ACM Research (ACMR) Valuation Check After Major Insider Share Sale by Wang David H

A large insider sale has just put ACM Research (ACMR) back on investors radar, after major shareholder Wang David H disclosed selling 130,000 shares worth about 4.36 million in early December.

See our latest analysis for ACM Research.

That sale lands against a backdrop of strong momentum, with ACM Research posting a 30.1 percent 3 month share price return and an impressive 135.7 percent 1 year total shareholder return. This suggests investors are still leaning into its growth story despite insider profit taking.

If this kind of semiconductor strength has your attention, it could be a good moment to scout other high growth tech and AI names through high growth tech and AI stocks.

With ACM Research still trading below analyst targets despite triple digit 1 year returns, investors face a key question: is the market underestimating its earnings power or already baking in years of future growth?

Most Popular Narrative: 14% Undervalued

Compared with the last close at $35.10, the most widely followed narrative sees fair value closer to $40.81, hinging on durable double digit growth and stable margins.

Analysts are assuming ACM Research's revenue will grow by 19.1% annually over the next 3 years.

Analysts are assuming ACM Research's profit margins will remain the same at 13.8% over the next 3 years.

Curious how steady margins plus rapid top line expansion add up to that higher price tag, and what profit multiple the narrative is quietly banking on? Dig into the full story to see the numbers behind this conviction view.

Result: Fair Value of $40.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on China and ongoing export control risks could quickly challenge those growth assumptions if trade tensions or local demand deteriorate.

Find out about the key risks to this ACM Research narrative.

Another Angle on Valuation

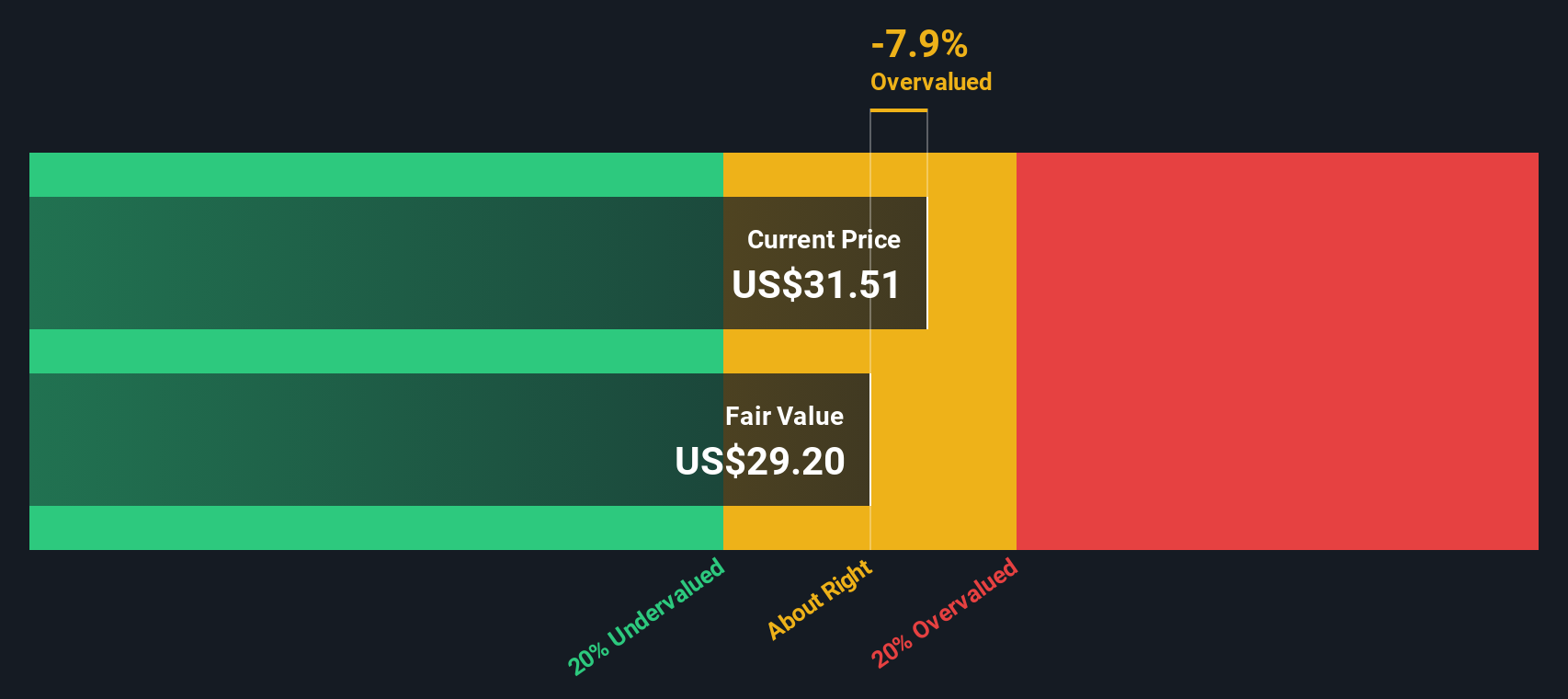

Not everyone agrees ACM Research is cheap. Our SWS DCF model puts fair value closer to $29.90, implying the stock is trading above intrinsic value and could be mildly overvalued if cash flows or growth slow. Is recent momentum running ahead of fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ACM Research for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ACM Research Narrative

If you see the story differently, or just want to test your own assumptions against the numbers, you can build a custom view in minutes, Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding ACM Research.

Looking for more investment ideas?

You can go beyond a single opportunity by quickly scanning curated shortlists, comparing fundamentals side by side, and uncovering fresh ideas built from real underlying data.

- Capture potential market mispricings by reviewing these 908 undervalued stocks based on cash flows that may be trading below what their cash flows suggest they are worth.

- Capitalize on developments in automation and machine learning by focusing on these 26 AI penny stocks with growth stories tied to real-world adoption.

- Strengthen your income strategy by targeting these 15 dividend stocks with yields > 3% that can help boost portfolio yield while still passing key quality checks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com