ASX Growth Companies With High Insider Ownership December 2025

As the Australian market navigates a week of volatility with fluctuating investor sentiment, attention turns to growth companies that demonstrate resilience and potential through high insider ownership. In this context, stocks with significant insider stakes can be particularly appealing as they often indicate strong confidence from those who know the company best, aligning well with current market dynamics where stability and informed optimism are valued.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 10.4% | 96.4% |

| Titomic (ASX:TTT) | 13.5% | 74.9% |

| Polymetals Resources (ASX:POL) | 37.7% | 108% |

| Pointerra (ASX:3DP) | 19.8% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Lunnon Metals (ASX:LM8) | 11% | 31.4% |

| IRIS Metals (ASX:IR1) | 23% | 144.4% |

| Elsight (ASX:ELS) | 17.3% | 77% |

| Echo IQ (ASX:EIQ) | 19% | 51.4% |

| Adveritas (ASX:AV1) | 18.4% | 96.8% |

Here we highlight a subset of our preferred stocks from the screener.

Alpha HPA (ASX:A4N)

Simply Wall St Growth Rating: ★★★★★★

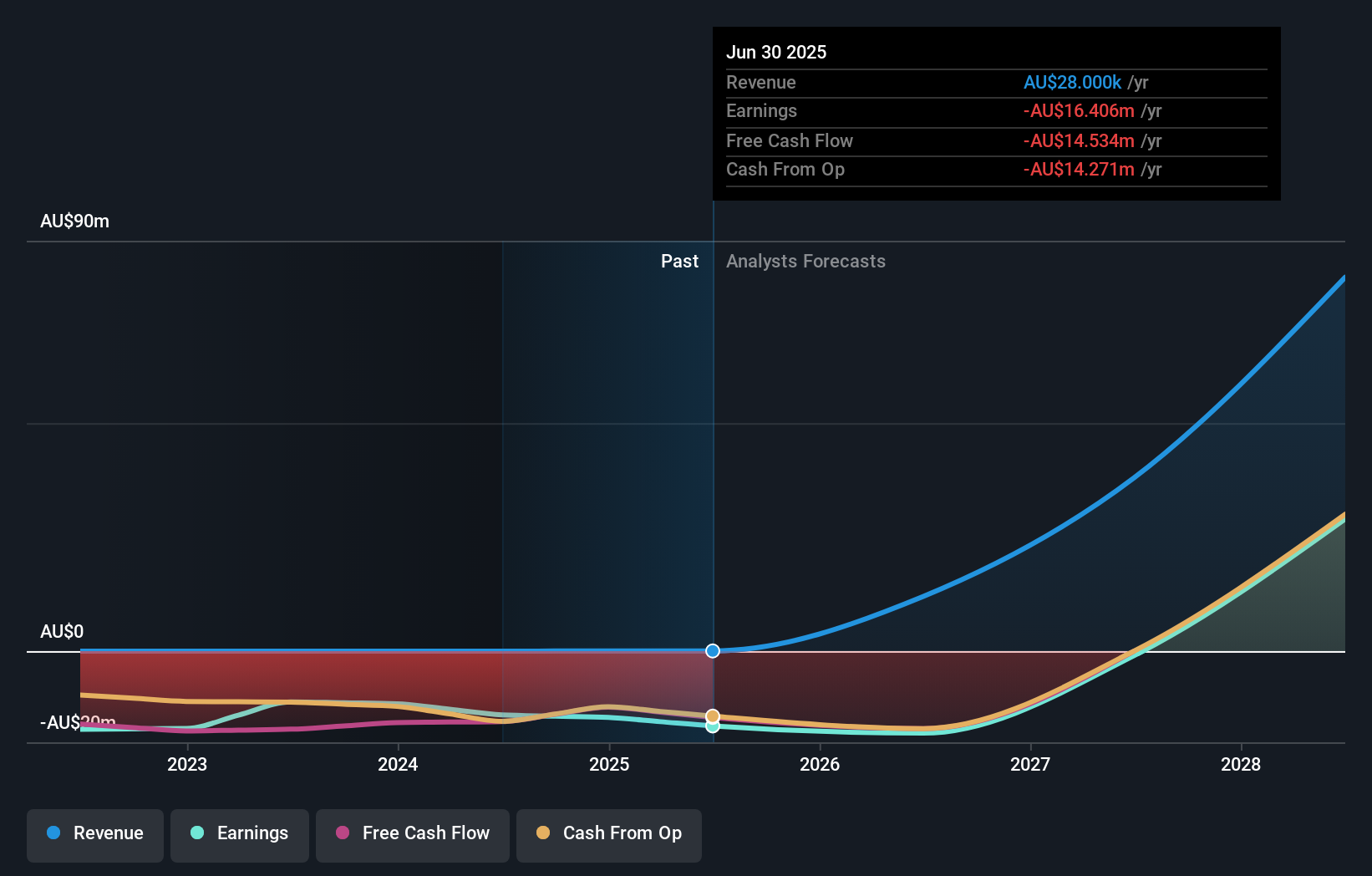

Overview: Alpha HPA Limited is a specialty materials and technology company engaged in the HPA First and Alpha Sapphire projects in Queensland, with a market cap of A$835.89 million.

Operations: The company generates revenue from its HPA First Project with A$0.26 million and the Alpha Sapphire Project with A$0.06 million.

