ASX Penny Stocks To Watch In December 2025

As Australian shares edge towards a modest gain, the market's recent volatility has kept investors on their toes, with fluctuations throughout the week reflecting a cautious sentiment. For those interested in exploring smaller or newer companies, penny stocks remain an intriguing option despite their somewhat antiquated name. These stocks can offer surprising value when backed by strong financials and growth potential, providing opportunities for investors to discover promising candidates with solid foundations.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.395 | A$113.2M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.52 | A$71.7M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.80 | A$49.81M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.87 | A$441.09M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.26 | A$240.79M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.073 | A$38.45M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.88 | A$3.29B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.20 | A$1.35B | ✅ 3 ⚠️ 2 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.65 | A$245.34M | ✅ 3 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.48 | A$650.45M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 415 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Big River Industries (ASX:BRI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Big River Industries Limited, with a market cap of A$119.59 million, operates in Australia and New Zealand where it manufactures, distributes, and retails timber and building products.

Operations: The company generates revenue from two main segments: Panels, contributing A$129.73 million, and Construction, accounting for A$275.36 million.

Market Cap: A$119.59M

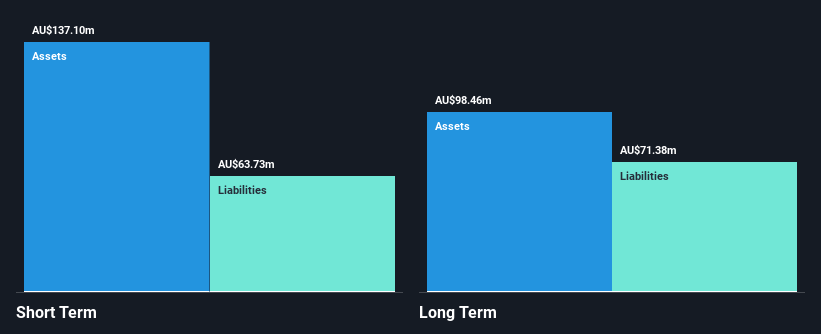

Big River Industries Limited, with a market cap of A$119.59 million, operates in the timber and building products sector across Australia and New Zealand. Despite being unprofitable with a negative return on equity of -14.55%, it trades at 61.6% below its estimated fair value, suggesting potential upside if profitability improves. The company recently announced a follow-on equity offering worth A$10 million and has made strategic board changes to enhance governance as part of its growth strategy. While short-term assets cover both short- and long-term liabilities comfortably, the dividend yield is not well supported by earnings due to current losses.

- Unlock comprehensive insights into our analysis of Big River Industries stock in this financial health report.

- Gain insights into Big River Industries' future direction by reviewing our growth report.

Djerriwarrh Investments (ASX:DJW)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Djerriwarrh Investments Limited is a publicly owned investment manager with a market capitalization of A$814.87 million.

Operations: The company's revenue is primarily derived from its portfolio of investments, amounting to A$53.07 million.

Market Cap: A$814.87M

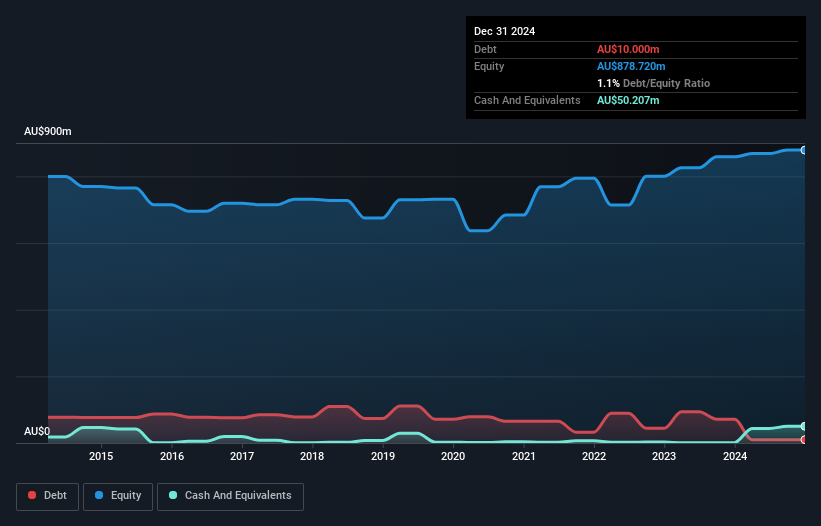

Djerriwarrh Investments Limited, with a market cap of A$814.87 million, demonstrates financial stability through its well-covered interest payments by EBIT at 24.1x and a strong debt position, having more cash than total debt. The company's earnings have grown 7.9% annually over the past five years, though recent growth slowed to 0.6%, trailing the industry average. Its board and management team are experienced with long tenures, contributing to stable operations despite low return on equity at 4.5%. Although dividends are not fully covered by earnings or free cash flow, Djerriwarrh maintains high-quality earnings and improved profit margins year-over-year.

- Click to explore a detailed breakdown of our findings in Djerriwarrh Investments' financial health report.

- Evaluate Djerriwarrh Investments' historical performance by accessing our past performance report.

