Reviewing MYR Group (MYRG)’s Valuation as Electrification and AI Infrastructure Tailwinds Strengthen

MYR Group (MYRG) is back on investors radar after management doubled down on its optimistic outlook for electrification and AI infrastructure, highlighting rising demand and the potential for earnings growth over the next two years.

See our latest analysis for MYR Group.

Behind that upbeat commentary, MYR Group’s momentum has been strong, with the share price up 54.54% year to date and a standout 149.55% three year total shareholder return, signalling investors are leaning into the long term electrification story.

If MYR Group’s trajectory has your attention, this could be a good moment to explore other infrastructure and grid enablers via fast growing stocks with high insider ownership.

But with MYR Group now trading near analysts price targets and carrying a modest intrinsic premium, should investors view the electrification boom as a fresh entry point, or assume the market has already priced in years of future growth?

Most Popular Narrative Narrative: 5% Undervalued

With MYR Group last closing at $228.54 against a narrative fair value of $240.60, the most followed view sees modest upside still on the table.

Sustained momentum in electrification spanning grid upgrades, data center buildouts, and transportation coupled with robust private/public sector investment, is expected to drive strong demand for MYR Group's infrastructure services, elevating the overall addressable market and supporting top-line growth.

Curious how steady growth assumptions, rising margins, and a future earnings multiple come together to justify that higher value? Unpack the full playbook behind this narrative.

Result: Fair Value of $240.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shrinking renewables exposure and persistent labor cost pressures could quickly challenge the growth and margin assumptions that underpin this mildly undervalued narrative.

Find out about the key risks to this MYR Group narrative.

Another Way to Look at Value

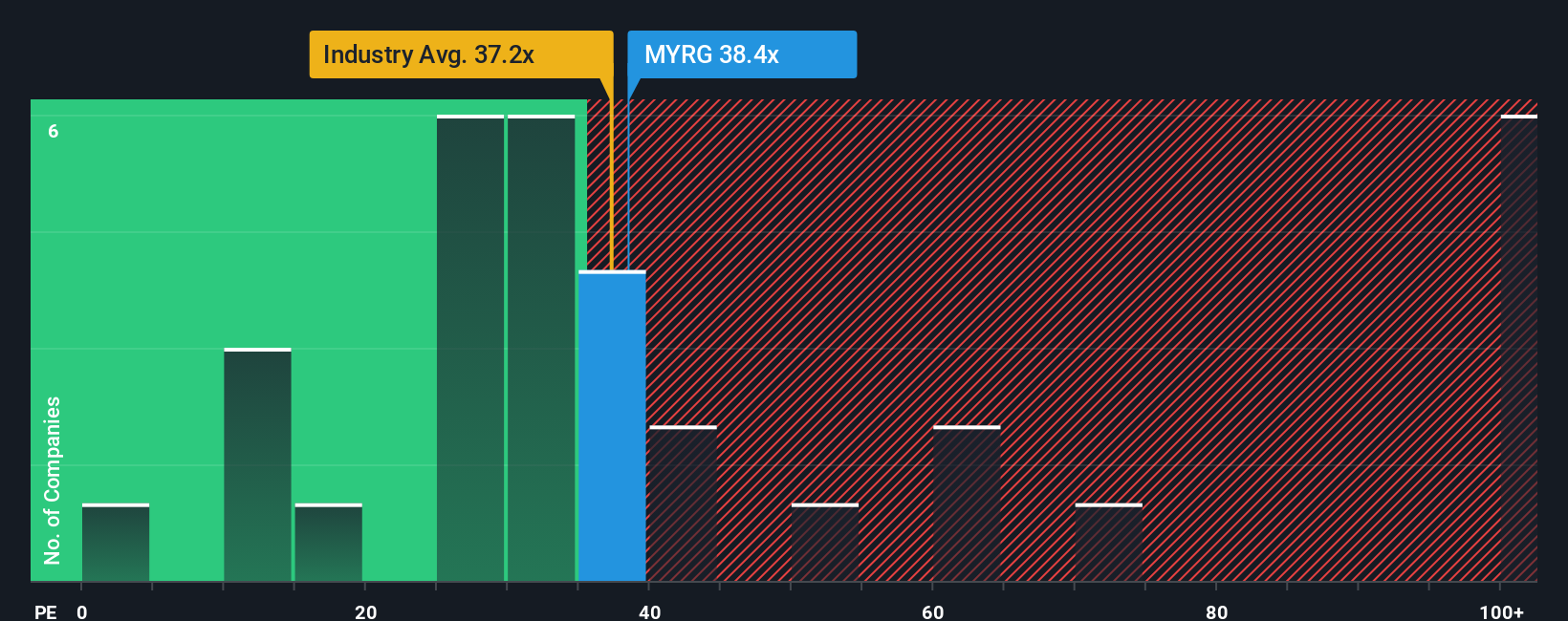

On earnings, MYR Group looks stretched. The current P/E of 36.3x sits above both the US Construction industry at 34.2x and peers at 26x. It also stands well ahead of a 27.8x fair ratio that the market could drift toward, leaving less margin for error if growth cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MYR Group Narrative

If you are not fully aligned with this view, or simply prefer hands on analysis, you can build a personalized MYR Group storyline in just minutes: Do it your way.

A great starting point for your MYR Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop with one great story. Use the Simply Wall St Screener to uncover fresh opportunities that match your strategy before the market gets ahead of you.

- Capture high potential income by reviewing steady cash generators and reliable payers through these 15 dividend stocks with yields > 3% before yields compress.

- Position yourself early in transformative innovation by targeting companies powering automation, machine learning, and smart infrastructure with these 26 AI penny stocks.

- Strengthen your long term returns by focusing on mispriced opportunities that look cheap against future cash flows via these 908 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com