Three Undiscovered Gems In Australia With Promising Potential

The Australian market has experienced a week of fluctuating fortunes, with early gains often retracting by afternoon as investors react to broader economic signals and specific corporate developments. In such a dynamic environment, identifying stocks with strong fundamentals and unique growth prospects can be particularly rewarding; this article highlights three lesser-known Australian companies that may offer promising opportunities for discerning investors.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 10.00% | 9.57% | ★★★★★★ |

| Joyce | NA | 9.93% | 17.54% | ★★★★★★ |

| Hearts and Minds Investments | NA | 56.27% | 59.19% | ★★★★★★ |

| Spheria Emerging Companies | NA | -1.31% | 0.28% | ★★★★★★ |

| Euroz Hartleys Group | NA | 1.82% | -25.32% | ★★★★★★ |

| Focus Minerals | NA | 75.35% | 51.34% | ★★★★★★ |

| Energy World | NA | -47.50% | -44.86% | ★★★★★☆ |

| Zimplats Holdings | 5.44% | -9.79% | -42.03% | ★★★★★☆ |

| Australian United Investment | 1.90% | 5.23% | 4.56% | ★★★★☆☆ |

| Reef Casino Trust | 19.84% | 6.96% | 10.88% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

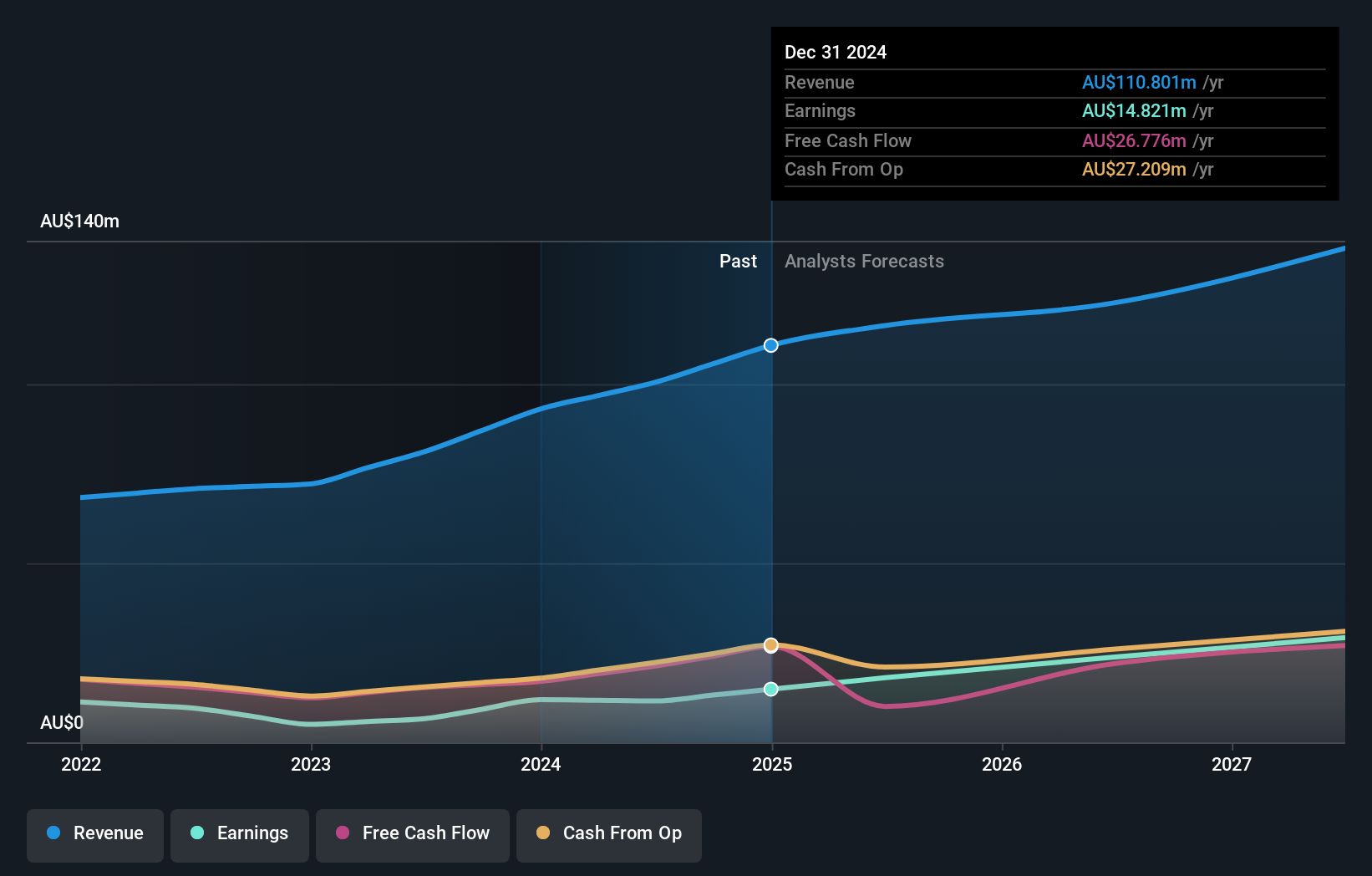

Australian Ethical Investment (ASX:AEF)

Simply Wall St Value Rating: ★★★★★★

Overview: Australian Ethical Investment Ltd is a publicly owned investment manager with a market cap of A$586.38 million, focusing on ethical and sustainable investment strategies.

Operations: Australian Ethical Investment generates revenue primarily from its funds management segment, which amounted to A$119.38 million.

Australian Ethical Investment, a notable player in the ethical investment space, has shown impressive growth with earnings surging 75% over the past year. This performance surpasses the Capital Markets industry average of 12.7%, highlighting its robust position. The company is debt-free, maintaining this status for five years, which underscores financial prudence and stability. Free cash flow remains positive at A$26 million as of June 2025, indicating strong operational efficiency. Looking ahead, earnings are projected to increase by 18% annually, suggesting continued momentum in an industry increasingly focused on sustainable investing practices.

