Is VEON (VEON) Quietly Turning Local AI Sovereignty Into a New Competitive Edge?

- In late 2025, VEON subsidiary Kyivstar and Ukraine’s WINWIN AI Center selected Google’s Gemma model on Vertex AI to build a national Ukrainian large language model that keeps sensitive data processed within Ukraine for sectors such as government, healthcare, and financial services.

- This move, alongside Kyivstar’s Nasdaq listing and VEON’s broader AI alliances, underscores how the group is tying local language AI development to digital transformation and data sovereignty across its core markets.

- Next, we’ll examine how Kyivstar’s leadership in building Ukraine’s national LLM with Google could reshape VEON’s investment narrative around AI-enabled growth.

Find companies with promising cash flow potential yet trading below their fair value.

VEON Investment Narrative Recap

To own VEON you need to believe that its shift from a pure telecom operator to a digital and AI-focused platform can offset macro, currency and leverage pressures in its frontier markets. The Ukrainian national LLM project with Google supports VEON’s AI narrative but does not, by itself, change the near term focus on sustaining earnings momentum while managing high debt and exposure to volatile economies.

The QazCode partnership with MeetKai across Kazakhstan, Uzbekistan, Ukraine, Pakistan and Bangladesh is especially relevant here, since it extends the same local language AI push beyond Ukraine. Together with Kyivstar’s LLM work, it frames VEON’s AI initiatives as potential contributors to digital service growth at a time when traditional connectivity faces competition from OTT players and alternative technologies.

Yet against this AI opportunity, investors should also weigh how VEON’s high leverage and refinancing needs could limit its ability to fully fund these initiatives if...

Read the full narrative on VEON (it's free!)

VEON's narrative projects $5.1 billion revenue and $688.2 million earnings by 2028.

Uncover how VEON's forecasts yield a $76.68 fair value, a 52% upside to its current price.

Exploring Other Perspectives

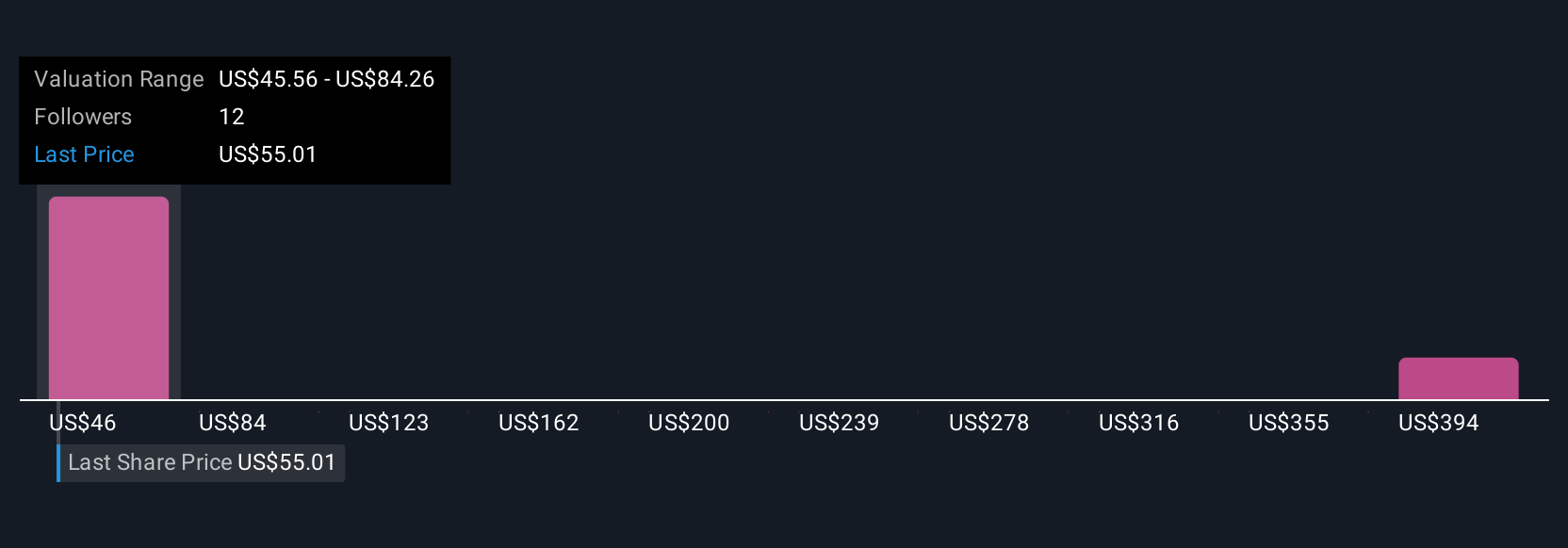

Four fair value estimates from the Simply Wall St Community range from US$45.56 to US$463.36, showing how far apart individual views can be. You should weigh these against VEON’s exposure to macro and currency volatility in its core markets, and consider how that might shape the company’s future performance before relying on any single view.

Explore 4 other fair value estimates on VEON - why the stock might be worth 9% less than the current price!

Build Your Own VEON Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your VEON research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free VEON research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate VEON's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com