Borr Drilling (NYSE:BORR): Valuation Check After Analyst Upgrades and Market Expansion Plans

Borr Drilling (BORR) jumped about 9% after fresh upgrades from SEB Equities and Citi, with both institutions backing the company’s outlook as it outlines plans to expand its jack up drilling footprint.

See our latest analysis for Borr Drilling.

The latest move adds to a strong run, with the share price returning around 27% over the past month and 35% over the last quarter, while the one year total shareholder return sits above 20%. This suggests momentum is building as investors reassess Borr’s growth and risk profile at a 4.05 dollar share price.

If this kind of rerating in offshore drilling has your attention, it could be worth scanning aerospace and defense stocks for other industry names where sentiment and fundamentals may be starting to line up.

Yet with modest revenue growth, falling net income, and the shares now trading only slightly below analyst targets, investors have to ask whether Borr is still undervalued or whether the market is already pricing in its next leg of growth.

Most Popular Narrative Narrative: 1.5% Overvalued

With Borr Drilling closing at 4.05 dollars against a narrative fair value of 3.99 dollars, the valuation gap is narrow but telling for expectations.

The analysts have a consensus price target of 3.1 dollars for Borr Drilling based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of 4.0 dollars, and the most bearish reporting a price target of just 2.8 dollars.

Curious how a modest growth outlook can still support a richer future earnings multiple than many peers? Wondering which profit assumptions keep this valuation afloat? Dive in to see the numbers behind that call.

Result: Fair Value of $3.99 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained energy demand or tighter rig supply could lift utilization and day rates, challenging assumptions of shrinking margins and muted long term earnings.

Find out about the key risks to this Borr Drilling narrative.

Another Lens On Value

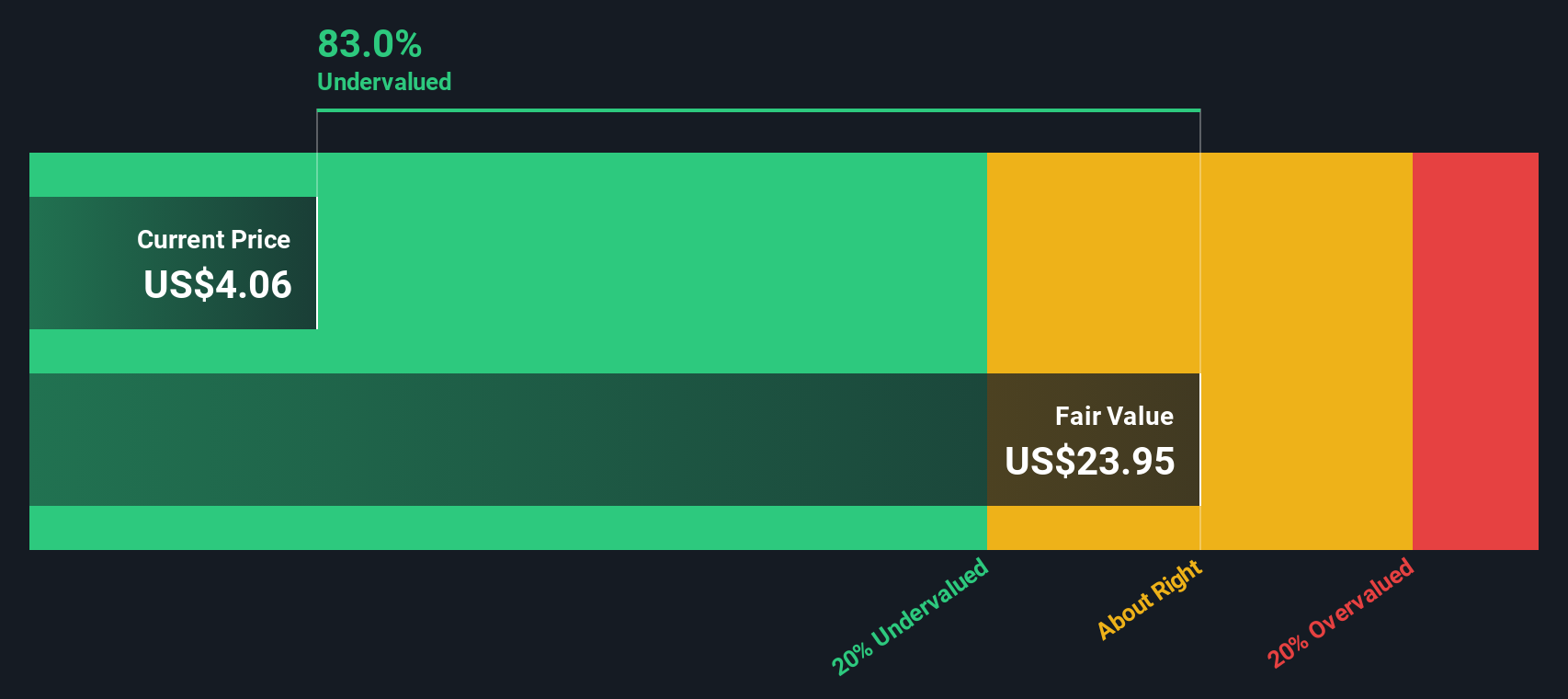

While the narrative fair value sees Borr as 1.5% overvalued, our DCF model points the other way, suggesting the shares trade roughly 83% below a 23.95 dollar fair value. One view says expectations are stretched; the other signals a steep discount. Which story do you trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Borr Drilling for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Borr Drilling Narrative

If you see things differently or want to dig into the numbers yourself, you can build a personalised view in just a few minutes: Do it your way.

A great starting point for your Borr Drilling research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with just one stock, you may miss the next big winner, so put Simply Wall Street’s screener to work and upgrade your opportunity set.

- Capture potential multi baggers early by scanning these 3574 penny stocks with strong financials that combine small size with balance sheet strength and improving fundamentals before the crowd catches on.

- Capitalize on powerful long term themes by targeting these 26 AI penny stocks positioned at the intersection of innovation, automation and expanding real world AI adoption.

- Identify quality income opportunities by reviewing these 15 dividend stocks with yields > 3% that focus on dependable payouts, sensible payout ratios and capacity for future growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com