Hut 8 (HUT) Valuation Check After American Bitcoin Unlock‑Driven Sell-Off and Sentiment Shock

The sharp sell off in American Bitcoin, where newly unlocked shares hit the market at once, has rattled sentiment around Hut 8 (HUT) as well and raised questions about how tightly their fortunes are linked.

See our latest analysis for Hut 8.

Zooming out from the American Bitcoin shock, Hut 8’s share price has cooled in the very short term, with a 7 day share price return of minus 5.71 percent and 30 day share price return of minus 4.84 percent. However, the 90 day share price return of 66.52 percent and year to date share price return of 93.83 percent, alongside a 1 year total shareholder return of 40.31 percent at a latest share price of 42.43 dollars, still point to strong, if volatile, momentum that can quickly swing as investors recalibrate both growth expectations and risk around its Bitcoin and infrastructure exposure.

If this kind of volatility has you thinking about diversification, it might be a good time to explore high growth tech and AI stocks as potential next wave beneficiaries of digital infrastructure demand.

With Hut 8 still trading at a roughly 32 percent discount to the average analyst price target despite its powerful run, investors now face a tougher call: is this a fresh entry point or is future growth already baked in?

Most Popular Narrative Narrative: 26.7% Undervalued

Compared with Hut 8’s last close of 42.43 dollars, the most followed narrative points to a meaningfully higher fair value anchored in its expanding power and compute platform.

The Power First strategy, featuring sizable pipeline origination (10.8 GW under diligence, 3.1 GW under exclusivity) and dual-purpose sites for both Bitcoin mining and AI compute, provides scalability and flexibility to benefit from rising institutional adoption of digital assets and accelerating demand for clean energy-powered blockchain infrastructure, bolstering future revenue and earnings growth.

Want to see how a rapid revenue ramp, shifting profit margins, and a punchy future earnings multiple combine into that higher fair value line? The narrative unpacks bold assumptions on how power contracts, AI infrastructure, and Bitcoin exposure interact across the next few years. Curious which projections do the heavy lifting in this pricing story?

Result: Fair Value of $57.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, extended Bitcoin price weakness or regulatory pressure on fossil fuel based power could derail growth assumptions and compress the valuation narrative.

Find out about the key risks to this Hut 8 narrative.

Another Lens on Valuation

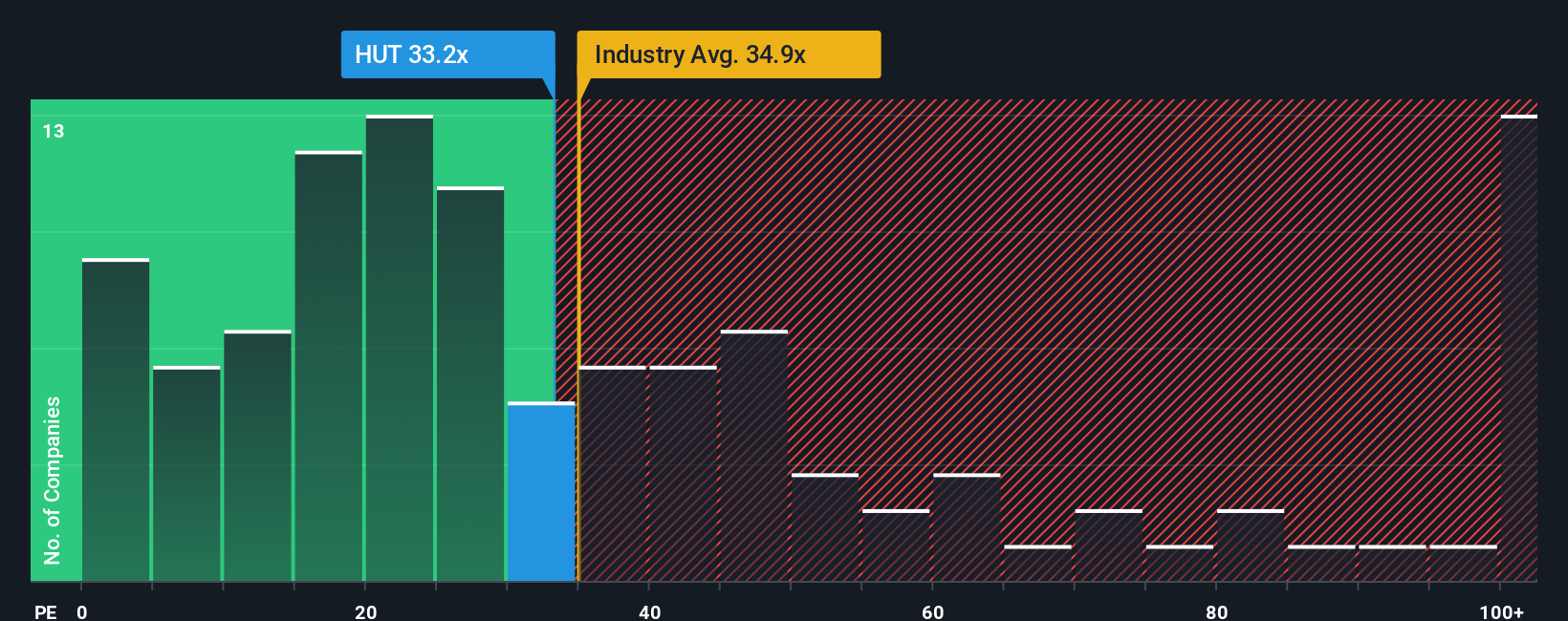

While the narrative fair value of 57.87 dollars suggests upside, a simple earnings multiple tells a cooler story. Hut 8 trades on 22.5 times earnings versus a fair ratio of 7.9 times, leaving it looking expensive despite sitting below the US Software average of 31.5 times. Is the market overpaying for growth that might not land?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hut 8 Narrative

If you see things differently or would rather dig into the numbers yourself, you can spin up a custom Hut 8 narrative in minutes, Do it your way.

A great starting point for your Hut 8 research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Ready for your next investing move?

Use the Simply Wall Street Screener to pinpoint fresh, high conviction ideas in minutes, so you are not stuck reacting while others act first.

- Capture early-stage potential by reviewing these 3574 penny stocks with strong financials that pair small market caps with surprisingly resilient fundamentals and room for re-rating.

- Ride powerful secular trends by zeroing in on these 26 AI penny stocks positioned to monetise real world demand for intelligent automation and data driven workflows.

- Lock in income and stability by focusing on these 15 dividend stocks with yields > 3% that can bolster total returns when markets turn choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com