What News (NWSA)'s Expanded US$1 Billion Buyback Authorization Means For Shareholders

- In recent days, News Corporation announced an update on its ongoing stock repurchase programs, authorizing the acquisition of up to US$1.00 billion of its Class A and Class B common stock to adjust its capital structure and return cash to shareholders.

- This sizeable buyback capacity highlights management’s willingness to use balance sheet flexibility to boost per-share metrics and reinforce the company’s long-term capital return agenda.

- Next, we’ll explore how this expanded share repurchase capacity could influence News Corporation’s investment narrative and future capital return profile.

Find companies with promising cash flow potential yet trading below their fair value.

News Investment Narrative Recap

To own News Corporation, you need to believe its shift toward digital subscriptions, data services and real estate platforms can offset pressure on traditional media and cyclical ad and housing markets. The new US$1.00 billion repurchase authorization supports the near term capital return story, but does not materially change the central risk that slowing audience engagement and soft advertising could constrain revenue growth and dampen operating leverage.

Among recent updates, the Q1 FY2025 result showed modest revenue growth alongside higher net profit margins, reinforcing the company’s focus on efficiency and cash generation that can underpin ongoing buybacks. Against this backdrop, the expanded repurchase capacity sits alongside efforts to grow recurring digital revenue and data licensing, which remain key to supporting earnings resilience if macro or advertising trends stay weak.

Yet, while buybacks can support per share metrics, investors should still pay close attention to the risk that AI driven content shifts could...

Read the full narrative on News (it's free!)

News' narrative projects $9.3 billion revenue and $754.0 million earnings by 2028. This requires 3.2% yearly revenue growth and a $274.0 million earnings increase from $480.0 million today.

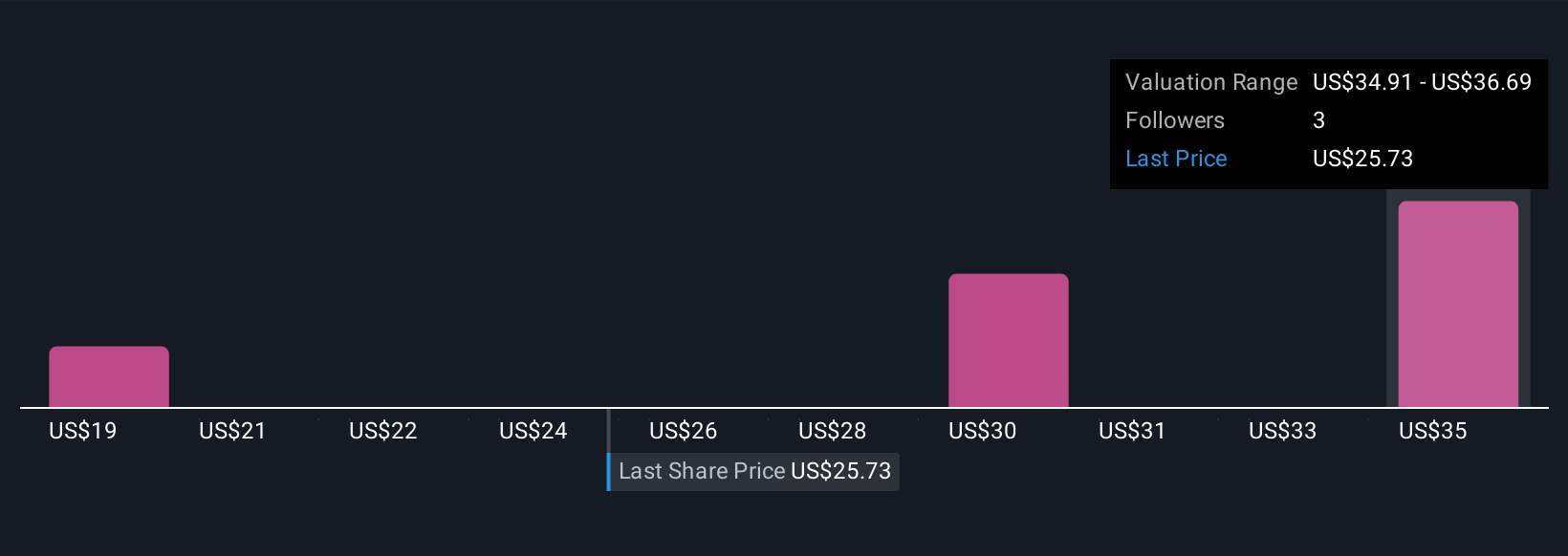

Uncover how News' forecasts yield a $36.69 fair value, a 41% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community value News between US$18.89 and US$36.69, showing wide disagreement on upside potential. As you weigh those views, remember that structural pressure on print and legacy media could still influence how reliably News converts its digital ambitions into earnings over time.

Explore 3 other fair value estimates on News - why the stock might be worth as much as 41% more than the current price!

Build Your Own News Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your News research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free News research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate News' overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com