Does Sabine Royalty Trust’s (SBR) Softer Payout Reveal Volume Risk at the Core of Its Story?

- In early December 2025, Argent Trust Company, as Trustee of Sabine Royalty Trust, reported preliminary monthly production of 28,904 barrels of oil and 796,698 Mcf of gas, alongside a cash distribution of US$0.196670 per unit payable on December 29 to holders of record on December 15.

- This lower monthly distribution, driven by reduced oil and gas production despite firmer commodity prices and lower Ad Valorem taxes, highlights how sensitive the trust’s payout is to underlying volume swings.

- We’ll now examine how the reduced monthly distribution and softer production trends shape Sabine Royalty Trust’s investment narrative for unitholders.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Sabine Royalty Trust's Investment Narrative?

To own Sabine Royalty Trust, you have to be comfortable tying your returns to monthly royalty cheques that move with both commodity prices and production volumes, rather than a traditional growth story. The trust screens as relatively good value on earnings, with very high profitability and a long record of turning most of its revenue into distributable income, but its unstable payout history is a reminder that distributions can swing sharply. The December 2025 update, with materially lower oil and gas volumes and a cut in the monthly cash distribution to US$0.196670 per unit, brings that risk into focus and may temper the near term income catalyst that had supported recent total returns. For now, the news looks more like a reset in expectations than a structural break, but it puts volume volatility front and center for unitholders.

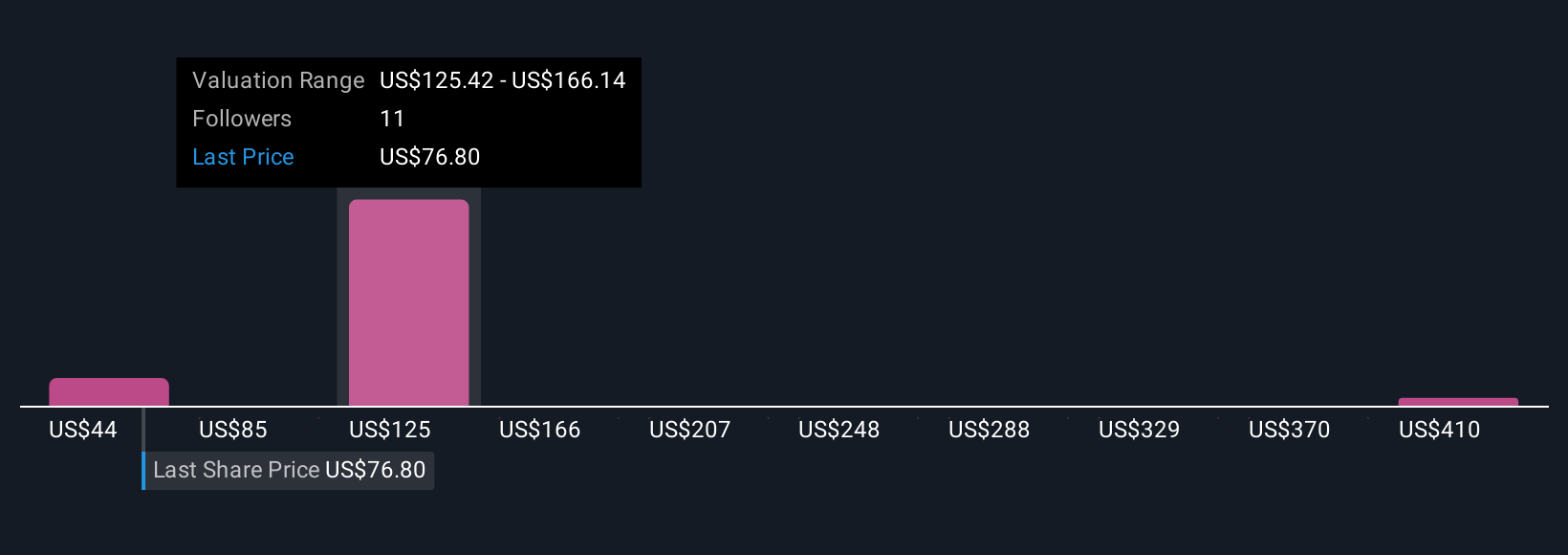

However, one key risk is how quickly distributions can fall when production dips. Despite retreating, Sabine Royalty Trust's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 4 other fair value estimates on Sabine Royalty Trust - why the stock might be worth 39% less than the current price!

Build Your Own Sabine Royalty Trust Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sabine Royalty Trust research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Sabine Royalty Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sabine Royalty Trust's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com