Is Moody’s A3 Upgrade And Dividend Hike Altering The Investment Case For Kimco Realty (KIM)?

- Recently, Moody's upgraded Kimco Realty to an A3 credit rating with a stable outlook, highlighting its high-quality, predominantly grocery-anchored portfolio, strong occupancy, and prudent balance sheet, while the company also raised guidance and increased its dividend on the back of solid operating results.

- This combination of a stronger credit profile and a higher dividend underscores Kimco's emphasis on balance sheet strength and income-focused returns, supported by diversified tenants and well-staggered debt maturities.

- Next, we’ll examine how Moody’s A3 upgrade could reshape Kimco’s investment narrative, especially around balance sheet strength and income durability.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

Kimco Realty Investment Narrative Recap

To own Kimco, you need to believe in the resilience of open air, grocery anchored centers and the company’s ability to keep them leased and cash generative despite e commerce and interest rate pressures. Moody’s A3 upgrade reinforces the balance sheet side of that story, but it does not remove the key near term swing factors: how well Kimco can re lease legacy vacancies and manage any slowdown in retailer demand.

The clearest link to Moody’s decision is Kimco’s recent dividend increase to US$0.26 per share and raised 2025 net income guidance, both backed by high occupancy and a conservative AFFO payout ratio. Together with the A3 rating and well staggered debt maturities, these moves support the near term income catalyst, while still leaving Kimco exposed if funding costs rise or acquisition opportunities remain constrained...

Read the full narrative on Kimco Realty (it's free!)

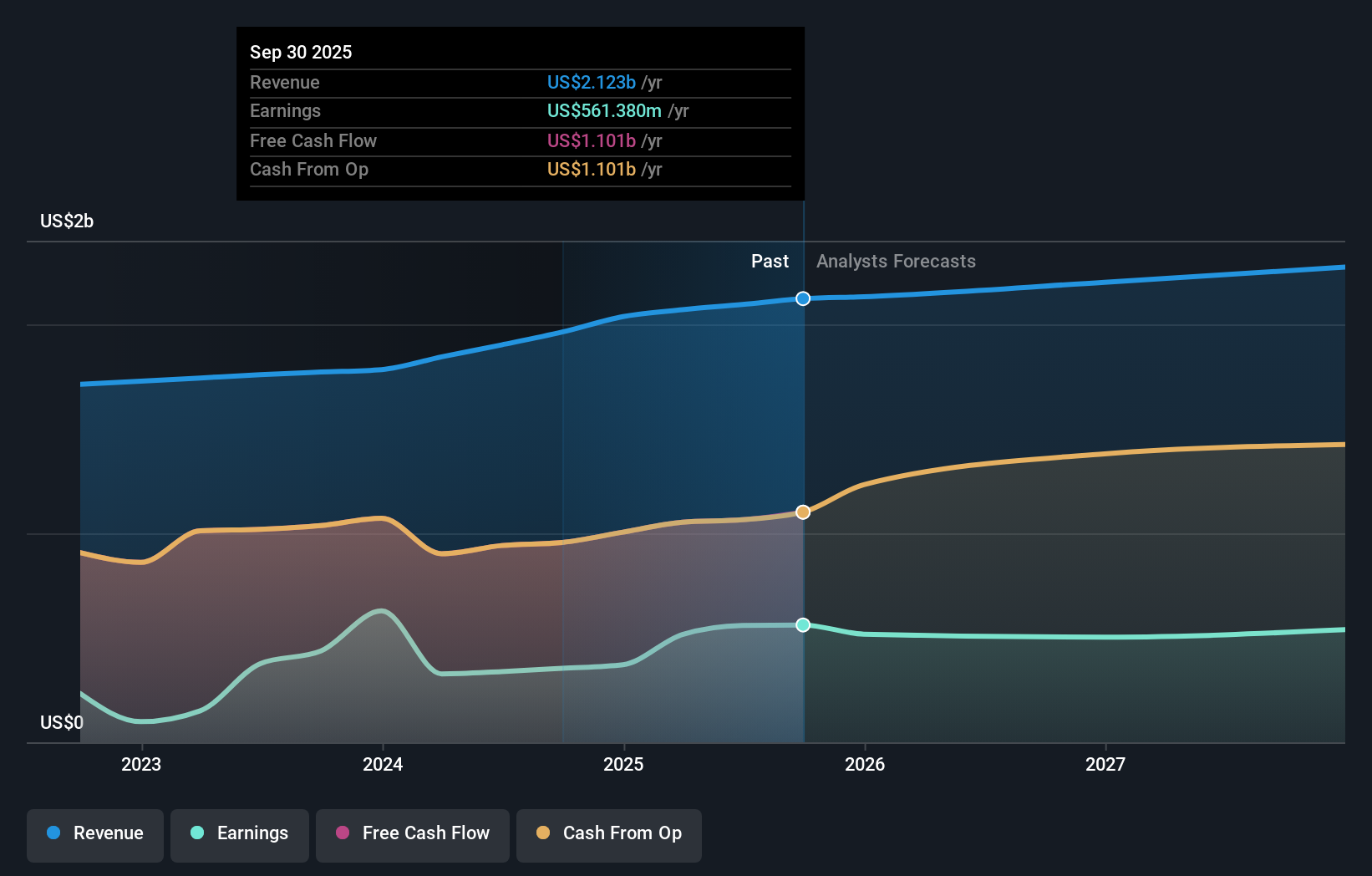

Kimco Realty's narrative projects $2.3 billion revenue and $540.4 million earnings by 2028. This assumes 3.0% yearly revenue growth and an earnings decrease of $18.7 million from $559.1 million today.

Uncover how Kimco Realty's forecasts yield a $24.18 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Two members of the Simply Wall St Community currently estimate Kimco’s fair value between US$24.18 and US$30.89 per share, highlighting how far opinions can stretch. When you weigh that against Kimco’s upgraded A3 credit rating and income focused profile, it underlines why understanding both balance sheet strength and retail tenant risks can be so important before you commit capital.

Explore 2 other fair value estimates on Kimco Realty - why the stock might be worth as much as 53% more than the current price!

Build Your Own Kimco Realty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kimco Realty research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Kimco Realty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kimco Realty's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com