Asian Penny Stocks To Watch In December 2025

As global markets keenly await the final Federal Reserve meeting of the year, Asian markets are navigating a landscape marked by mixed economic signals and cautious optimism. Amid these conditions, penny stocks—often smaller or newer companies with potential for significant growth—continue to capture investor interest due to their affordability and growth prospects. While the term 'penny stocks' might seem outdated, these investments can still represent valuable opportunities when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.78 | HK$2.27B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.47 | HK$909.23M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.67 | HK$2.22B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.02 | SGD413.39M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.96 | THB2.98B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.101 | SGD52.87M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.43 | SGD13.5B | ✅ 5 ⚠️ 1 View Analysis > |

| F & J Prince Holdings (PSE:FJP) | ₱2.20 | ₱859.28M | ✅ 2 ⚠️ 3 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.00 | NZ$142.34M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.96 | NZ$248.92M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 955 stocks from our Asian Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

TK Group (Holdings) (SEHK:2283)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: TK Group (Holdings) Limited is an investment holding company involved in the manufacture, sale, subcontracting, fabrication, and modification of molds and plastic components with a market cap of HK$2.22 billion.

Operations: The company's revenue is primarily derived from Plastic Components Manufacturing, which accounts for HK$1.62 billion, followed by Mold Fabrication at HK$893.09 million.

Market Cap: HK$2.22B

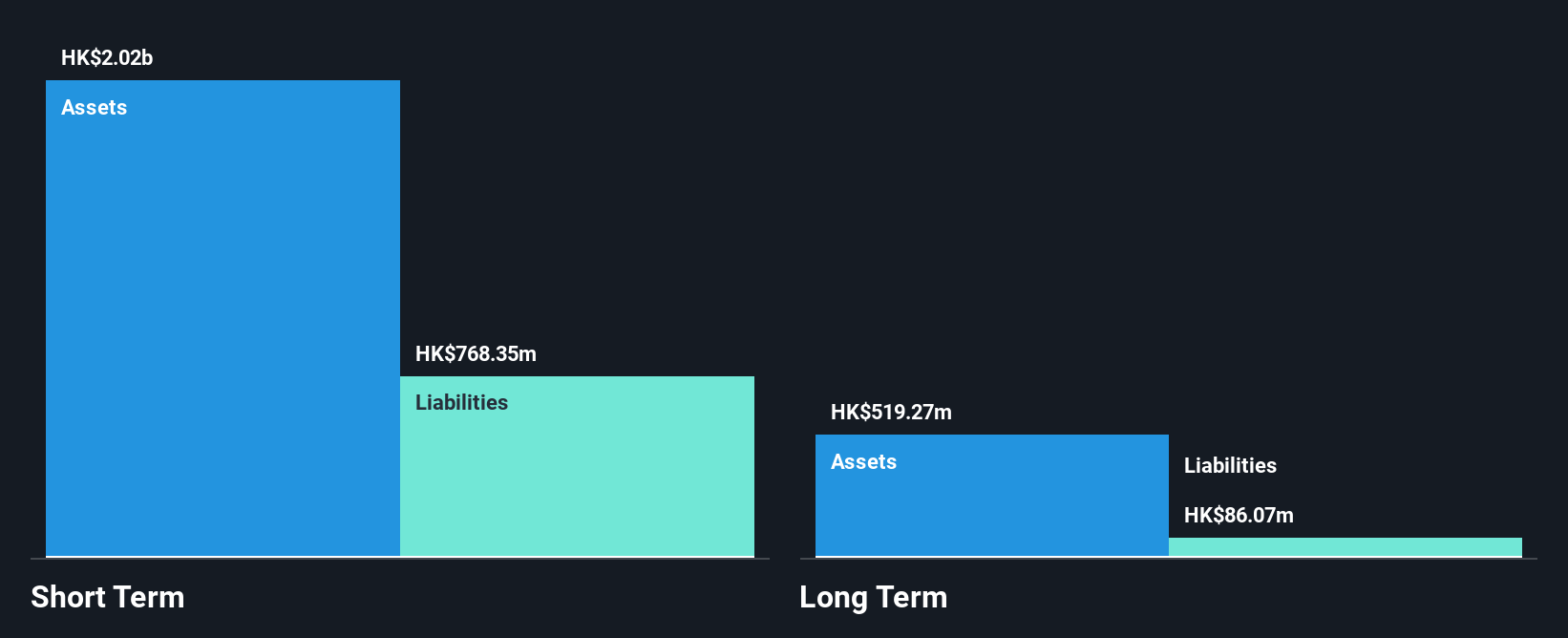

TK Group (Holdings) Limited presents a compelling case within the penny stock landscape, with a market cap of HK$2.22 billion and significant revenue streams from Plastic Components Manufacturing (HK$1.62 billion) and Mold Fabrication (HK$893.09 million). The company benefits from a seasoned management team and board, each with an average tenure of 12.1 years, contributing to its stable operations. Its debt-free status enhances financial flexibility, while short-term assets comfortably cover both short-term and long-term liabilities. Despite trading at 33.1% below estimated fair value, TK Group's earnings growth outpaces the industry average, though its dividend track record remains unstable.

