New Found Gold (TSXV:NFG) Is Up 30.2% After Expanding Queensway Footprint And Reporting High-Grade Drills

- New Found Gold Corp. recently closed its acquisition of adjoining mineral claims from Exploits Discovery, expanding the Queensway Gold Project in Newfoundland and Labrador by up to 31% to 230,225 hectares, in exchange for share issuance and a 1% NSR royalty with an option to buy back half.

- Coupled with high‑grade grade-control drilling results at the Keats zone and fresh insider buying by Sprott Mining Inc., the enlarged land package strengthens the company’s exploration footprint and underscores internal confidence in the Queensway project.

- We’ll now examine how the high‑grade Keats drilling results, alongside the Queensway land expansion, shape New Found Gold’s investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is New Found Gold's Investment Narrative?

To own New Found Gold, you have to believe Queensway can progress from a high‑grade discovery story into a credible development path, despite zero revenue and continuing losses. Near term, the key catalysts still sit around drilling and technical work that can firm up resources and support future mine studies. The latest Keats grade‑control results speak directly to that, giving investors more confidence in continuity of high grades, while the 31% Queensway land expansion raises the stakes on district‑scale upside but also lengthens the exploration runway. Insider buying by Sprott Mining adds a layer of alignment, yet it does not change the core risk that the company remains an expensive, early‑stage explorer with a relatively new management team, no cash flow and ongoing dilution risk if markets tighten.

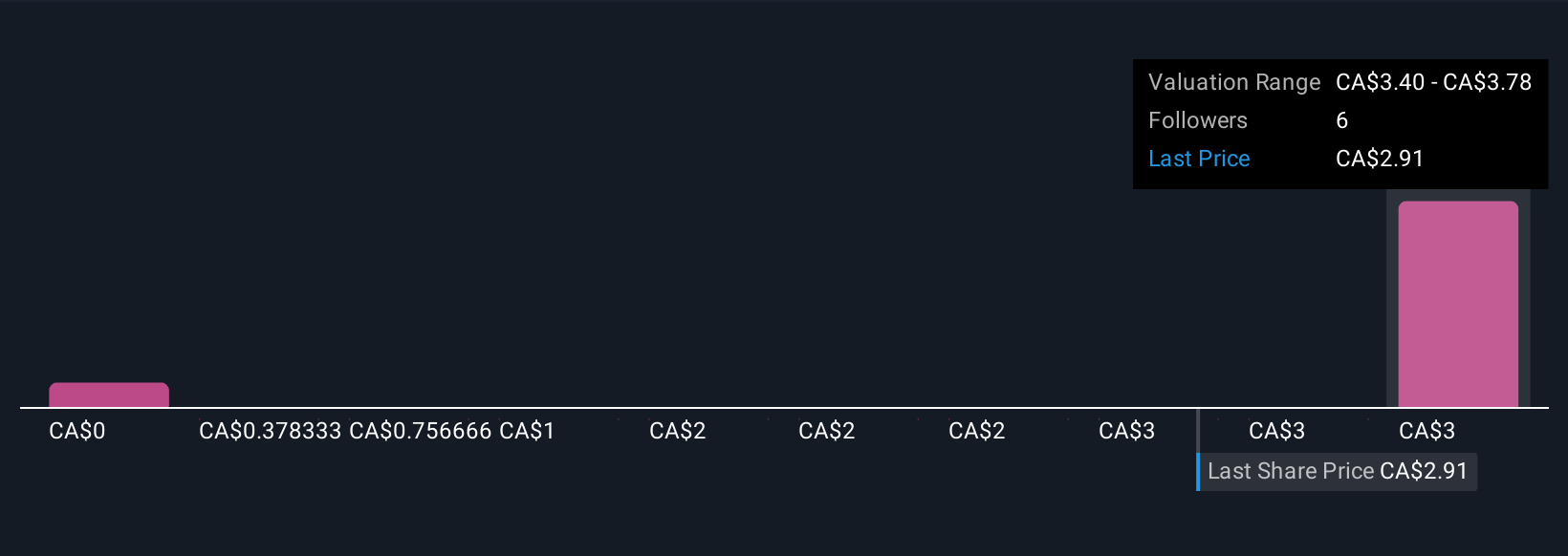

However, investors also need to weigh how much dilution and execution risk they are comfortable carrying. New Found Gold's shares have been on the rise but are still potentially undervalued by 9%. Find out what it's worth.Exploring Other Perspectives

Three Simply Wall St Community fair value views span from CA$0.44 to CA$4.38, underlining just how differently people read Queensway’s potential. When you set those wide opinions against the recent land expansion, high grade Keats data and insider buying, it becomes even more important to decide how you personally balance geological upside against funding needs and execution risk over the next few years.

Explore 3 other fair value estimates on New Found Gold - why the stock might be worth less than half the current price!

Build Your Own New Found Gold Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your New Found Gold research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free New Found Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate New Found Gold's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com