High Growth Tech Stocks in Asia for December 2025

As global markets navigate the anticipation of potential interest rate cuts from the Federal Reserve, Asian tech stocks are capturing attention with their growth potential, particularly in light of China's ongoing enthusiasm for technology and artificial intelligence despite broader economic challenges. In this environment, identifying high-growth tech stocks involves looking for companies that demonstrate resilience and innovation amidst fluctuating market conditions and economic indicators.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Suzhou TFC Optical Communication | 35.80% | 36.87% | ★★★★★★ |

| Zhongji Innolight | 34.82% | 35.50% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Knowmerce | 42.51% | 33.23% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

Wasion Holdings (SEHK:3393)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wasion Holdings Limited is an investment holding company that focuses on the research, development, production, and sale of energy metering and energy efficiency management solutions for the energy supply industries, with a market capitalization of approximately HK$14.41 billion.

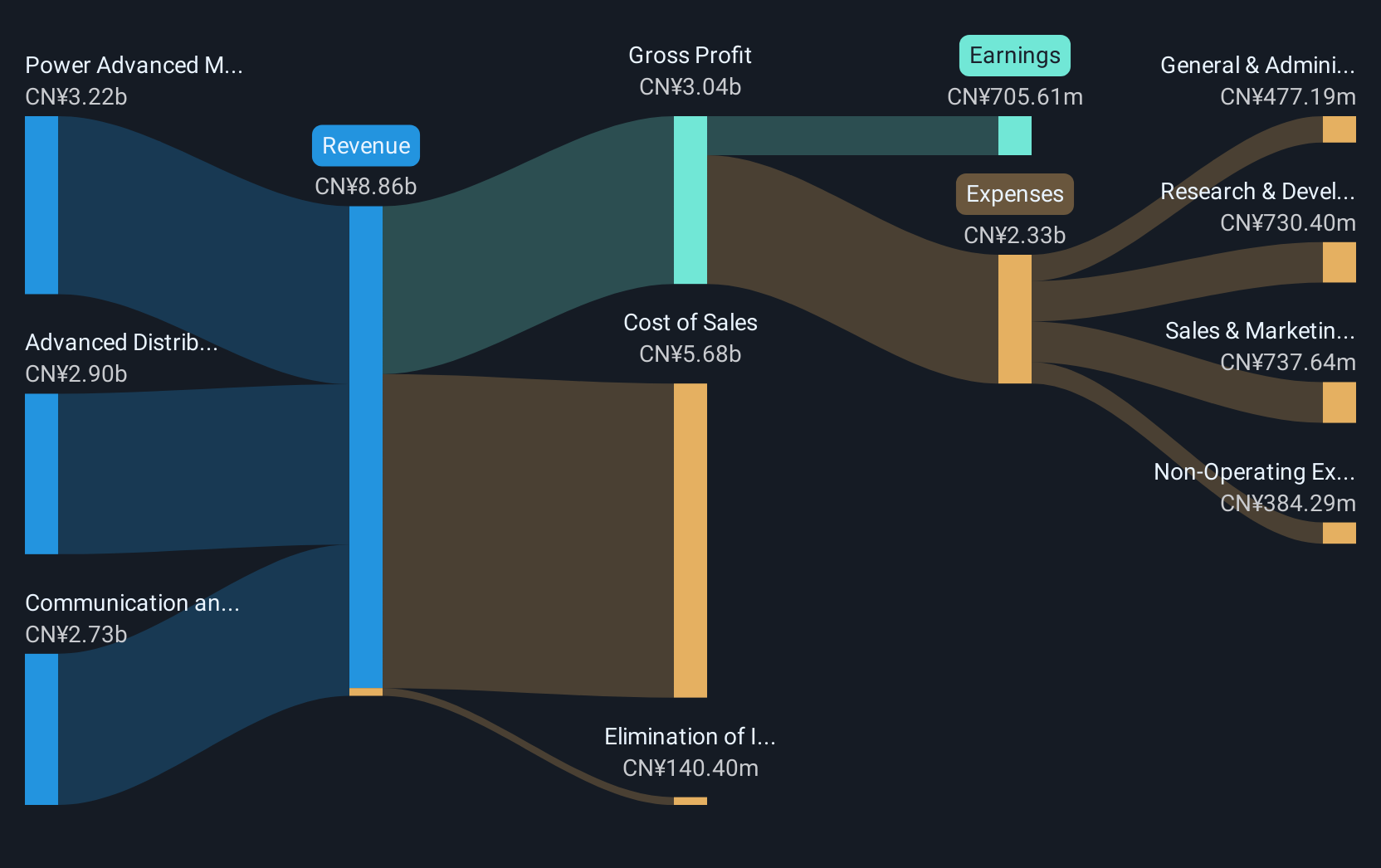

Operations: The company generates revenue primarily through three segments: Power Advanced Metering Infrastructure (CN¥3.65 billion), Advanced Distribution Operations (CN¥2.98 billion), and Communication and Fluid Advanced Metering Infrastructure (CN¥2.88 billion).

Wasion Holdings has demonstrated robust growth, with earnings surging by 27.5% last year, outpacing the electronic industry's average of 7.2%. This performance is anchored by significant contract wins like the recent RMB201.16 million deal with China Southern Power Grid, underscoring its competitive edge in metering equipment. Moreover, anticipated revenue and earnings growth rates of 19.3% and 24.7% respectively suggest strong forward momentum, supported by strategic wins from its subsidiaries such as Willfar Information Technology's RMB168.97 million contract. These achievements not only reflect Wasion's operational excellence but also position it well amidst Asia’s high-growth tech landscape despite a forecasted lower Return on Equity of 19.2%.

- Click here and access our complete health analysis report to understand the dynamics of Wasion Holdings.

Gain insights into Wasion Holdings' historical performance by reviewing our past performance report.

Jiangsu Cai Qin Technology (SHSE:688182)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Cai Qin Technology Co., Ltd focuses on the research, development, production, and sale of microwave dielectric ceramic components both domestically and internationally, with a market cap of CN¥10.04 billion.

Operations: The company generates revenue primarily from the communication equipment manufacturing segment, amounting to CN¥632.79 million.

