbook? The narrative joins the dots.

Result: Fair Value of $144 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering tariff uncertainty and heavy reliance on acquisitions mean that any policy shock or deal misstep could quickly derail the margin expansion story.

Find out about the key risks to this EnerSys narrative.

Another Angle on Valuation

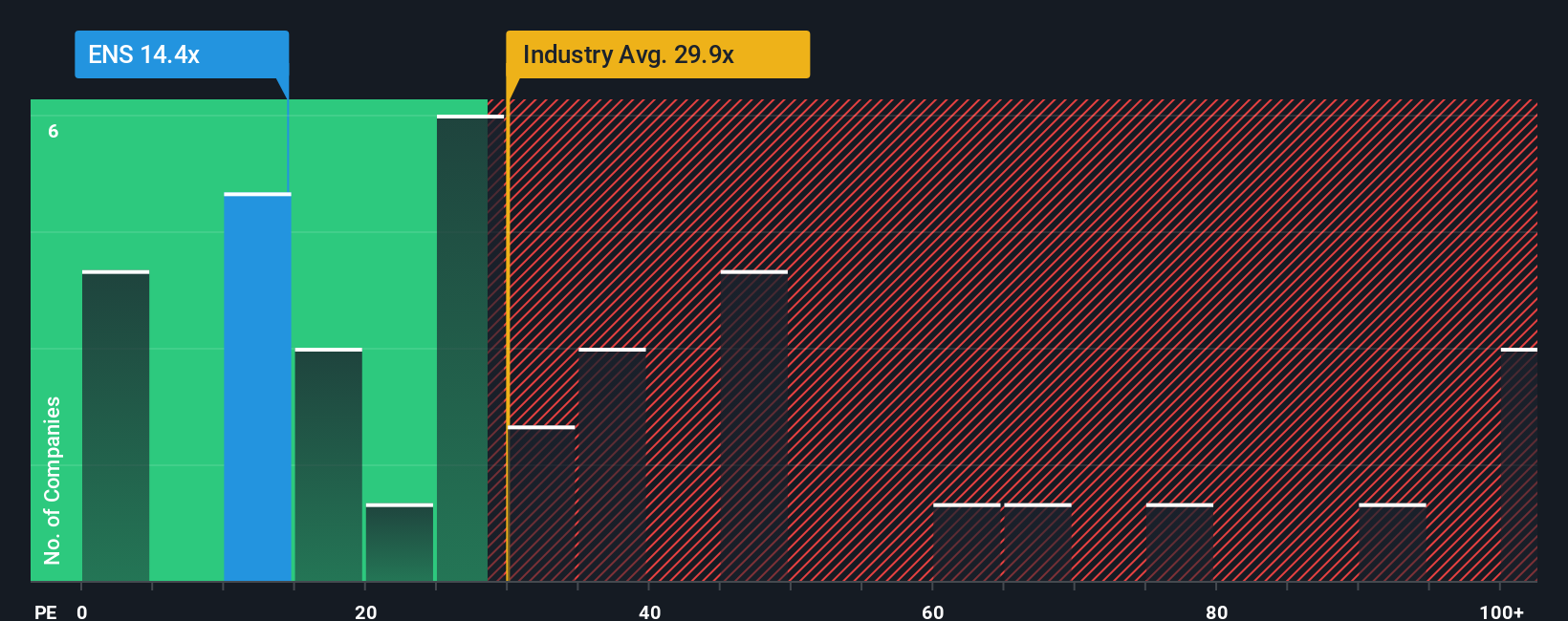

While the narrative model flags EnerSys as about 2.5 percent overvalued, a simple earnings lens tells a calmer story. At 16.2 times earnings, the stock trades well below the US Electrical industry on 31.3 times and a peer average of 37.3 times, versus a fair ratio of 24.6 times. Is the market underestimating how durable these earnings could be, or already assuming a slowdown?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EnerSys Narrative

If this framework does not quite fit your view, or you prefer to dig into the numbers yourself, you can build a full narrative in minutes, Do it your way.

A great starting point for your EnerSys research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

EnerSys might fit your strategy today, but you will miss fresh opportunities if you stop here. Let Simply Wall Street Screeners surface your next move.

- Capitalize on high-growth themes by targeting these 26 AI penny stocks that could reshape entire industries and power the next wave of market leaders.

- Lock in reliable cashflow potential with these 15 dividend stocks with yields > 3% that aim to keep paying you, even when markets turn choppy.

- Position yourself early in the next structural trend by scanning these 81 cryptocurrency and blockchain stocks riding blockchain innovation and digital asset adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com