We Think CJ Logistics (KRX:000120) Is Taking Some Risk With Its Debt

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies CJ Logistics Corporation (KRX:000120) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is CJ Logistics's Debt?

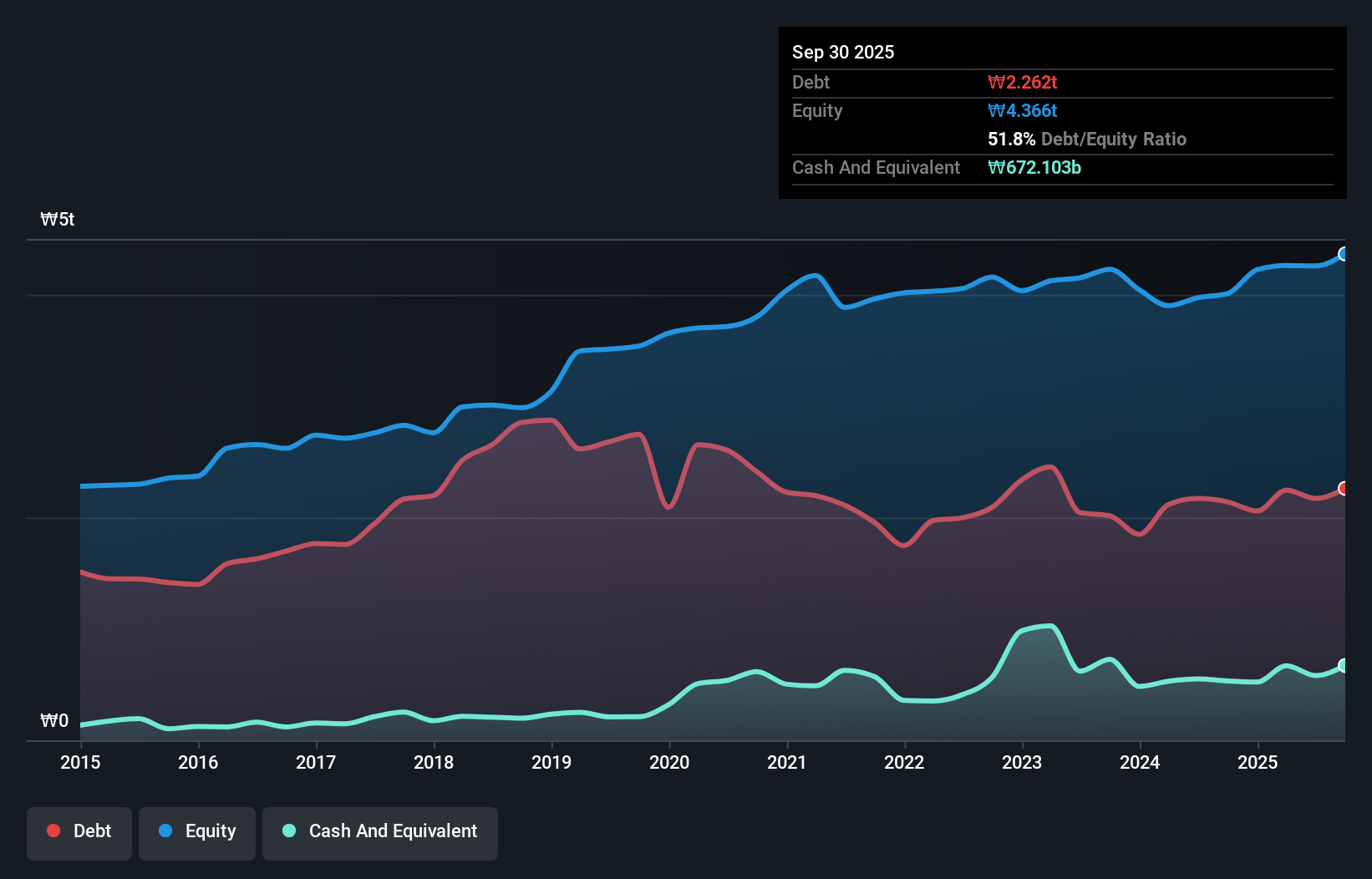

As you can see below, at the end of September 2025, CJ Logistics had ₩2.26t of debt, up from ₩2.14t a year ago. Click the image for more detail. However, because it has a cash reserve of ₩672.1b, its net debt is less, at about ₩1.59t.

A Look At CJ Logistics' Liabilities

We can see from the most recent balance sheet that CJ Logistics had liabilities of ₩3.19t falling due within a year, and liabilities of ₩2.78t due beyond that. Offsetting these obligations, it had cash of ₩672.1b as well as receivables valued at ₩1.61t due within 12 months. So it has liabilities totalling ₩3.70t more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the ₩1.94t company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, CJ Logistics would likely require a major re-capitalisation if it had to pay its creditors today.

Check out our latest analysis for CJ Logistics

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While CJ Logistics's low debt to EBITDA ratio of 1.4 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 3.5 times last year does give us pause. So we'd recommend keeping a close eye on the impact financing costs are having on the business. Unfortunately, CJ Logistics saw its EBIT slide 5.9% in the last twelve months. If that earnings trend continues then its debt load will grow heavy like the heart of a polar bear watching its sole cub. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if CJ Logistics can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, CJ Logistics generated free cash flow amounting to a very robust 96% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Our View

Mulling over CJ Logistics's attempt at staying on top of its total liabilities, we're certainly not enthusiastic. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. Once we consider all the factors above, together, it seems to us that CJ Logistics's debt is making it a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. Over time, share prices tend to follow earnings per share, so if you're interested in CJ Logistics, you may well want to click here to check an interactive graph of its earnings per share history.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.