Needham’s Bullish View on Ethical Scale Might Change The Case For Investing In Vital Farms (VITL)

- Earlier this week, Needham initiated coverage on Vital Farms with a Buy rating, citing the company’s capacity expansion, strong consumer demand, and leading position in ethical, pasture-raised eggs and butter.

- Analysts are increasingly highlighting Vital Farms’ combination of ethical sourcing and operational scale as a potential differentiator within the premium food products space.

- We’ll now examine how Needham’s upbeat initiation, centered on capacity expansion and ethical leadership, reshapes Vital Farms’ broader investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Vital Farms Investment Narrative Recap

To own Vital Farms, you have to believe that consumer demand for ethically sourced, pasture raised eggs and butter will remain strong enough to support its expanding capacity and premium positioning. Needham’s upbeat initiation reinforces this thesis but does not materially change the near term catalyst, which is successful ramp up of new production and distribution, or the biggest risk, that heavy capital spending could strain cash flow if demand or pricing softens.

Among recent announcements, Vital Farms’ decision on 4 November 2025 to raise its full year 2025 net revenue guidance to at least US$775,000,000, following Q3 results, is most relevant. It ties directly into the capacity expansion story that Needham highlights, while also reminding investors that higher growth ambitions come with execution risk around costs, margins and the timing of new facilities coming online.

Yet behind the optimism, investors should be aware of the pressure that accelerated capital spending could place on free cash flow and...

Read the full narrative on Vital Farms (it's free!)

Vital Farms’ narrative projects $1.2 billion revenue and $103.0 million earnings by 2028. This requires 22.5% yearly revenue growth and an earnings increase of about $51 million from $51.6 million today.

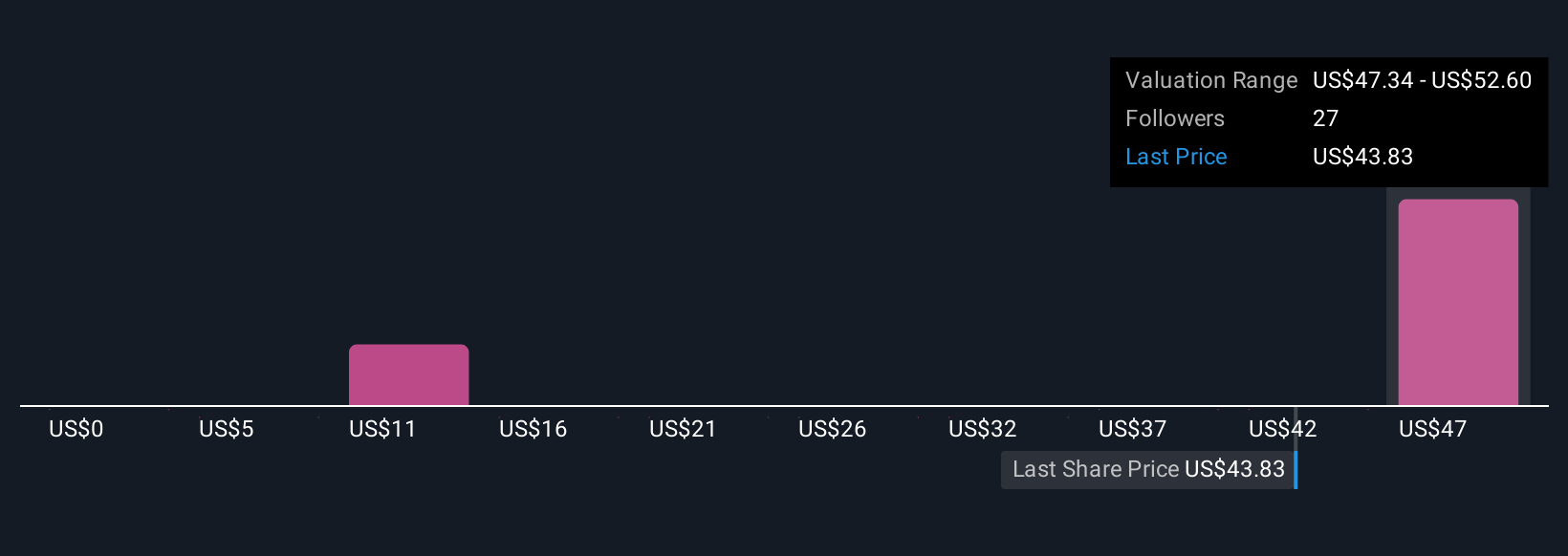

Uncover how Vital Farms' forecasts yield a $52.60 fair value, a 66% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community span roughly US$40 to US$348, showing how differently individuals see Vital Farms. You can weigh those views against the central catalyst of capacity expansion, which could amplify both the upside and the execution risks already in focus for this business.

Explore 6 other fair value estimates on Vital Farms - why the stock might be worth just $40.34!

Build Your Own Vital Farms Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vital Farms research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Vital Farms research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vital Farms' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com