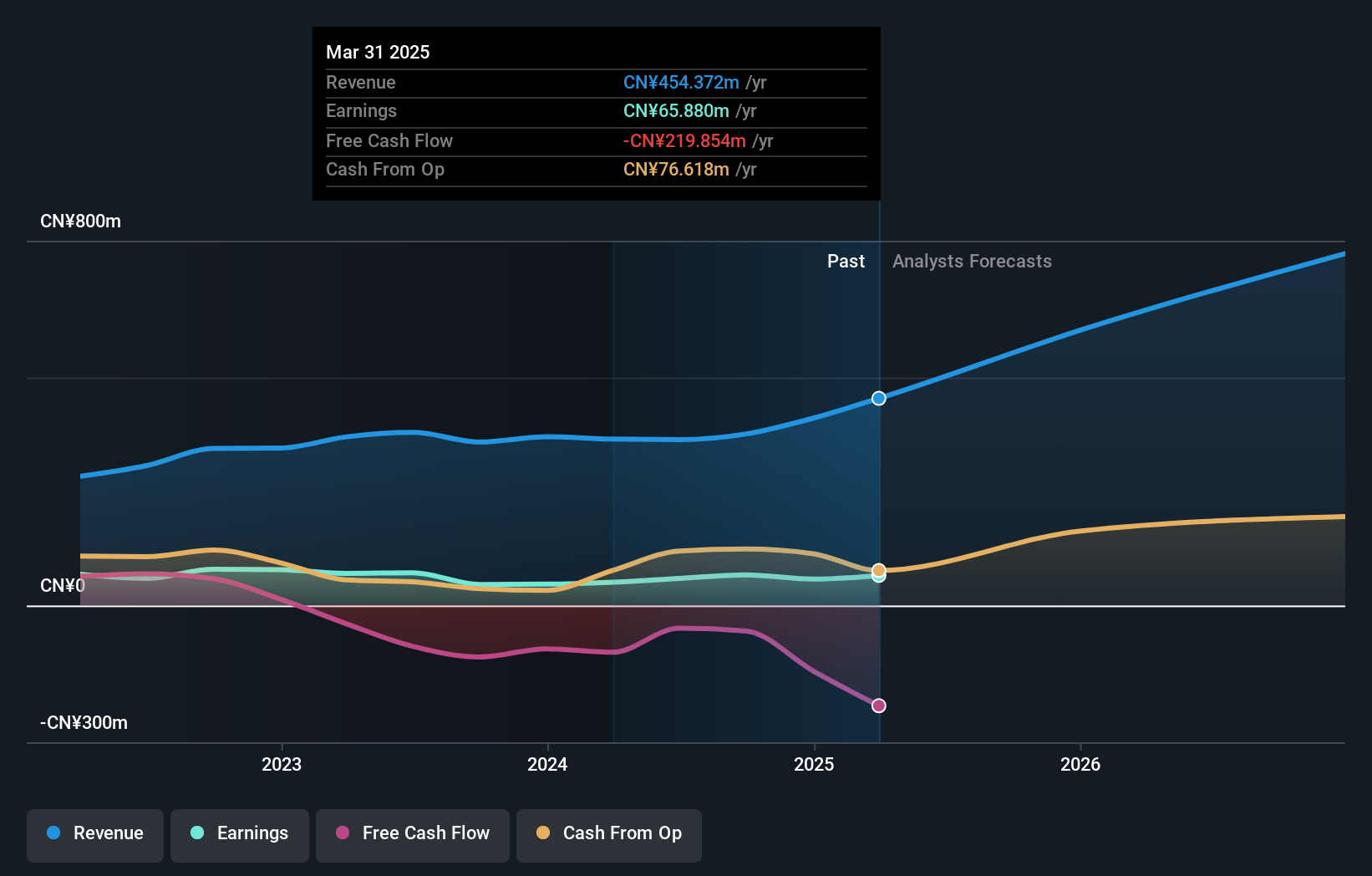

Jiangsu Cai Qin Technology has shown impressive growth, with a 35.8% increase in annual revenue and a 39.7% rise in earnings, outstripping many of its peers in the tech sector. This performance is bolstered by significant R&D investment, which stands at CNY 73 million, accounting for approximately 14.9% of their total revenue. Recent events such as the Q3 earnings call reveal robust sales growth from CNY 269.06 million to CNY 490.95 million year-over-year and an increase in net income from CNY 50.04 million to CNY 86.24 million, reflecting strong operational efficiency and market expansion strategies that are likely to propel future growth trajectories within Asia’s dynamic tech landscape.

- Unlock comprehensive insights into our analysis of Jiangsu Cai Qin Technology stock in this health report.

Understand Jiangsu Cai Qin Technology's track record by examining our Past report.

Guomai Technologies (SZSE:002093)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guomai Technologies, Inc. provides a range of services including internet of things technology, consulting and design, science park operation and development, as well as education services in China, with a market capitalization of CN¥13.13 billion.

Operations: Guomai Technologies focuses on delivering diverse services in the internet of things sector, encompassing technology solutions, consulting and design, as well as science park operations and development. The company also engages in education services within China.

