Allied Properties REIT (TSX:AP.UN) Valuation After 60% Distribution Cut and Rising Balance Sheet Concerns

Allied Properties Real Estate Investment Trust (TSX:AP.UN) just cut its monthly distribution by roughly 60 percent, trimming December’s payout to CA$0.06 per unit. This move reshapes its income profile and raises sector wide dividend questions.

See our latest analysis for Allied Properties Real Estate Investment Trust.

That harsh distribution cut lands on a unit price that has already been under pressure, with a roughly 35 percent 3 month share price return and a 5 year total shareholder return of about negative 52 percent. This suggests momentum has clearly been fading.

If this shift in income changes how you think about REITs, it could be a good moment to scan the market for alternatives and explore fast growing stocks with high insider ownership.

With the unit price deeply underwater versus its five year history, yet still trading at a discount to some valuation estimates, investors now face a key decision: is Allied cheap after the cut or simply priced for weaker growth?

Price to Sales of 3x, Is it justified?

Allied Properties REIT trades at CA$12.88, implying a price to sales ratio of about 3 times, which screens as expensive against several benchmarks.

The price to sales multiple compares the market value of the trust to the revenue it generates. This is a common yardstick for property businesses where profits can be volatile. For Allied, this means investors are currently paying roughly three dollars for every dollar of annual revenue, a richer tag than many of its closest peers.

According to our assessment, that 3 times price to sales ratio stands above both the estimated fair price to sales level of 2.5 times and the peer and broader North American office REIT averages. This suggests the market is still assigning a premium relative to sales, even as the trust remains unprofitable and its total returns have lagged both the wider Canadian market and its own industry.

Stacked against the North American office REITs group, where the average price to sales sits closer to 2.1 times and domestic peers closer to 1.6 times, Allied’s 3 times multiple looks significantly elevated. If sentiment or fundamentals revert toward those lower ranges, the valuation gap could compress sharply from here.

Explore the SWS fair ratio for Allied Properties Real Estate Investment Trust

Result: Price to Sales of 3x (OVERVALUED)

However, sustained negative total returns and continued net losses could force deeper valuation resets, particularly if office demand or leasing spreads weaken further.

Find out about the key risks to this Allied Properties Real Estate Investment Trust narrative.

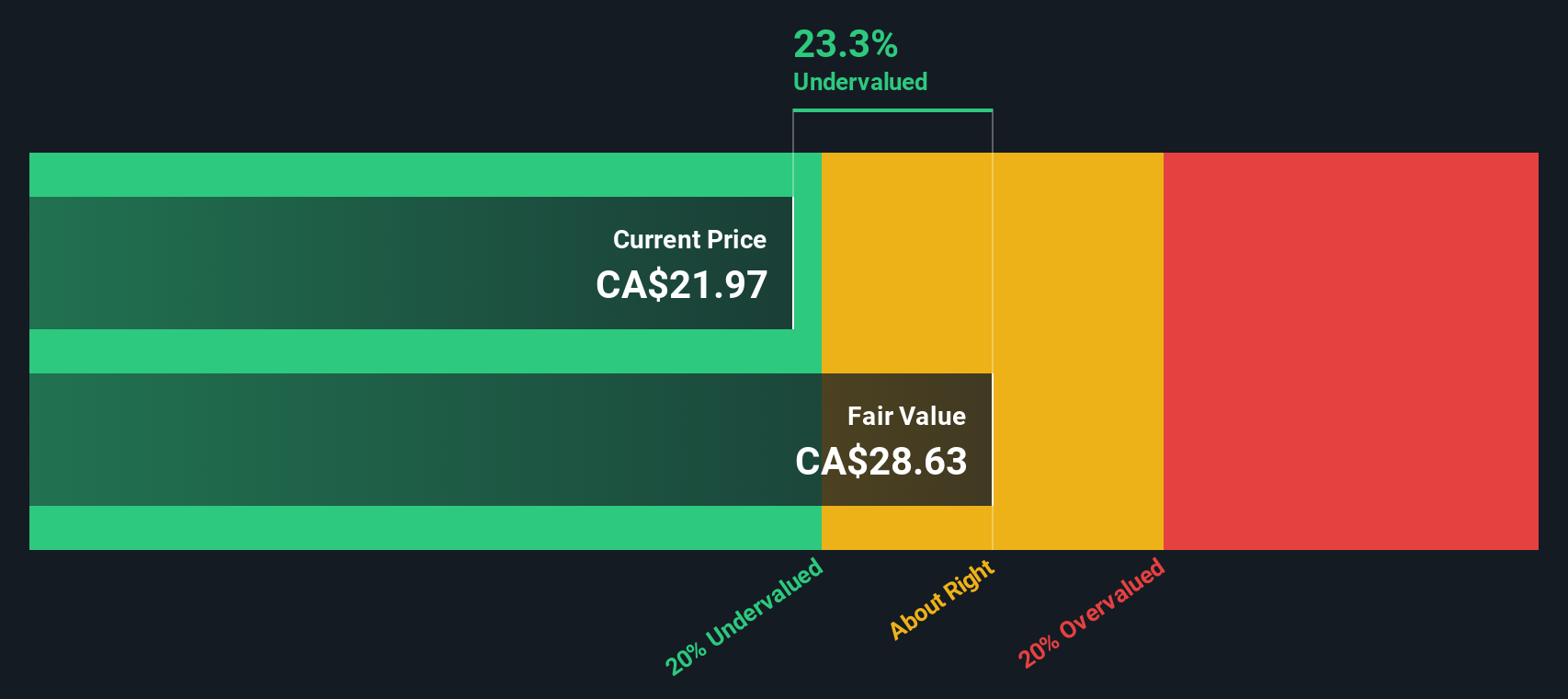

Another View, Discounted Cash Flow Signals Upside

Our DCF model paints a different picture, suggesting Allied is trading about 44 percent below its CA$23.11 fair value estimate. If cash flows recover as forecast and the price drifts toward that level, is the current pessimism creating a value window or a value trap?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Allied Properties Real Estate Investment Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Allied Properties Real Estate Investment Trust Narrative

If you see the numbers differently or would rather dig into the data yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Allied Properties Real Estate Investment Trust research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop with a single REIT. Your next strong return might come from fresh ideas uncovered with the Simply Wall St screener tailored to your strategy.

- Capture potential bargains by scanning these 908 undervalued stocks based on cash flows that trade below their cash flow value before the crowd notices.

- Ride powerful secular trends by backing innovators in these 26 AI penny stocks poised to benefit from accelerating AI adoption.

- Lock in dependable income streams by targeting these 15 dividend stocks with yields > 3% that combine attractive yields with solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com