Toro Energy (ASX:TOE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Toro Energy Limited, with a market cap of A$56.53 million, operates as a uranium development and exploration company in Australia.

Operations: The company's revenue segment consists solely of mineral exploration, generating A$0.1 million.

Market Cap: A$56.53M

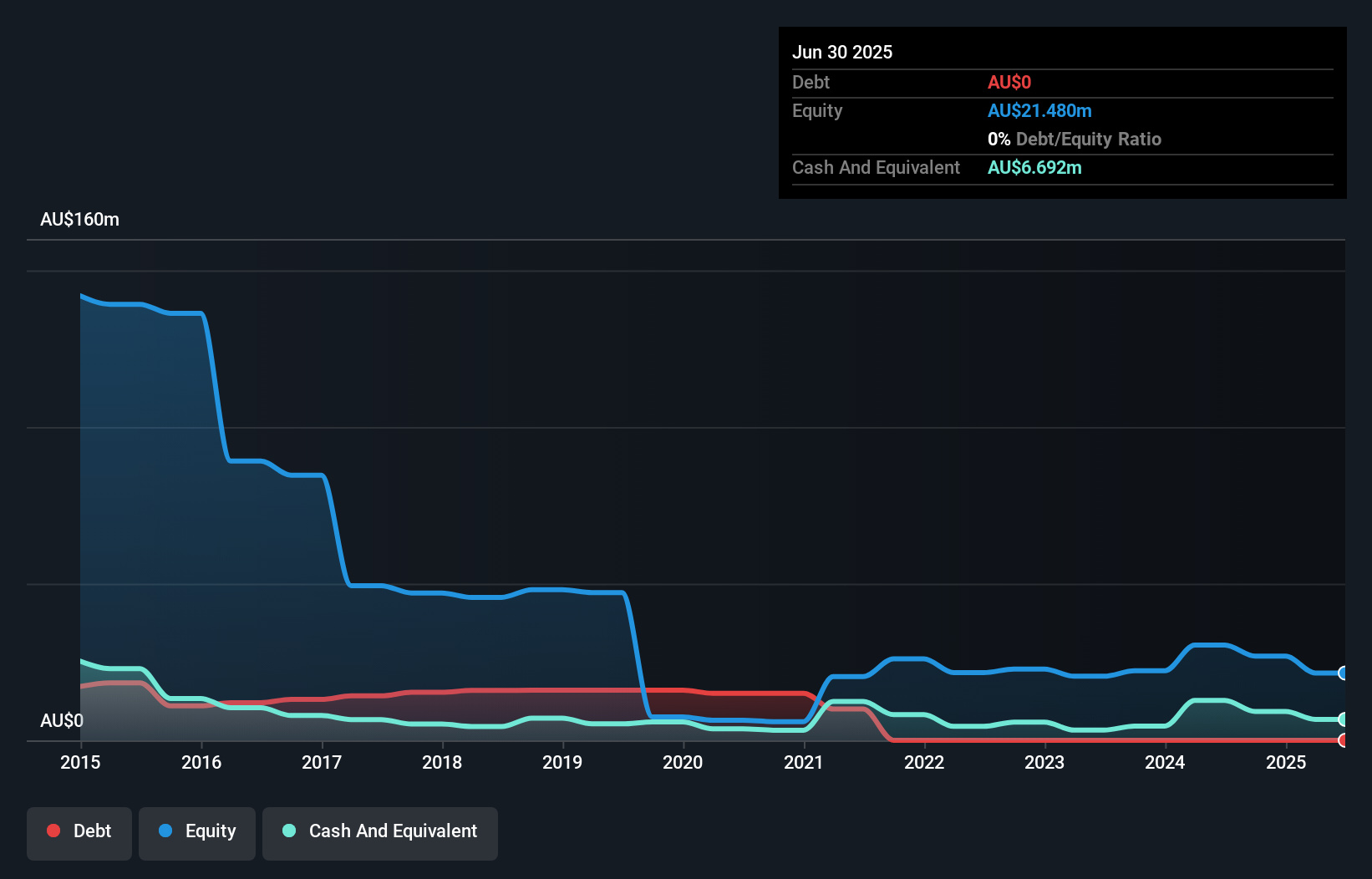

Toro Energy Limited, with a market cap of A$56.53 million, operates as a pre-revenue uranium exploration company in Australia. The company maintains strong financial health with short-term assets covering both short and long-term liabilities, and it remains debt-free after reducing its debt from five years ago. Despite being unprofitable, Toro has reduced losses over the past five years by 22.6% annually. Recently, IsoEnergy Ltd. announced plans to acquire the remaining stake in Toro for A$66.6 million, subject to shareholder approval and regulatory conditions, potentially impacting future operations and ownership structure significantly if completed by mid-2026.

- Get an in-depth perspective on Toro Energy's performance by reading our balance sheet health report here.

- Gain insights into Toro Energy's past trends and performance with our report on the company's historical track record.

Turning Ideas Into Actions

- Embark on your investment journey to our 415 ASX Penny Stocks selection here.

- Seeking Other Investments? Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com