Asian Small Caps With Insider Buying Opportunities In December 2025

As December 2025 unfolds, the Asian markets are navigating a landscape marked by mixed economic signals, with manufacturing activity contracting while services sectors show resilience. Amid these dynamics, small-cap stocks in Asia present intriguing opportunities for investors seeking growth potential, especially as insider buying can often signal confidence in a company's future prospects. Identifying stocks that demonstrate strong fundamentals and align with current market conditions is crucial for those looking to capitalize on potential undervaluation in this segment.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.3x | 1.0x | 28.69% | ★★★★★★ |

| Clover | 19.4x | 1.6x | 33.09% | ★★★★☆☆ |

| Centurion | 3.7x | 3.1x | -55.33% | ★★★★☆☆ |

| Chinasoft International | 21.7x | 0.7x | -1205.63% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 44.60% | ★★★★☆☆ |

| Nickel Asia | 12.4x | 1.9x | 11.99% | ★★★☆☆☆ |

| Ever Sunshine Services Group | 6.5x | 0.4x | -424.88% | ★★★☆☆☆ |

| PSC | 10.1x | 0.4x | 18.15% | ★★★☆☆☆ |

| Paragon Care | 20.9x | 0.1x | 6.18% | ★★★☆☆☆ |

| Nufarm | NA | 0.3x | -129.00% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

Café de Coral Holdings (SEHK:341)

Simply Wall St Value Rating: ★★★☆☆☆

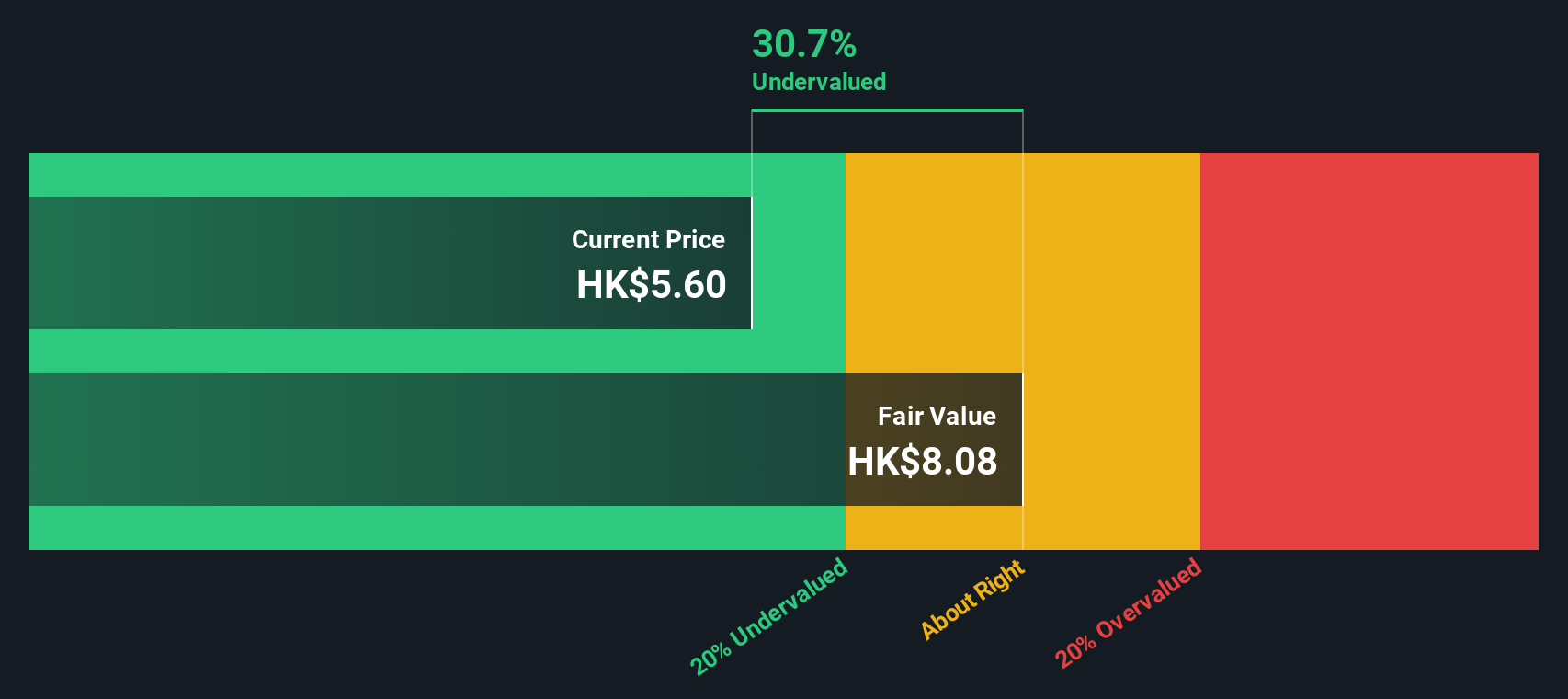

Overview: Café de Coral Holdings operates a network of quick-service restaurants primarily in Hong Kong, with a market capitalization of HK$6.55 billion.

