Does Boumadine’s Record Intercept And New Structure Change The Bull Case For Aya (TSX:AYA)?

- Aya Gold & Silver recently reported its strongest mineralized intercept to date at the Boumadine project in Morocco, including a record metal factor interval and the discovery of a new high-grade parallel structure from its 2025 drill program.

- With up to 16 drill rigs planned and significant mineralization identified beyond the current pit shells, Boumadine’s scale and resource growth potential are becoming increasingly central to Aya’s long-term project pipeline.

- We’ll now examine how this record Boumadine intercept and new high-grade structure could influence Aya’s investment narrative and growth outlook.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Aya Gold & Silver Investment Narrative Recap

To own Aya Gold & Silver, you need to believe Boumadine can mature into a large, economically robust asset alongside a steadily performing Zgounder mine. The latest record Boumadine intercept and new high-grade structure appear to reinforce Boumadine as the key near to medium term growth catalyst, but they do not remove core risks around metallurgical complexity, high capital needs and Aya’s concentration in Morocco.

The updated Boumadine mineral resource estimate from February 2025 is particularly relevant here, because it set the baseline tonnage and grade framework that this new intercept may build on. As Aya accelerates toward its 360,000 metre infill program and potentially larger pit shells, that earlier resource work helps investors judge whether today’s drilling progress meaningfully changes the scale and quality of the project or simply refines an already ambitious plan.

Yet behind Boumadine’s promise, investors also need to be aware of how Aya’s heavy reliance on Moroccan assets could...

Read the full narrative on Aya Gold & Silver (it's free!)

Aya Gold & Silver's narrative projects $266.9 million revenue and $92.6 million earnings by 2028. This requires 42.2% yearly revenue growth and a $102.8 million earnings increase from -$10.2 million today.

Uncover how Aya Gold & Silver's forecasts yield a CA$23.08 fair value, a 28% upside to its current price.

Exploring Other Perspectives

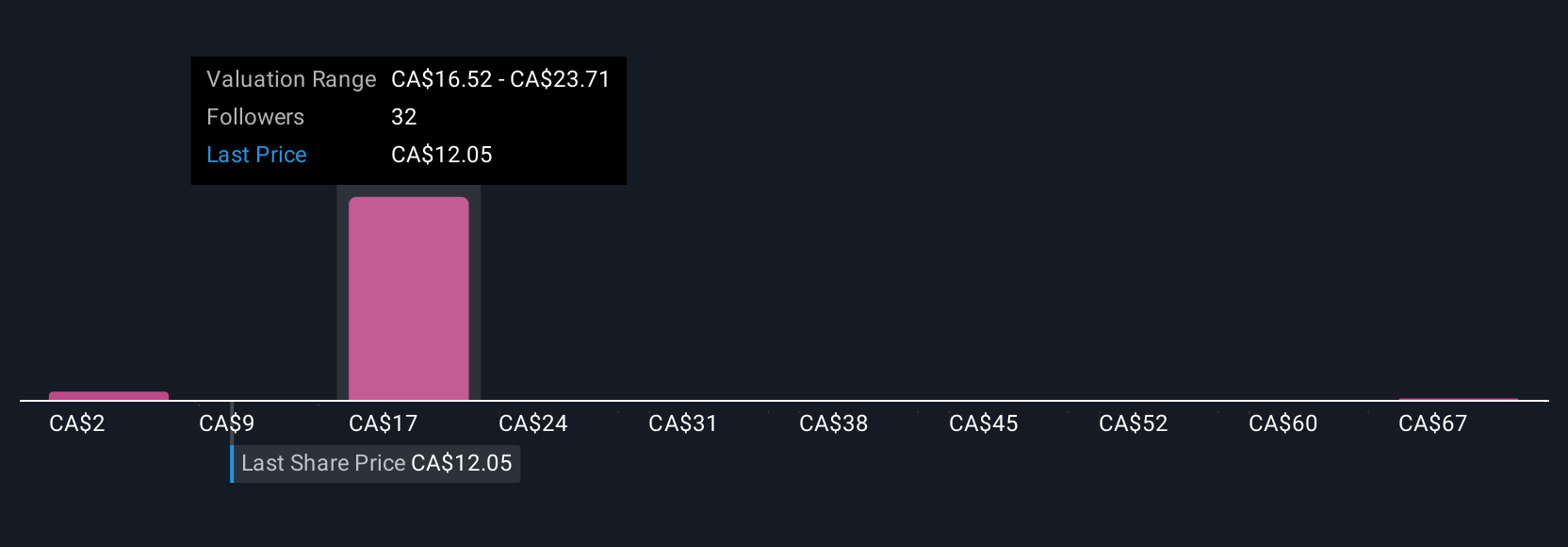

Nine fair value estimates from the Simply Wall St Community span roughly CA$9 to CA$102 per share, showing how far opinions on Aya’s potential can stretch. When you weigh that spread against the company’s capital intensive Boumadine build out and the execution risk that comes with aggressive drilling and expansion plans, it becomes even more important to examine several different viewpoints before deciding how Aya might fit in your portfolio.

Explore 9 other fair value estimates on Aya Gold & Silver - why the stock might be worth over 5x more than the current price!

Build Your Own Aya Gold & Silver Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aya Gold & Silver research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Aya Gold & Silver research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aya Gold & Silver's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com