How Strong 2024 Guidance Amid Slower Q4 Growth At Innodata (INOD) Has Changed Its Investment Story

- In the past month, Innodata reported third-quarter revenue growth of 20%, secured US$42.0 million in new contracts, launched a Federal Practice targeting U.S. government work, and reiterated guidance for at least 45% full-year organic revenue growth despite signaling slower momentum in the fourth quarter.

- This mix of strong full-year ambitions alongside a near-term growth slowdown highlights the tension between enthusiasm for Innodata’s AI opportunities and concerns about how durable that demand may be.

- Against this backdrop, we’ll consider how reaffirmed robust full-year growth guidance despite slowing quarterly momentum may reshape Innodata’s investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Innodata Investment Narrative Recap

To own Innodata, you need to believe its specialized AI data and services can stay relevant even if hype cools and large customers rethink spending. The latest quarter’s 20% revenue growth, new US$42.0 million in contracts, and reaffirmed “at least 45%” full‑year organic growth support the near term demand story, but the slowdown signaled for Q4 keeps customer concentration and AI cycle risk very much in focus.

The launch of Innodata Federal, focused on U.S. government agencies, looks particularly important in this context because it could gradually broaden the customer base beyond a handful of large tech clients. If this business gains traction over time, it may help offset revenue volatility risk tied to contract changes or insourcing decisions at those bigger commercial customers.

Yet even with reaffirmed growth targets, investors should be aware of how concentrated revenue from a few large technology clients can...

Read the full narrative on Innodata (it's free!)

Innodata’s narrative projects $350.9 million revenue and $41.6 million earnings by 2028. This requires 15.4% yearly revenue growth but implies an earnings decrease of $1.1 million from $42.7 million today.

Uncover how Innodata's forecasts yield a $93.75 fair value, a 62% upside to its current price.

Exploring Other Perspectives

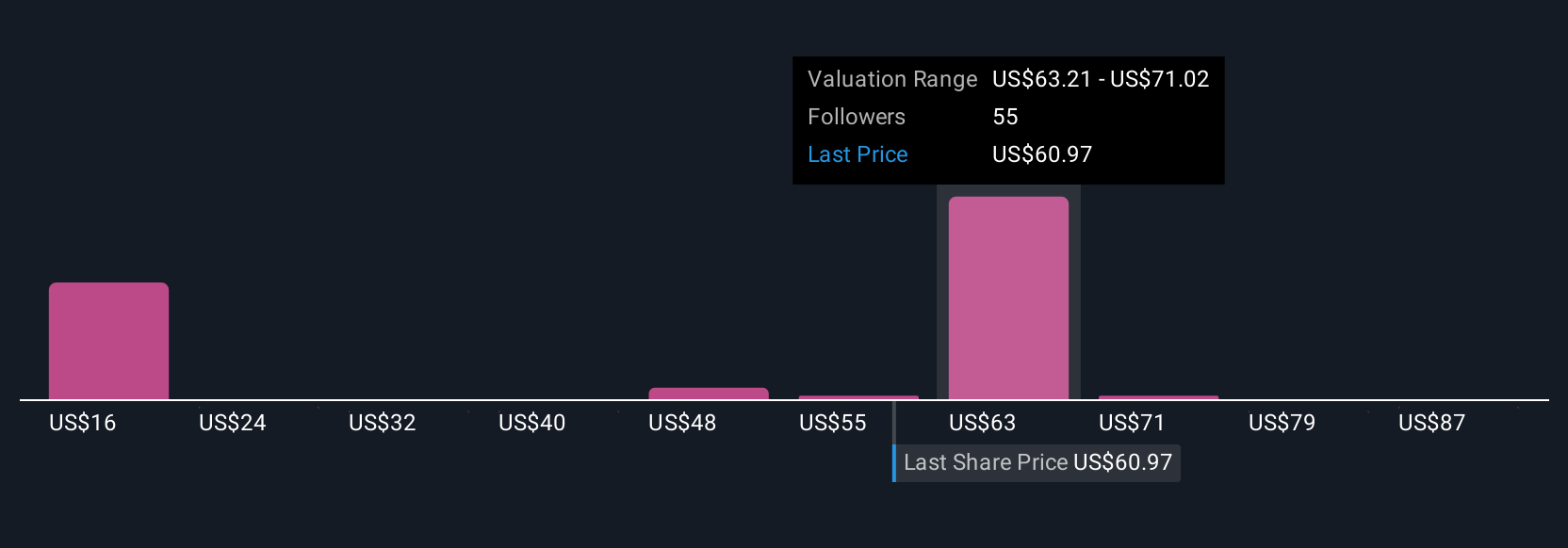

Sixteen fair value estimates from the Simply Wall St Community span roughly US$12 to US$94 per share, reflecting wide disagreement on Innodata’s worth. Against this spread, concerns about heavy reliance on a small set of large tech customers may meaningfully shape how you interpret those contrasting expectations for the company’s future performance.

Explore 16 other fair value estimates on Innodata - why the stock might be worth less than half the current price!

Build Your Own Innodata Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Innodata research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Innodata research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Innodata's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com