CrowdStrike’s Strong Q3, Raised Guidance and New AI Alliances Might Change The Case For Investing In CrowdStrike Holdings (CRWD)

- CrowdStrike Holdings reported past third-quarter results showing revenue rising to US$1,234.24 million but with a wider net loss of US$34 million, while also raising full-year revenue guidance and unveiling new AI-driven security products and partnerships with AWS, HPE, Kroll, and U.S. public-sector agencies.

- Together, record net new ARR growth, higher operating income, and deepening AI and cloud alliances position CrowdStrike’s Falcon platform more firmly at the center of next-generation cybersecurity spending.

- We’ll now examine how CrowdStrike’s raised revenue guidance and expanding AI-cloud partnerships influence its existing investment narrative and assumptions.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

CrowdStrike Holdings Investment Narrative Recap

To own CrowdStrike, you need to believe its Falcon platform can stay central to AI driven, cloud based security while the company scales toward consistent profitability. The latest results support the near term catalyst of accelerating net new ARR and higher operating income, but the wider net loss underlines the biggest current risk: whether heavy AI and cloud investments will translate into durable, GAAP level earnings improvement.

Among the recent announcements, the expanded AWS collaboration around Falcon Next Gen SIEM and pay as you go cloud offerings looks most relevant. It directly reinforces the catalyst of deepening cloud ecosystems and faster deal cycles, while also testing CrowdStrike’s ability to convert these partnerships into sustained ARR growth without eroding margins or over relying on complex non GAAP metrics.

Yet while growth and partnerships grab attention, investors should also be aware of the risk that heavy non GAAP adjustments and rising costs could...

Read the full narrative on CrowdStrike Holdings (it's free!)

CrowdStrike Holdings' narrative projects $7.9 billion revenue and $691.1 million earnings by 2028. This requires 22.1% yearly revenue growth and about a $988.1 million earnings increase from -$297.0 million today.

Uncover how CrowdStrike Holdings' forecasts yield a $533.26 fair value, a 4% upside to its current price.

Exploring Other Perspectives

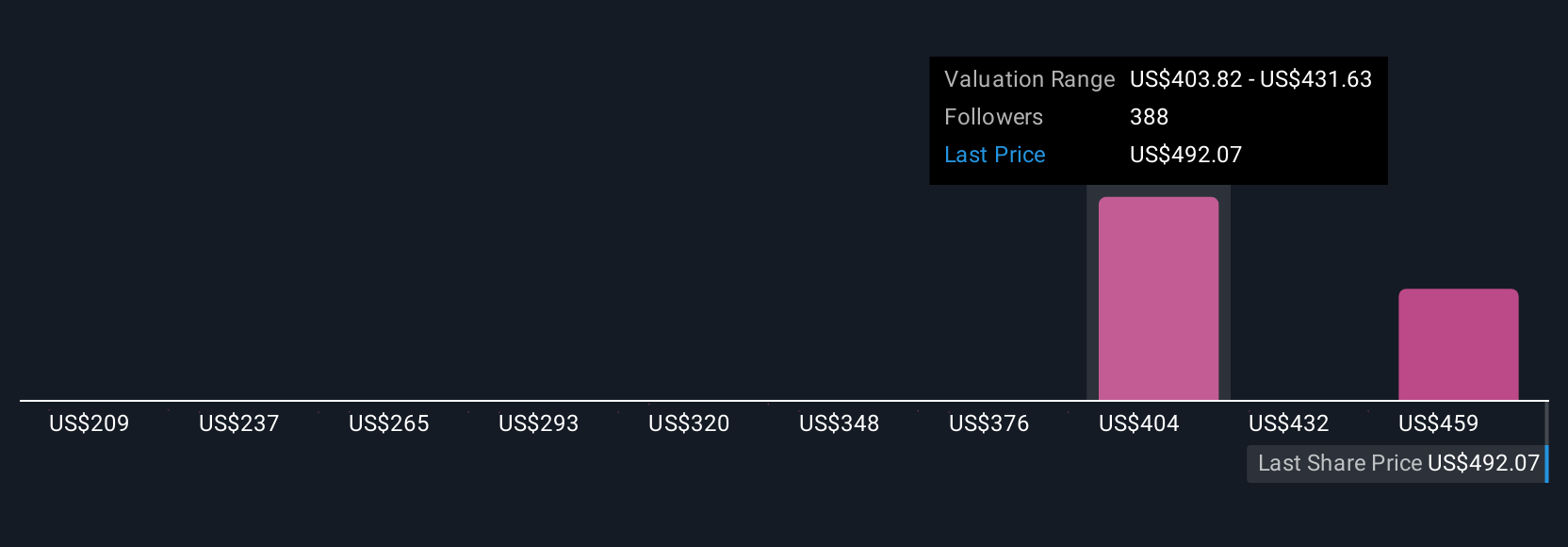

Twenty four members of the Simply Wall St Community value CrowdStrike between US$320.72 and US$600.50, highlighting how far apart views on upside are. Against this spread, the raised full year revenue guidance and accelerating AI driven partnerships sharpen the question of whether growth can offset concerns about profitability and execution, inviting you to compare several different assumptions about the company’s path ahead.

Explore 24 other fair value estimates on CrowdStrike Holdings - why the stock might be worth as much as 17% more than the current price!

Build Your Own CrowdStrike Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CrowdStrike Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free CrowdStrike Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CrowdStrike Holdings' overall financial health at a glance.

No Opportunity In CrowdStrike Holdings?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com