- Unlock comprehensive insights into our analysis of TK Group (Holdings) stock in this financial health report.

- Examine TK Group (Holdings)'s earnings growth report to understand how analysts expect it to perform.

Value Partners Group (SEHK:806)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Value Partners Group Limited is a publicly owned investment manager with a market cap of HK$4.68 billion.

Operations: The company generates revenue of HK$528.88 million from its asset management business segment.

Market Cap: HK$4.68B

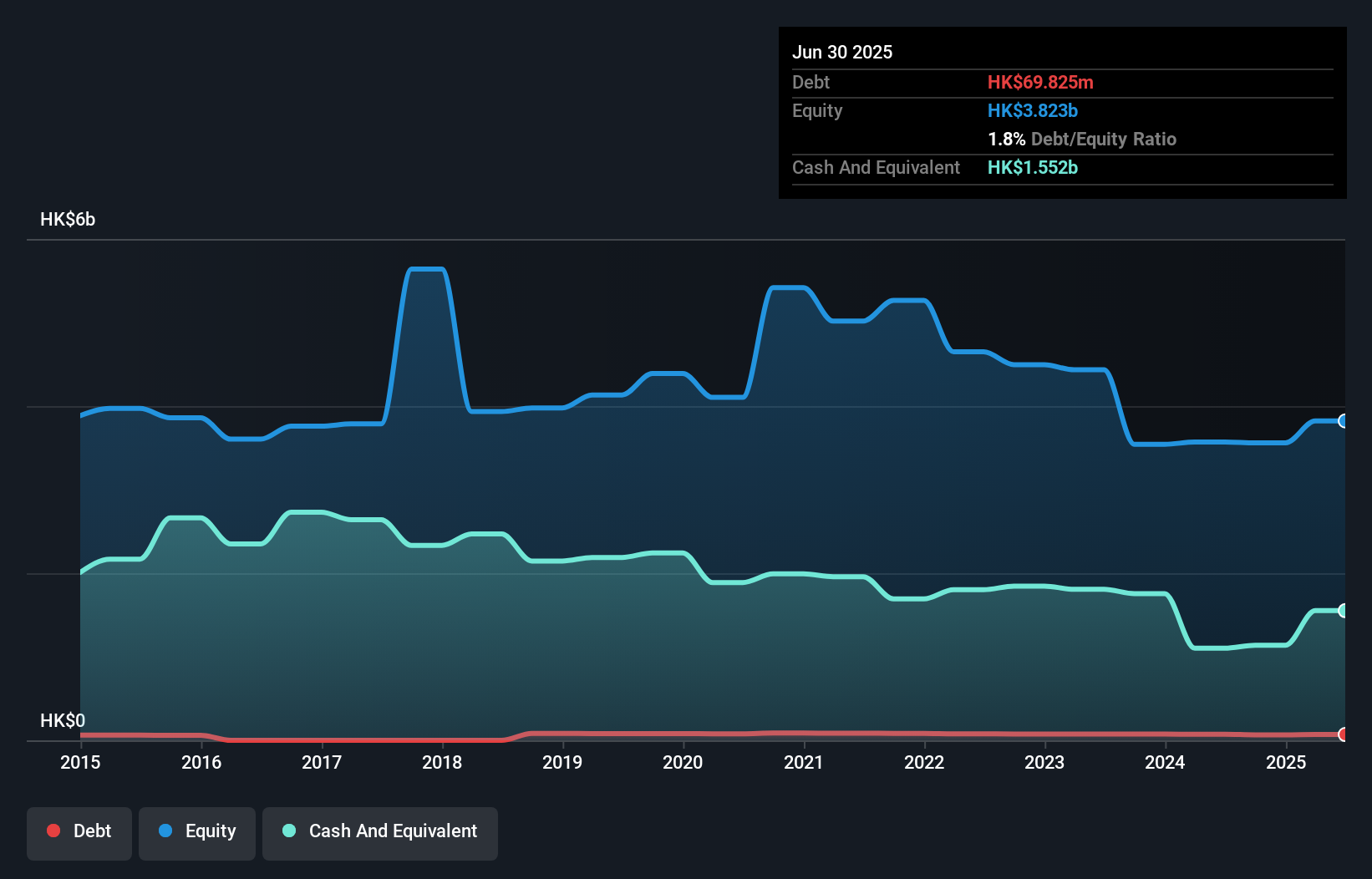

Value Partners Group, with a market cap of HK$4.68 billion, offers an intriguing profile in the penny stock sector. The company's recent executive changes, including the appointment of Mr. Ouyang Xi as an executive director, highlight a shift towards experienced leadership despite a board with limited average tenure of 1.1 years. Financially, Value Partners demonstrates robust short-term asset coverage over liabilities and maintains more cash than total debt, though its operating cash flow does not adequately cover debt obligations. A significant one-off gain has influenced recent earnings growth figures, which are forecasted to continue growing at 20.87% annually but remain tempered by low return on equity at 6.4%.

- Navigate through the intricacies of Value Partners Group with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Value Partners Group's future.