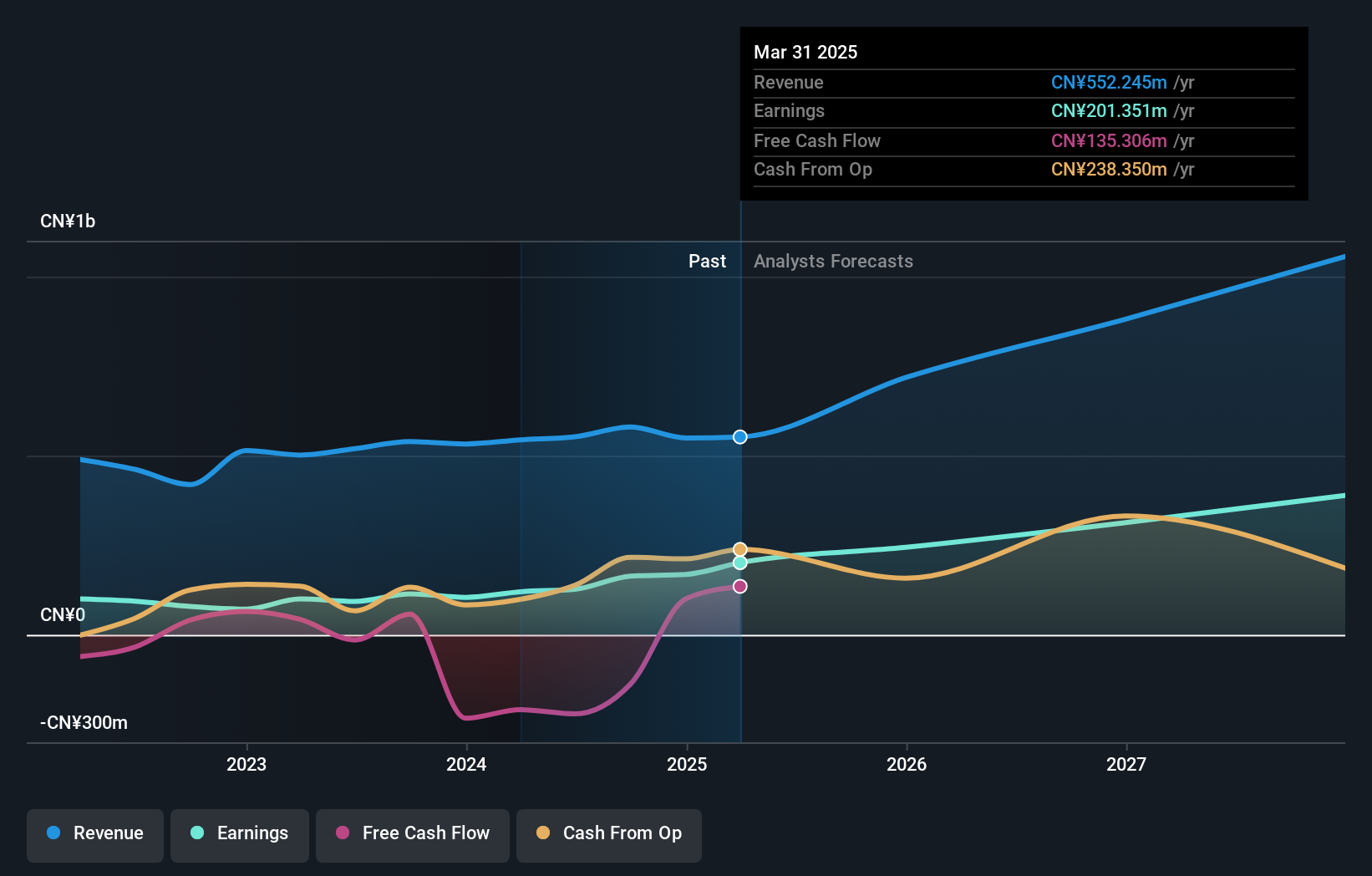

Guomai Technologies has demonstrated robust growth, with revenue increasing by 24.9% annually, outpacing the broader Chinese market's 14.4% growth rate. This performance is underpinned by a significant uptick in net income, rising from CNY 148.11 million to CNY 195.96 million within nine months, showcasing effective operational enhancements and market penetration strategies. Notably, the company's R&D commitment is evident as it consistently fuels innovation to stay competitive in Asia’s fast-evolving tech landscape, although its earnings growth of 25.8% per year slightly trails the regional market expectation of 27.2%.

- Click here to discover the nuances of Guomai Technologies with our detailed analytical health report.

Examine Guomai Technologies' past performance report to understand how it has performed in the past.

Next Steps

- Unlock our comprehensive list of 187 Asian High Growth Tech and AI Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com