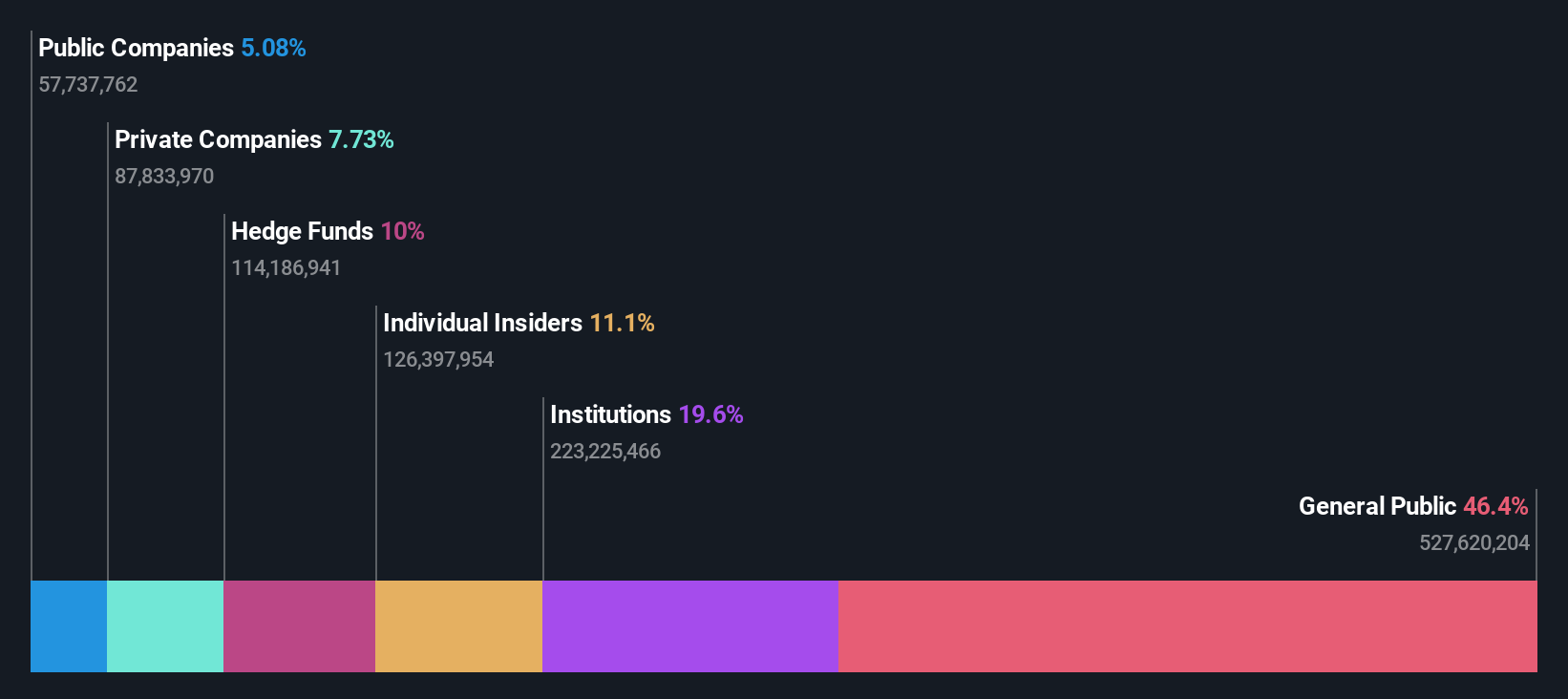

Insider Ownership: 10.5%

Revenue Growth Forecast: 97.7% p.a.

Alpha HPA is projected to achieve significant growth, with earnings expected to increase by 103.06% annually and revenue forecasted to grow at 97.7% per year, surpassing the market average. Despite trading at a substantial discount to its estimated fair value, it remains in a challenging financial position with less than A$1 million in revenue and under one year of cash runway. Recent events include their Annual General Meeting on November 24, 2025.

- Dive into the specifics of Alpha HPA here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of Alpha HPA shares in the market.

Artrya (ASX:AYA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Artrya Limited is a medical technology company focused on developing and commercializing an artificial intelligence platform for detecting, diagnosing, and addressing coronary artery disease in Australia, with a market cap of A$545.39 million.

Operations: The company's revenue segment includes the development of AI-driven CCTA image analysis technology, generating A$0.03 million.

Insider Ownership: 13.4%

Revenue Growth Forecast: 50.5% p.a.

Artrya is poised for substantial growth, with revenue expected to increase by 50.5% annually, outpacing the broader Australian market. Despite this, the company remains in a nascent financial stage, generating less than A$1 million in revenue. Insider activity has been mixed; significant shares were sold recently despite no substantial insider buying over three months. The company completed follow-on equity offerings totaling A$79.99 million recently, indicating potential dilution concerns for shareholders.

- Unlock comprehensive insights into our analysis of Artrya stock in this growth report.

- The analysis detailed in our Artrya valuation report hints at an inflated share price compared to its estimated value.

