ThredUp (TDUP): Rethinking Valuation After a Volatile Share Price Surge

ThredUp (TDUP) has quietly turned into a tricky stock for resale fans and investors alike, with the share price swinging higher over the past week even as longer term performance remains mixed.

See our latest analysis for ThredUp.

That recent 15.96% 7 day share price return on ThredUp, taking the stock to 8.72 dollars, comes on top of a powerful year to date share price surge but choppy shorter term momentum, while the one year total shareholder return also looks impressive.

If ThredUp has sharpened your appetite for growth stories, now could be a good moment to explore fast growing stocks with high insider ownership.

With shares still trading at a steep discount to analyst targets despite strong revenue and earnings momentum, investors face a key question: is ThredUp quietly undervalued, or has the market already priced in its next wave of growth?

Most Popular Narrative Narrative: 32.9% Undervalued

With the narrative fair value sitting well above ThredUp's last close at 8.72 dollars, the story centers on long term structural growth rather than day to day volatility.

The closure of the de minimis loophole and the introduction of new tariffs are making fast fashion and new apparel imports more expensive, increasing the relative value proposition and attractiveness of secondhand platforms like ThredUp, which should support further customer acquisition and drive strong revenue growth. Rising consumer awareness of sustainability and growing interest in circular fashion models continue to expand the addressable market for online resale, creating lasting demand tailwinds that are likely to boost volume growth and top line revenue for ThredUp.

Curious how a resale platform earns a premium usually reserved for elite growth stocks, without near term profitability, and still claims meaningful upside? The narrative unpacks bold assumptions on revenue expansion, margin lift, and future earnings power that sit behind that punchy valuation multiple. The full logic is only clear when you see the moving parts together.

Result: Fair Value of $13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat scenario could fray if customer acquisition costs spike or resale growth stalls, which would pressure margins and delay the path to sustainable profitability.

Find out about the key risks to this ThredUp narrative.

Another View: Price To Sales Sends A Different Signal

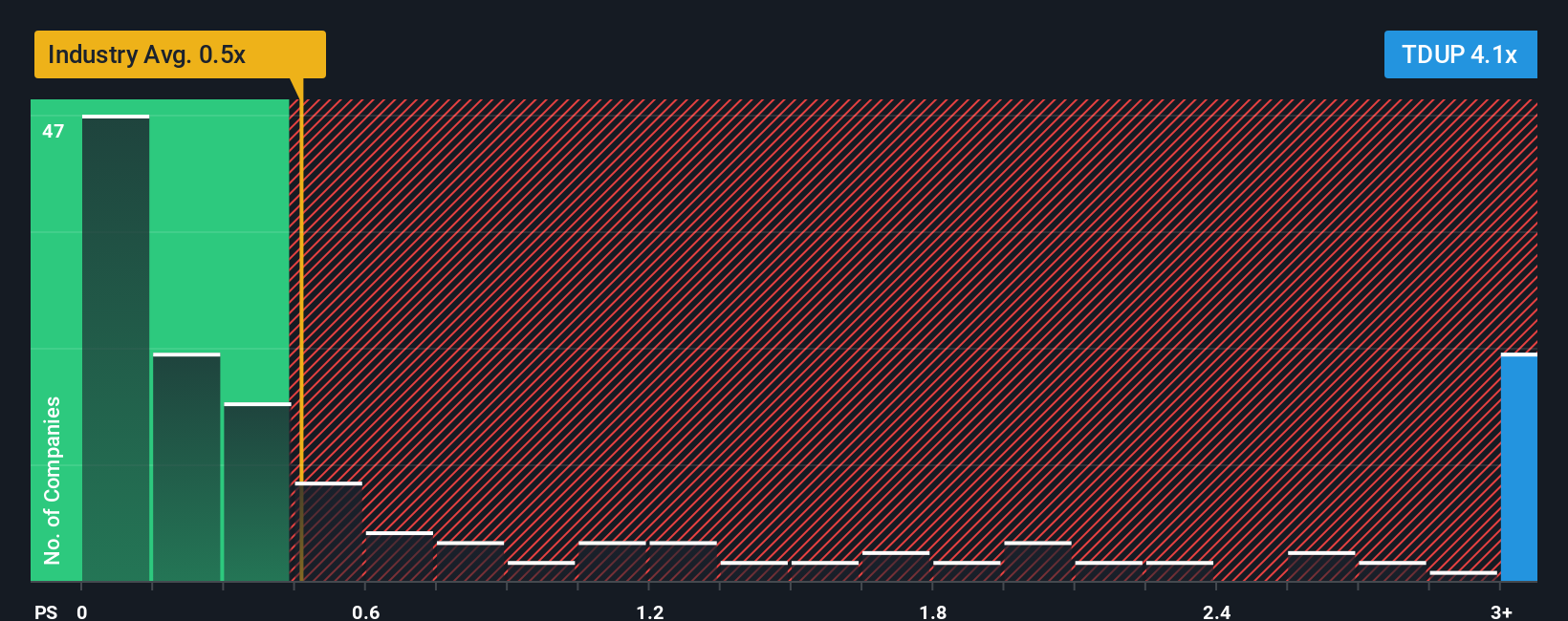

Step away from narratives and cash flow models and ThredUp suddenly looks expensive. Its price to sales ratio of 3.7 times towers over the US Specialty Retail average of 0.5 times, peers at 0.9 times, and even its own fair ratio of 1.6 times, raising real valuation risk if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ThredUp Narrative

And if this view does not quite match your own, you can dive into the numbers yourself and build a fresh perspective in minutes: Do it your way.

A great starting point for your ThredUp research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop at ThredUp, you could miss exceptional opportunities, so put the odds in your favor by scanning fresh ideas tailored to your strategy.

- Capitalize on powerful mispricings by targeting stocks trading below intrinsic value with these 908 undervalued stocks based on cash flows.

- Ride the next wave of machine learning breakthroughs by hunting early leaders among these 26 AI penny stocks.

- Lock in reliable income streams by focusing on companies offering attractive yields through these 15 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com