Did Zeta’s Small Equity Raise and Higher 2025–26 Outlook Just Shift ZETA’s Investment Narrative?

- Zeta Global Holdings Corp. recently completed a follow-on equity offering of US$0.999997 million, issuing 58,943 Class A common shares at about US$16.97 per share.

- Just before this capital raise, the company lifted its revenue guidance for late 2025 and 2026, highlighting management’s confidence in integrating Marigold’s enterprise software business into Zeta’s growth plans.

- We’ll now examine how the upgraded multi-year revenue outlook, including Marigold’s contribution, may influence Zeta Global Holdings’ investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Zeta Global Holdings Investment Narrative Recap

To own Zeta Global, you need to believe its AI-driven marketing cloud can keep winning budget from enterprises and agencies despite intense competition and rising privacy constraints. The recent follow-on equity raise is tiny in size and does not materially shift the near term picture, where the key catalyst is management’s upgraded multi-year revenue guidance and the biggest risk remains the company’s path to sustainably moving past GAAP net losses.

The most relevant update here is Zeta’s higher 2025 and 2026 revenue guidance, which now explicitly includes Marigold’s enterprise software contribution. That guidance frames how investors might think about the potential benefits of Zeta’s AI and data investments, while still weighing ongoing profitability risk and whether customer acquisition and product development spending can be brought into line with future earnings power.

Yet alongside the higher revenue outlook, one issue investors should be aware of is...

Read the full narrative on Zeta Global Holdings (it's free!)

Zeta Global Holdings' narrative projects $1.9 billion revenue and $106.5 million earnings by 2028. This requires 18.3% yearly revenue growth and a $143.1 million earnings increase from -$36.6 million today.

Uncover how Zeta Global Holdings' forecasts yield a $29.67 fair value, a 56% upside to its current price.

Exploring Other Perspectives

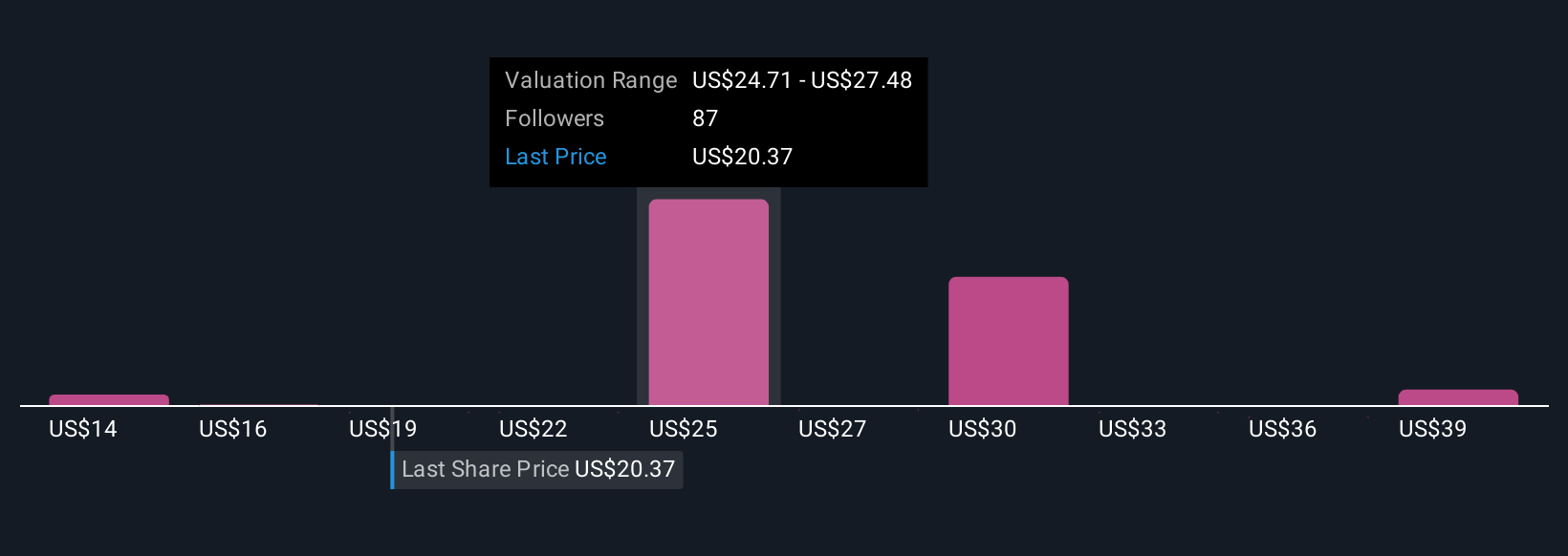

Twenty nine fair value estimates from the Simply Wall St Community range from US$14.28 to US$41.34, underscoring how far apart individual views can be. When you set that against Zeta’s raised multi year revenue guidance and integration of Marigold, it becomes even more important to compare different expectations for how quickly the business can translate growth into durable profitability.

Explore 29 other fair value estimates on Zeta Global Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Zeta Global Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zeta Global Holdings research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Zeta Global Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zeta Global Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com