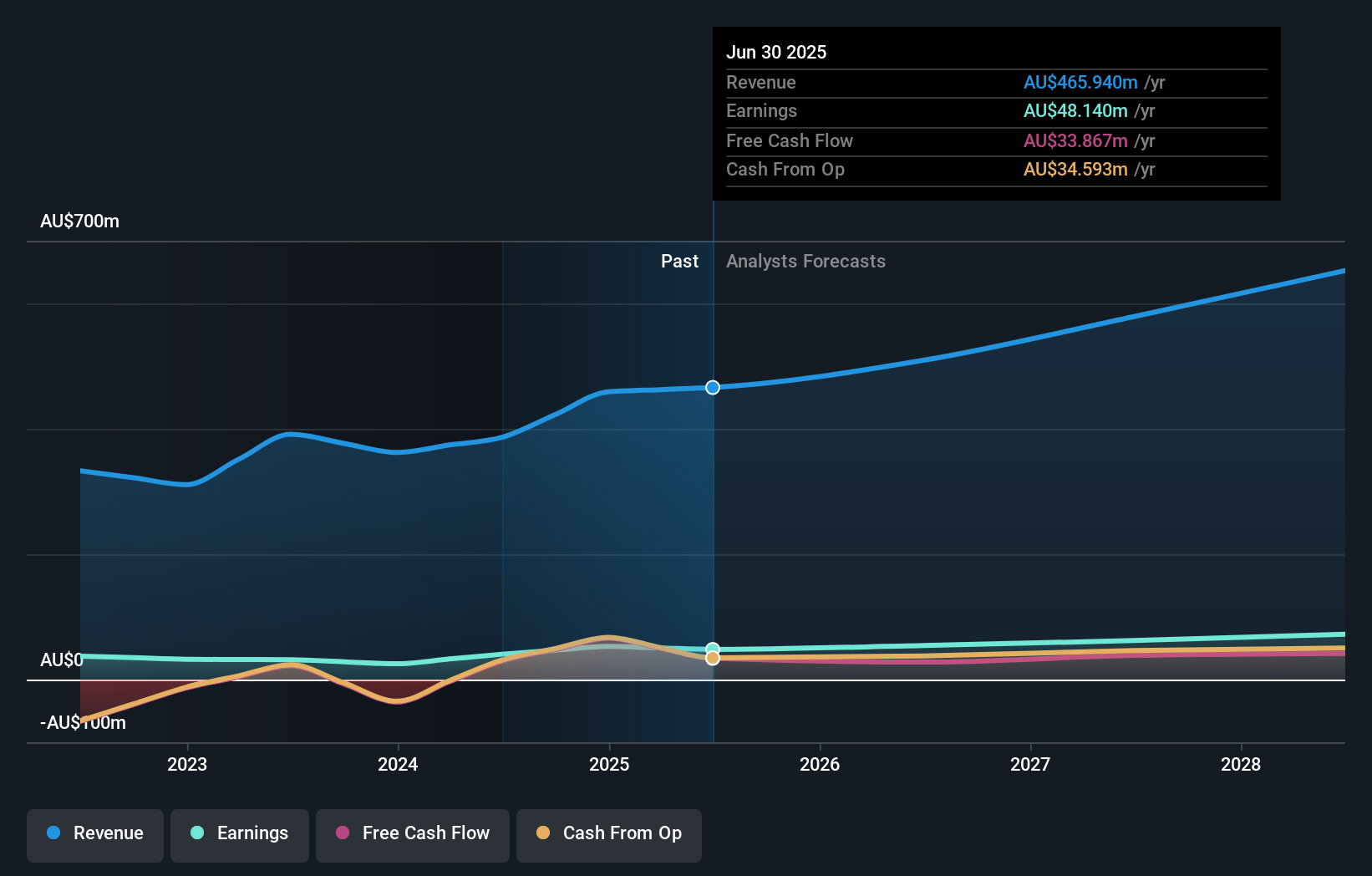

Cedar Woods Properties (ASX:CWP)

Simply Wall St Value Rating: ★★★★★★

Overview: Cedar Woods Properties Limited is an Australian company engaged in property development and investment, with a market cap of A$689.11 million.

Operations: Cedar Woods Properties generates revenue primarily from its property development and investment activities, amounting to A$465.94 million. The company's financial performance is significantly influenced by its operational costs and the efficiency of its projects, impacting its overall profitability.

Cedar Woods Properties, a dynamic player in the Australian property market, is making waves with its diverse offerings and strategic initiatives. With a price-to-earnings ratio of 14.3x, it trades below the national average of 21.7x, suggesting good value relative to peers. Over the past five years, earnings have grown at an impressive 12.1% annually while reducing its debt-to-equity ratio from 38.6% to 27.6%. The company has high-quality earnings and well-covered interest payments with EBIT covering them by 7.2 times, indicating financial strength despite recent insider selling activity that might raise eyebrows among investors.

IVE Group (ASX:IGL)

Simply Wall St Value Rating: ★★★★★☆

Overview: IVE Group Limited, along with its subsidiaries, operates in the marketing sector across Australia and has a market capitalization of A$441.09 million.

Operations: IVE Group generates revenue primarily from its advertising segment, amounting to A$959.25 million.

IVE Group, a notable player in the Australian print and marketing sector, has shown robust financial health with earnings growing by 69% over the past year, significantly outperforming the media industry. The company's debt to equity ratio improved from 105% to 75% over five years, reflecting better financial management. Trading at a substantial discount of 74% below its estimated fair value suggests potential for investors seeking undervalued opportunities. Despite high net debt to equity at 52%, interest payments are well covered by EBIT at 5.1 times coverage, indicating strong operational efficiency and potential for continued profitability.

- Click to explore a detailed breakdown of our findings in IVE Group's health report.

Review our historical performance report to gain insights into IVE Group's's past performance.

Seize The Opportunity

- Embark on your investment journey to our 58 ASX Undiscovered Gems With Strong Fundamentals selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com