Intuit (INTU) Valuation Check After Earnings Beat, Cautious Guidance and Investor Day Growth Update

Intuit (INTU) has been in the spotlight after its latest earnings beat was followed by cautious guidance, a combination that initially pressured the stock but set the stage for a more nuanced investor debate.

See our latest analysis for Intuit.

Despite the post earnings wobble, Intuit’s 7 day share price return of 6.24% and year to date share price gain of 8.16% suggest momentum is rebuilding. A 3 year total shareholder return of 71.85% underlines that the longer term story remains firmly intact.

If Intuit’s mix of software, data and AI has your attention, this could be a smart moment to explore other potential winners among high growth tech and AI stocks.

With the stock still trading at a notable discount to analyst targets despite robust growth in AI driven fintech, investors face a key question: is Intuit quietly undervalued here, or is the market already pricing in its next leg of expansion?

Most Popular Narrative Narrative: 16.3% Undervalued

With Intuit last closing at $673.63 against a narrative fair value near $805, the story hinges on whether its AI centric growth runway is being fully appreciated.

The accelerating adoption of Intuit's AI driven all in one platform including virtual teams of AI agents and human experts positions the company to consolidate customers' tech stacks, drive automation of workflows, and unlock substantial ROI for customers, supporting higher average revenue per customer (ARPC) and net margin expansion over time.

Curious how double digit growth, rising margins and a premium future earnings multiple all come together in one upside case? Unpack the full valuation blueprint inside the narrative.

Result: Fair Value of $805.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower Mailchimp recovery and Credit Karma’s cyclicality could quickly challenge the upside case if execution slips or consumer credit conditions tighten.

Find out about the key risks to this Intuit narrative.

Another Take on Valuation

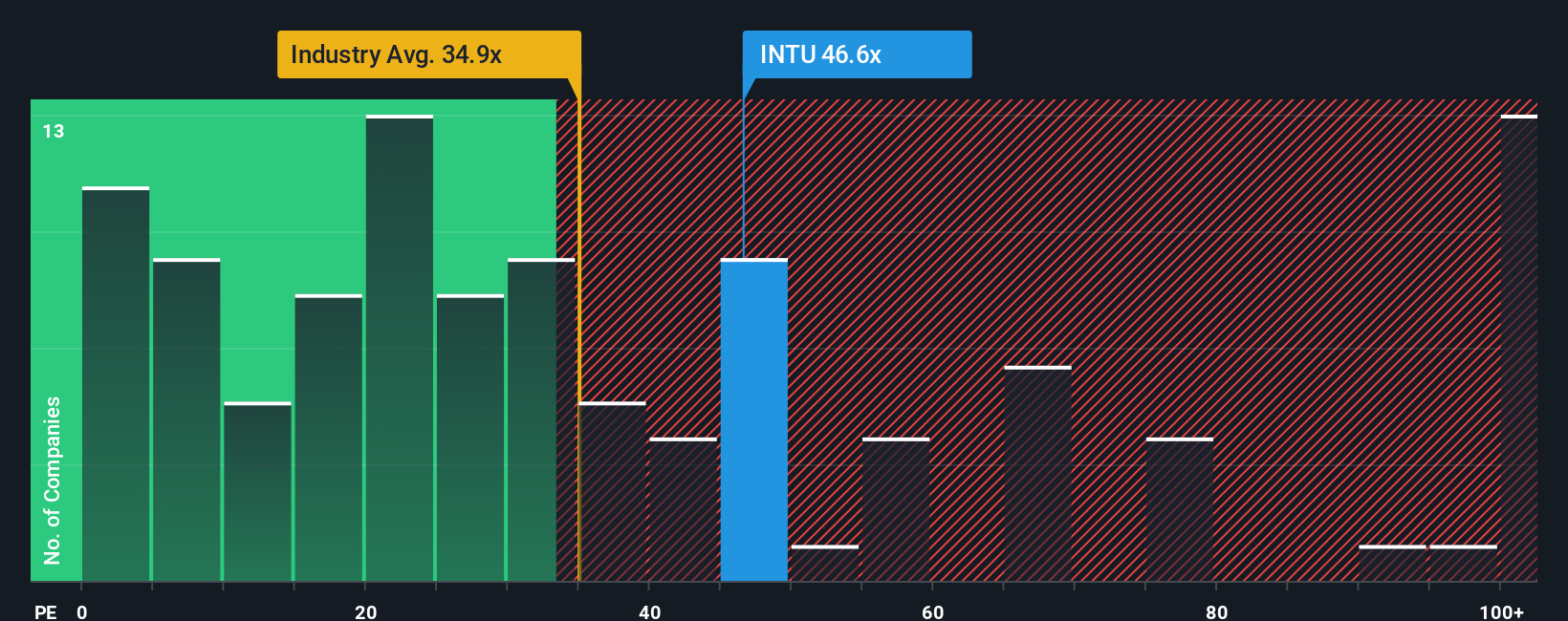

Put differently, Intuit’s price earnings ratio of 45.5 times looks steep versus the US software average at 31.5 times and even above its own fair ratio of 40.7 times. The stock is cheaper than close peers, but that premium still raises a simple question: how much optimism is already in the price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Intuit Narrative

If you see the numbers differently or want to dig into the data yourself, you can build a personalized view in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Intuit.

Looking for more investment ideas?

If you want to stay a step ahead of the crowd, use the Simply Wall Street Screener to spot strong opportunities before they hit everyone’s radar.

- Capture early stage potential with these 3574 penny stocks with strong financials that already show disciplined financial strength instead of relying on hype alone.

- Target tomorrow’s growth engines by scanning these 26 AI penny stocks positioned at the intersection of software, automation, and real business adoption.

- Lock in quality at attractive valuations by zeroing in on these 908 undervalued stocks based on cash flows where cash flows and fundamentals tell a more compelling story than the current share price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com