Huapont Life SciencesLtd (SZSE:002004)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Huapont Life Sciences Co., Ltd. operates in diverse sectors including medicine, medical care, agrochemicals, new materials, and tourism both in China and internationally with a market cap of approximately CN¥9.59 billion.

Operations: No specific revenue segments are reported for Huapont Life Sciences Co., Ltd.

Market Cap: CN¥9.59B

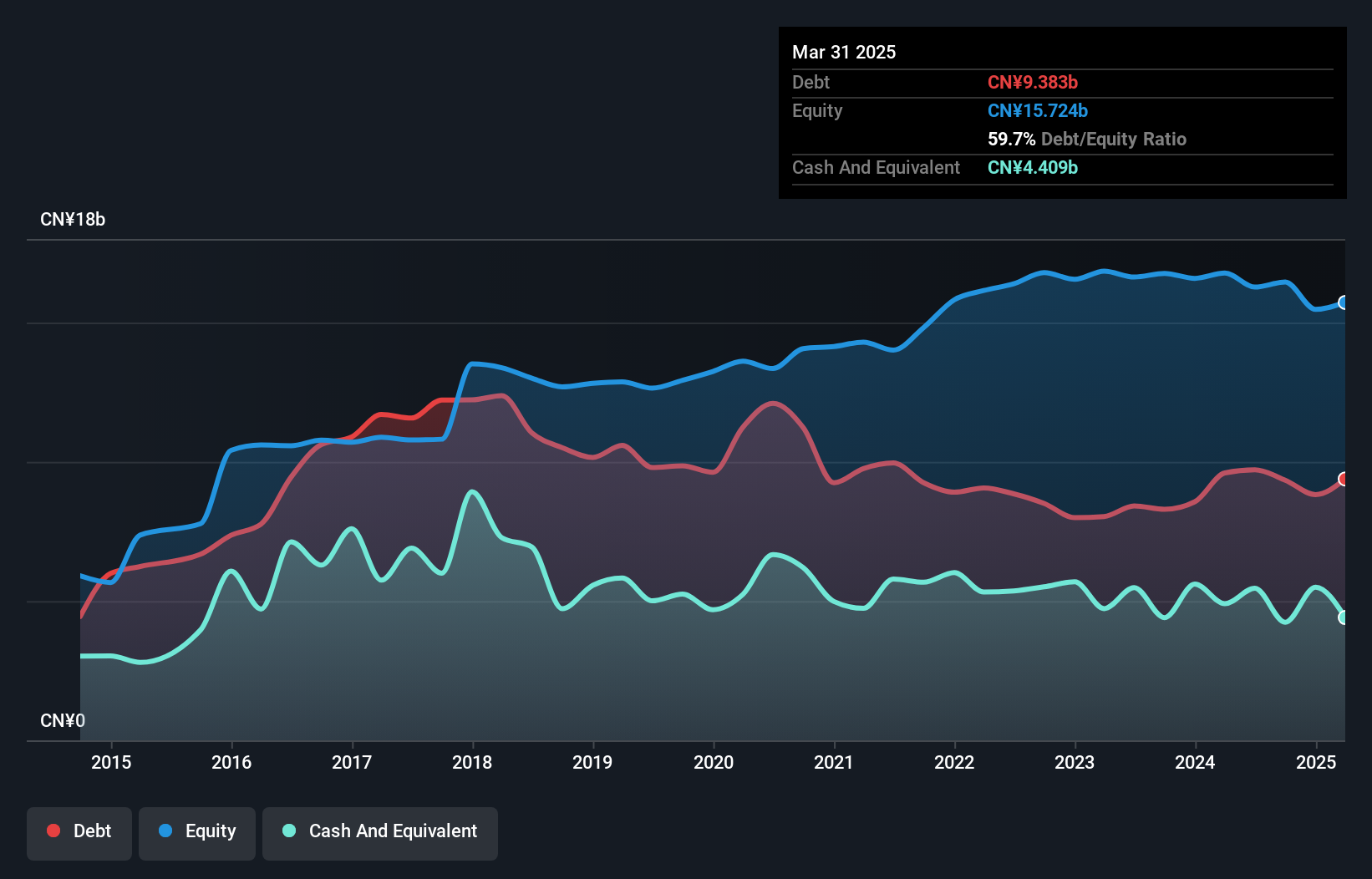

Huapont Life Sciences Ltd., with a market cap of CN¥9.59 billion, presents a mixed picture in the penny stock landscape. The company reported sales of CN¥9.09 billion for the first nine months of 2025, showing modest growth from the previous year. Despite being unprofitable with declining earnings over five years, Huapont maintains satisfactory debt levels and strong asset coverage over liabilities. The seasoned management team and board offer stability, yet challenges persist with negative return on equity and unsustainable dividend coverage by earnings. Interest payments are well covered by EBIT, indicating some financial resilience amidst volatility concerns.

- Dive into the specifics of Huapont Life SciencesLtd here with our thorough balance sheet health report.

- Explore historical data to track Huapont Life SciencesLtd's performance over time in our past results report.

Summing It All Up

- Click here to access our complete index of 955 Asian Penny Stocks.

- Ready To Venture Into Other Investment Styles? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com