Operations: The company's primary revenue stream is derived from its restaurant segment, with recent revenues reaching HK$8.34 billion. The cost of goods sold (COGS) has been a significant expense, contributing to a gross profit margin of 9.41%. Operating expenses have also impacted profitability, with general and administrative expenses being notable contributors. Net income for the latest period was HK$135.46 million, reflecting a net income margin of 1.62%.

PE: 23.8x

Café de Coral Holdings, a small-cap player in Asia's food and beverage sector, reported a drop in sales to HK$4.04 billion for the half-year ending September 2025, down from HK$4.26 billion the previous year. Net income also declined significantly to HK$46.73 million from HK$144.02 million due to lower revenue and fair value losses on investment properties. Despite these challenges, insider confidence is evident with purchases spanning recent months, suggesting potential optimism about future growth prospects amidst current undervaluation concerns.

- Delve into the full analysis valuation report here for a deeper understanding of Café de Coral Holdings.

Assess Café de Coral Holdings' past performance with our detailed historical performance reports.

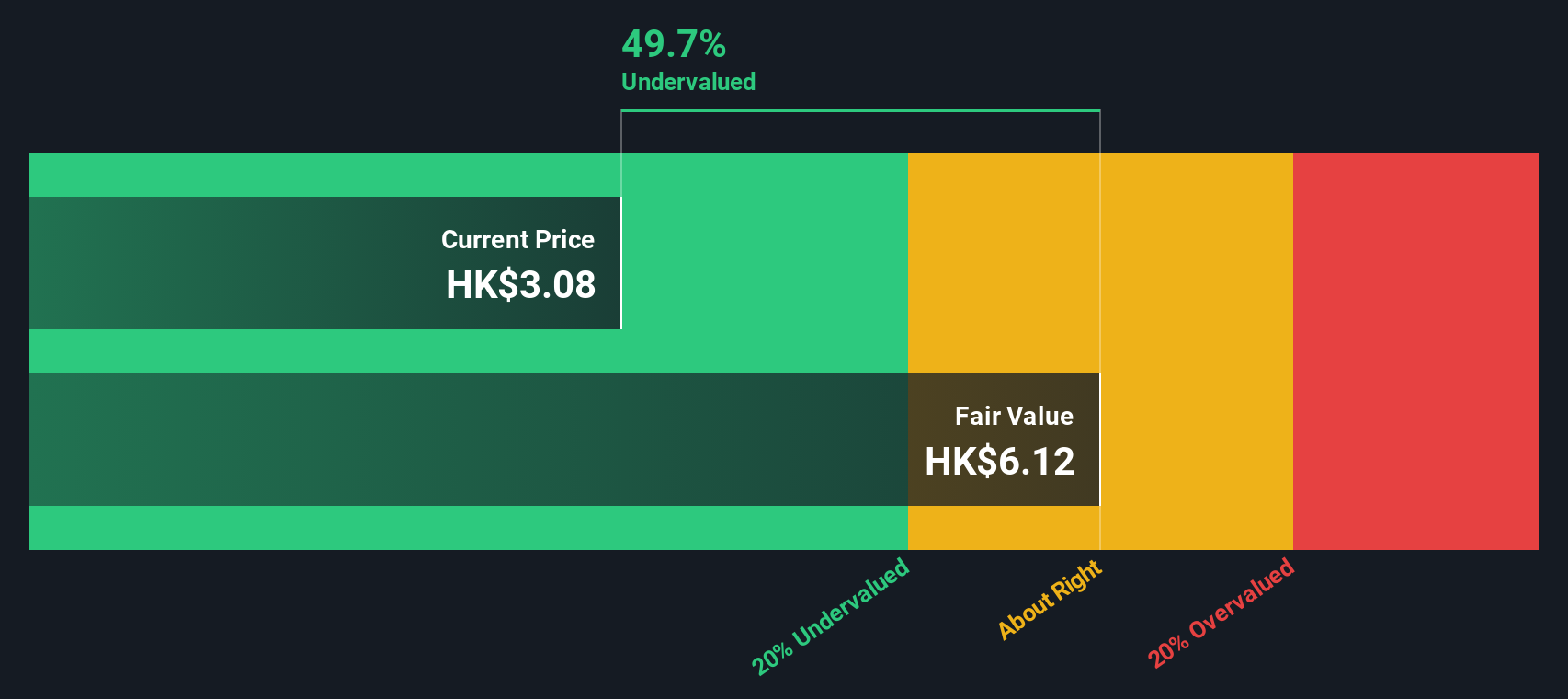

Greentown Management Holdings (SEHK:9979)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Greentown Management Holdings is a company engaged in project management and consulting services within the real estate sector, with a market capitalization of CN¥7.48 billion.

