Is Mid-America Apartment Communities (MAA) Undervalued After Its Recent Share Price Pullback?

Mid-America Apartment Communities (MAA) has quietly lagged the broader market this year, with the stock down about 14% year to date, even as revenue still edges higher in a tougher rate backdrop.

See our latest analysis for Mid-America Apartment Communities.

That softer 1 year to date share price return of around negative mid teens sits alongside a modest 1 month share price rebound and a still positive 5 year total shareholder return. This suggests momentum has cooled even as the long term story remains intact.

If you like the steady income and defensiveness of REITs but want to see what else is setting up interestingly, it is worth exploring fast growing stocks with high insider ownership.

With MAA trading below analyst targets yet still growing revenue, investors are left asking: is the current weakness a sign the stock is undervalued, or is the market already pricing in its future growth?

Most Popular Narrative: 11.9% Undervalued

With Mid-America Apartment Communities last closing at $131.67 against a narrative fair value of $149.52, the latest consensus frames this pullback as a potential mispricing rather than a structural break in the story.

Decreasing construction starts and ongoing challenges in securing development capital are expected to extend a low-supply environment for several years, allowing MAA's development pipeline and recently completed projects to deliver above-average stabilized yields and fueling long-term net operating income growth and margin expansion.

Wondering how modest top line growth, thinner margins and a richer future earnings multiple can still justify a higher fair value than today? The most popular narrative lays out the full math, from revenue runway to profit compression and the premium valuation it assumes Mid-America Apartment Communities can sustain over time.

Result: Fair Value of $149.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated Sunbelt supply and stubbornly higher expenses could cap rent growth, delay lease-ups, and undermine the upbeat long-term valuation narrative.

Find out about the key risks to this Mid-America Apartment Communities narrative.

Another Angle on Valuation

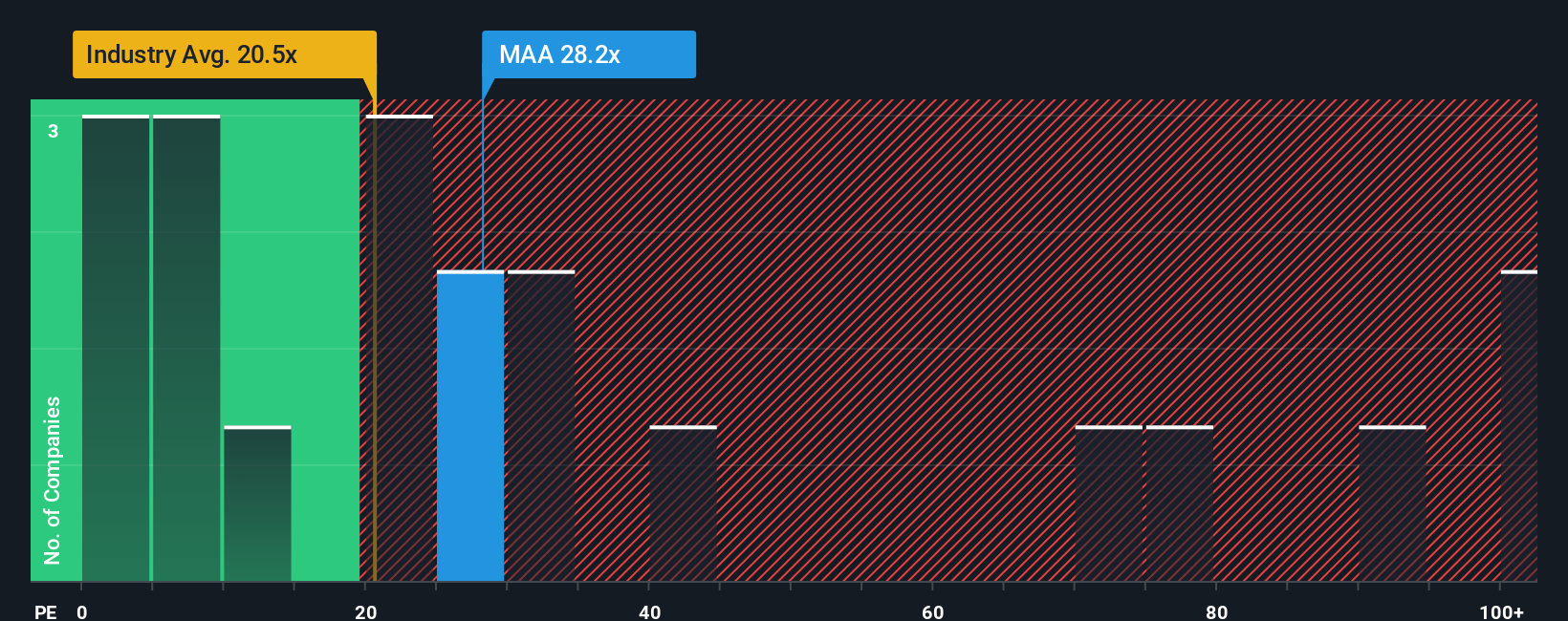

On earnings, Mid-America Apartment Communities looks less clear cut. Its price to earnings ratio of 27.9 times sits above the North American Residential REITs industry at 24.5 times, yet below peer averages at 40.2 times and only slightly under a 28.8 times fair ratio, suggesting limited mispricing.

That mix of mild premium to the sector, discount to peers and only a small gap to the fair ratio raises a tougher question: is this a subtle value opportunity or just fair compensation for slower expected growth and earnings pressure, and how much risk are you really being paid for?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mid-America Apartment Communities Narrative

If you see the numbers differently or simply prefer to dig into the details yourself, you can build a custom view in just a few minutes, Do it your way.

A great starting point for your Mid-America Apartment Communities research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more high conviction opportunities?

If you stop with just one stock, you will miss powerful setups the market is quietly offering right now, so put the Simply Wall Street Screener to work.

- Capture mispriced potential by targeting quality companies trading below intrinsic value through these 908 undervalued stocks based on cash flows before broader investors catch on.

- Position yourself at the forefront of technological change by filtering tomorrow's innovators with these 26 AI penny stocks while valuations still look attractive.

- Strengthen your income engine by seeking reliable payouts and growth prospects using these 15 dividend stocks with yields > 3% instead of waiting for yields to move without you.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com