Clearwater Analytics (CWAN) Valuation After Enfusion and Beacon Acquisitions Expand Its Growth Platform

Clearwater Analytics Holdings (CWAN) just made a strategic leap by acquiring Enfusion and Beacon, pulling asset managers and hedge funds into its orbit alongside insurers, and the market is starting to reprice that broader opportunity.

See our latest analysis for Clearwater Analytics Holdings.

The acquisitions come after a sharp 30 day share price return of 34.2 percent, even though the year to date share price return remains down 20.2 percent, and the three year total shareholder return of 20.5 percent suggests longer term momentum is still intact.

If Clearwater’s expansion has you thinking about where else growth and competitive advantages might be compounding, it could be worth exploring fast growing stocks with high insider ownership.

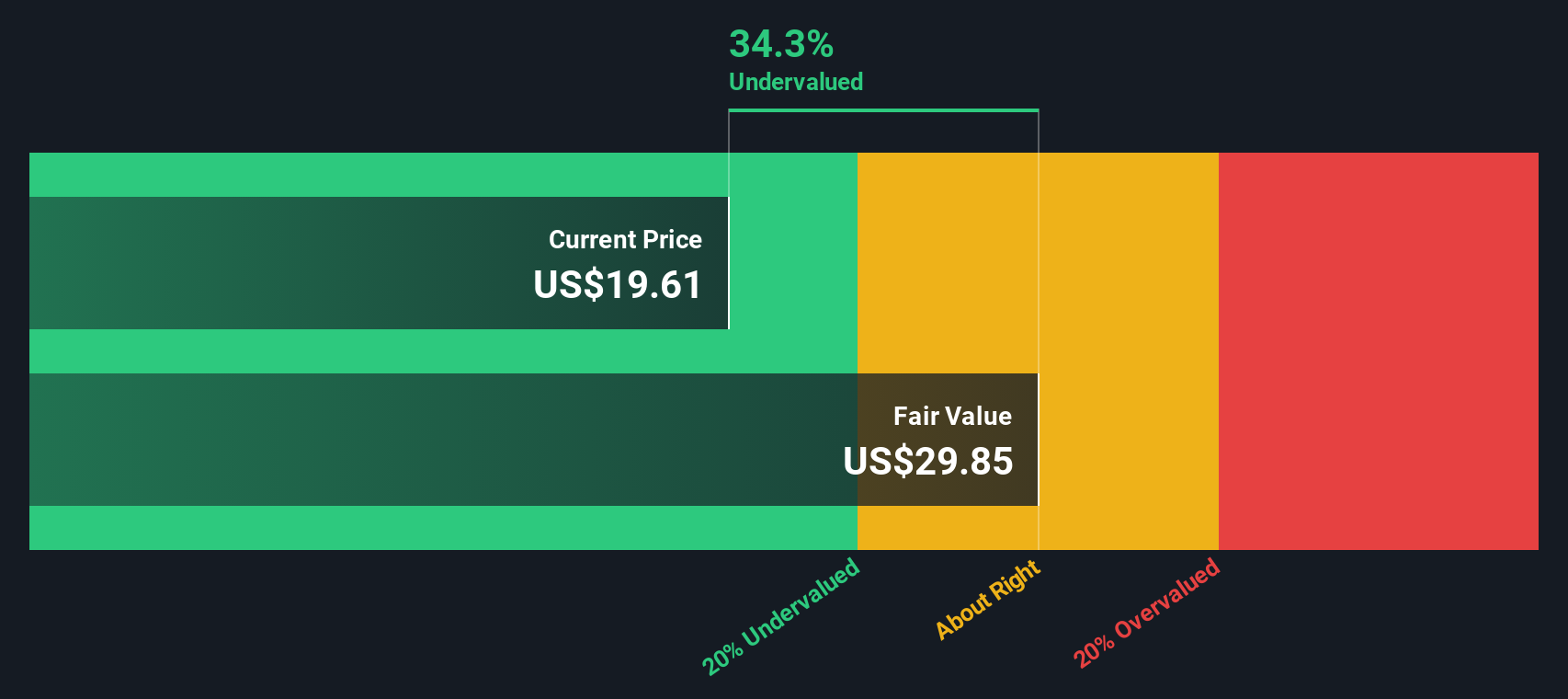

With analysts seeing more than 30 percent upside from here and Clearwater leaning hard into a bigger, stickier platform story, the real question now is simple: is this a fresh entry point, or is future growth already priced in?

Most Popular Narrative: 23.9% Undervalued

With the most widely followed narrative placing fair value above Clearwater Analytics Holdings' last close of $21.71, the valuation debate hinges on how far this rerating can run.

The analysts have a consensus price target of $30.545 for Clearwater Analytics Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $36.0, and the most bearish reporting a price target of just $23.0.

Want to know what kind of revenue trajectory, margin reset, and future earnings multiple have to line up to justify that upside story? The core assumptions behind this fair value hinge on high octane top line growth, a sharp profit margin reset, and a future valuation multiple more often reserved for sector standouts. Curious how those moving parts fit together into one bold valuation call? Read on to see the numbers that power this narrative.

Result: Fair Value of $28.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stretched integration plans and heavier debt loads could easily derail margin expansion, stall revenue momentum, and force a rethink of that premium growth narrative.

Find out about the key risks to this Clearwater Analytics Holdings narrative.

Another Angle on Value

Our DCF model is less enthusiastic, putting fair value around $21.33, slightly below the current $21.71 share price, which implies Clearwater is a touch overvalued rather than nearly 24 percent undervalued. If cash flows rule the day, is the upside story already spent?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Clearwater Analytics Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Clearwater Analytics Holdings Narrative

If you see the setup differently, or want to dig into the data on your own terms, you can build a full narrative in minutes: Do it your way.

A great starting point for your Clearwater Analytics Holdings research is our analysis highlighting 5 key rewards and 3 important warning signs that could impact your investment decision.

Looking for your next investment move?

Before momentum shifts again, take a few minutes to scan fresh opportunities with targeted screeners on Simply Wall Street and keep your watchlist ahead of the crowd.

- Capitalize on mispriced quality by reviewing these 908 undervalued stocks based on cash flows that blend solid fundamentals with attractive valuations.

- Position for the next wave of innovation by targeting these 26 AI penny stocks harnessing artificial intelligence to transform traditional industries.

- Strengthen your income strategy by hunting through these 15 dividend stocks with yields > 3% that may help boost long term total returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com