Operations: The company primarily generates revenue through its core operations, with a notable gross profit margin trend peaking at 52.94% in June 2023 before declining to 44.37% in June 2025. The cost of goods sold (COGS) has consistently increased over the years, impacting the gross profit figures. Operating expenses have shown variability but remain a significant portion of total expenses, with general and administrative expenses being a major component.

PE: 10.0x

Greentown Management Holdings, a smaller player in Asia's market, has caught attention due to insider confidence. In June 2025, an insider acquired 500,000 shares for approximately HK$1.52 million, indicating belief in potential growth despite a drop in profit margins from 29.2% to 17.7%. The recent appointment of Cheng Min as executive director could bolster strategic development given their extensive industry experience. However, reliance on external borrowing poses financial risks that investors should consider carefully.

- Click here and access our complete valuation analysis report to understand the dynamics of Greentown Management Holdings.

Gain insights into Greentown Management Holdings' past trends and performance with our Past report.

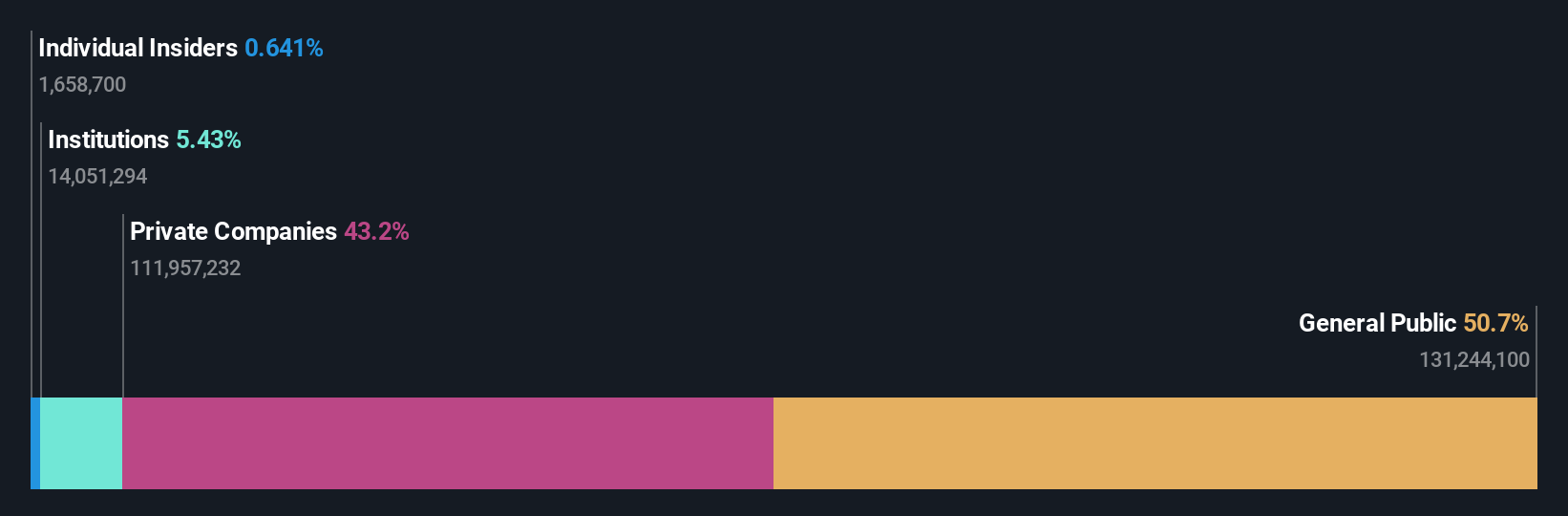

Bukit Sembawang Estates (SGX:B61)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Bukit Sembawang Estates is primarily engaged in property development, with additional operations in hospitality and investment holding, and has a market capitalization of approximately SGD 1.35 billion.

Operations: The company's primary revenue stream is from property development, contributing significantly to its overall income. Over recent periods, the net profit margin has shown a varied trend, reaching 27.66% in late 2025. Operating expenses have remained relatively stable with general and administrative expenses consistently around $11 million SGD in recent quarters.

PE: 12.2x

Bukit Sembawang Estates, known for its property development in Asia, has caught attention due to its share activity and financial performance. Recently, insider confidence was demonstrated as they increased their holdings over the past year. The company reported a decline in sales to S$130.24 million for the half-year ending September 2025 from S$324.02 million previously, with net income also dropping to S$47.15 million from S$62.92 million last year. Despite these figures, revenue is projected to grow by 12.64% annually; however, earnings are expected to see a slight decline of 2.1% per year over the next three years due to reliance on external borrowing for funding rather than customer deposits—considered higher risk—and high non-cash earnings levels impacting quality perceptions of profitability.

- Click to explore a detailed breakdown of our findings in Bukit Sembawang Estates' valuation report.

Learn about Bukit Sembawang Estates' historical performance.

Turning Ideas Into Actions

- Embark on your investment journey to our 51 Undervalued Asian Small Caps With Insider Buying selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com