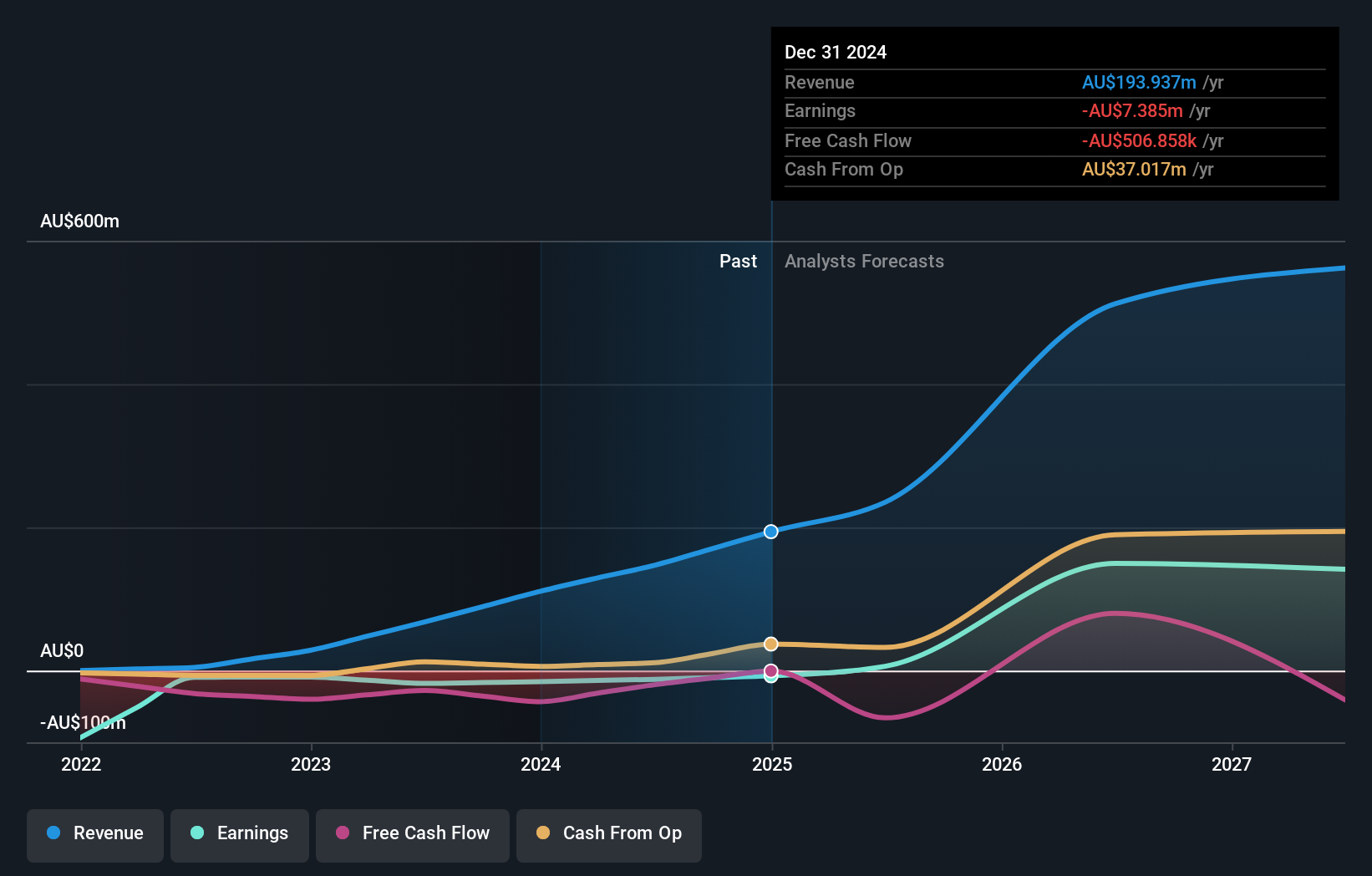

Develop Global (ASX:DVP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Develop Global Limited, listed under ticker ASX:DVP, is involved in the exploration and development of mineral resource properties in Australia with a market capitalization of A$1.46 billion.

Operations: The company's revenue primarily comes from Mining Services, which generated A$240.65 million, supplemented by A$14.63 million from Mining and Exploration activities.

Insider Ownership: 20.2%

Revenue Growth Forecast: 36.8% p.a.

Develop Global has seen a turnaround, reporting A$72.39 million in net income for the year ending June 30, 2025, compared to a loss previously. The company forecasts robust revenue growth of 36.8% annually, significantly outpacing the market average. Recent strategic appointments aim to bolster its accelerated growth strategy. However, past shareholder dilution may concern investors despite trading well below fair value estimates and strong projected earnings growth of 32.7% per year.

- Click here and access our complete growth analysis report to understand the dynamics of Develop Global.

- Our comprehensive valuation report raises the possibility that Develop Global is priced lower than what may be justified by its financials.

Taking Advantage

- Click this link to deep-dive into the 108 companies within our Fast Growing ASX Companies With High Insider Ownership screener.

- Curious About Other Options? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com