How Investors May Respond To Tokyu REIT (TSE:8957) Expanding Bond Capacity For Future Property Investments

- Earlier this month, TOKYU REIT, Inc. filed a shelf registration to issue up to ¥100,000 million in investment corporation bonds, earmarking proceeds for asset acquisitions, operations, and debt repayment.

- This move gives TOKYU REIT a ready-made funding framework that could increase its financial flexibility and speed of execution on future property investments.

- We will now examine how this expanded bond-issuing capacity shapes Tokyu REIT's investment narrative and potential balance-sheet resilience.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Tokyu REIT's Investment Narrative?

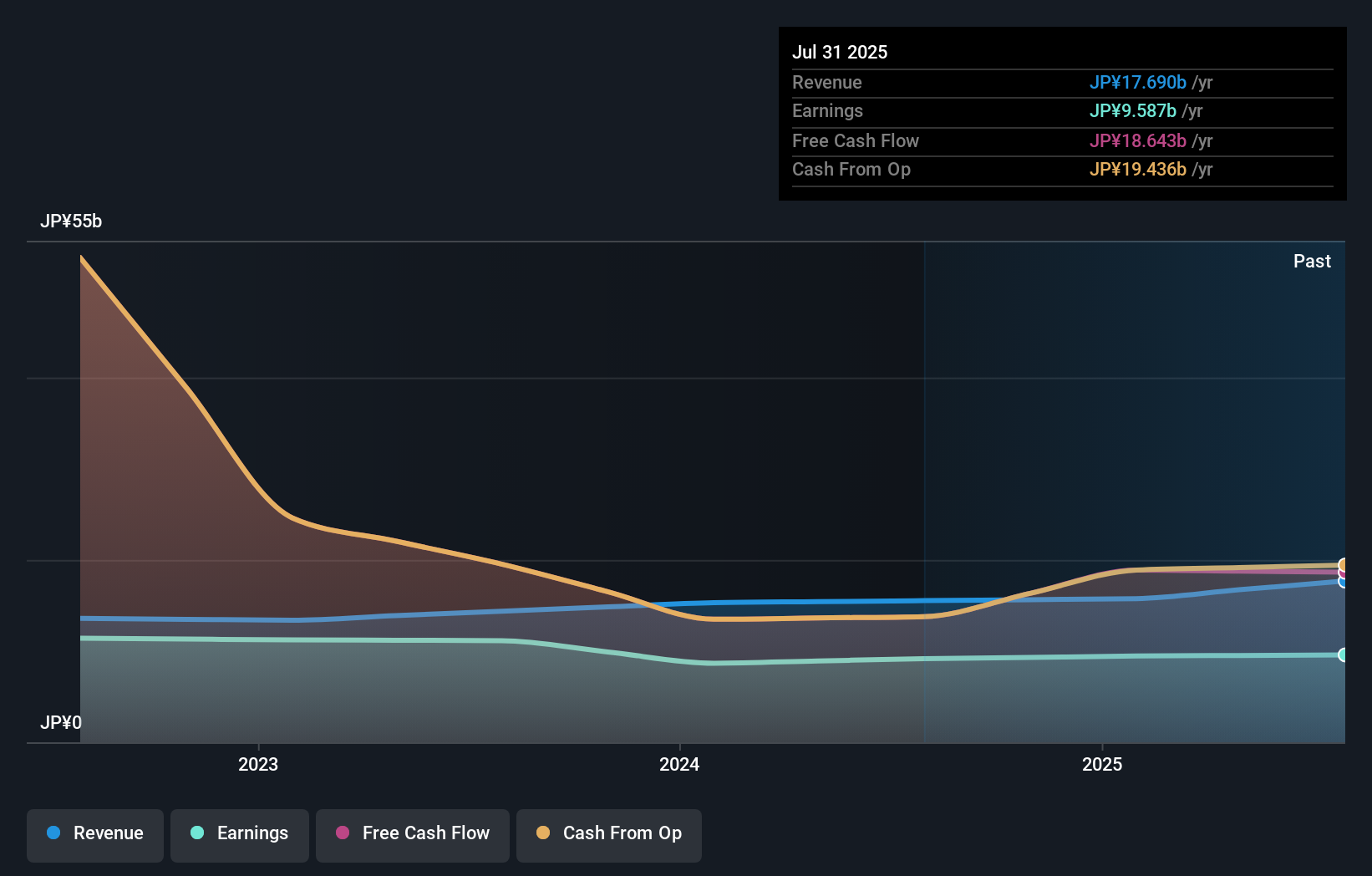

To own Tokyu REIT, you need to be comfortable tying your capital to a mature, income-focused Japanese office portfolio where growth looks incremental rather than explosive and valuation already prices in a fair amount of good news. Short term, the key catalysts remain execution on the acquisition pipeline, stability of occupancy and rent levels, and how the manager balances distributions against funding needs. The new ¥100,000 million bond shelf registration slots into this picture as a potential enabler rather than a game changer: it could smooth refinancing risk and speed up future deals, but by itself does not remove concerns about debt not being well covered by operating cash flow or a dividend that is thinly covered by earnings. The muted recent share-price reaction suggests the market sees it similarly.

Yet the comfort of a ready funding line sits alongside a less obvious balance sheet concern that investors should not ignore.

Tokyu REIT's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Simply Wall St Community members currently cluster around a single fair value view of ¥192,000, offering a narrow but clear benchmark. Set that against Tokyu REIT’s reliance on ample bond capacity and only modest profit growth, and it becomes even more important to weigh how different funding or earnings outcomes could affect your own expectations.

Explore another fair value estimate on Tokyu REIT - why the stock might be worth as much as ¥192000!

Build Your Own Tokyu REIT Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tokyu REIT research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Tokyu REIT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tokyu REIT's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com